By Anjan Roy

In the face of persistent inflationary pressures and tie in prices, the Reserve Bank of India has jacked up on Friday its basic policy rate —the repo rate— by 40 basis points to 5.4%. With this hike, the RBI policy rate now reaches what it was before the pandemic started.

This is a landmark which can be viewed as the complete normalisation of its monetary policy from the ultra accommodative stance adopted in the wake of the pandemic. From the early stages of the pandemic incidence in India, RBI followed a policy which was more engaged towards maintaining the tempo of the Indian economy against the severely contracting impact of the pandemic.

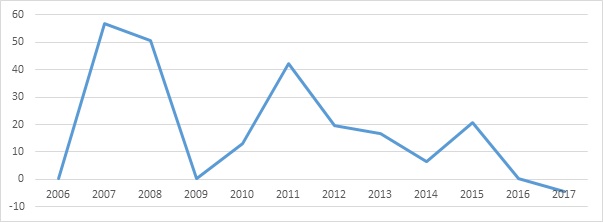

It may be recalled that for one quarter after the pandemic hit in the initial stage, the Indian GDP had shrunk by a quarter. For a whole year, the GDP had fallen and its performance diverged from the long term growth path. It thus needed a kind of nursing before the economy could get up on its feet.

Has the Indian economy then recovered from the adverse effects of the pandemic so that the RBI could reverse its accommodative monetary policy stance. In a way, yes, going by the optimistic note stuck by the RBI governor while announcing monetary policy.

Reserve Bank estimates growth in the first quarter of the current fiscal at 16.2%, dipping to 4 per cent by the fourth quarter, with growth for whole year at 7.2% for 2022-23.

In April RBI cut the GDP growth projection for 2022-23 to 7.2% from its earlier forecast of 7.8%. Governor Shaktikanta Das, however, stuck a line of caution saying that the continuing Russia-Ukraine war could yet weigh down the prospects. At any rate, he did not have any reason to further revise the growth prospects down at this point of time.

The overall projections for the economy pivot around the most unpredictable factor: nature of the monsoon and its incidence. So far, the monsoon has been 6% above the long term average. However, its incidence an intensity maters a lot as well as the spread of rains. So far, there has not been any untoward trends and RBI thus sets the farm sector growth at an even keel.

This is important, since the overall performance of the agriculture sector sets the tone for internal demand. As such, internal rural demand is somewhat sluggish and some of the critical off take in the rural areas are trailing. Tractor sales were noticed to be lower this year compared to one year back. However, there was a spurt in tractor sales last year and the current trailing demand could be on the back of large purchases a year back.

High frequency indicators of activity in the industrial and services sectors were holding up. Production and sales of consumer durables are rising and the manufacturing sector has hit high levels of capacity utilisation, according to the Reserve Bank’s surveys.

RBI expects the activity in the contact intensive services sectors, like tourism and IT services, to raise in the wake of overall improvement in economic activity. Since these segments are the drivers of the economy, the growth prospects would brighten with their gaining strength.

The external sector has shown particular buoyancy with exports rising despite global uncertainties. Exports increased, though imports went by record numbers resulting in unprecedented level of current account deficit of over $100 billion in April to July period. Global demand for Indian IT and ITES continued to grow and tourism and travel services also improved.

What is most encouraging that foreign direct investment flows at $13.1 billion was higher compared to $11.6 billion the same time last year.

Nevertheless, the adverse global situation gave rise to competitive depreciation of all currencies against the US dollar. This did not let off India and the rupee had depreciated and hit the 80 to a dollar rate which could possibly be explained only by the large sale movement of portfolio investments by overseas investors.

Thus, two critical parameters for setting any policy framework appear to be the anticipated incidence of two variables: how the financial markets react to the evolving monetary policy stance of the US Federal Reserve and the course of the once of crude oil.

The crude oil price behaviour undeniably influences the domestic price line as much as any policies of the central bank. This is true not only of India but all the other emerging nation economies. The average Indian crude oil import price is currently at around $105 per barrel. At this level the oil import bill places a huge burden on the current account.

This is the most important contributor to the imported inflation, which has been referred to by the RBI governor in his statement. There is precious little that can be done. The oil price dynamics will be the end result of a series of imponderables from Russian sanctions to Saudi Arabia’s crude production programmes on the basis of its geo-political considerations.

On the other hand, the monetary policy stance of US Fed, its decisions to hike or lower interest rates would drive the flow of capital across the world. As th US Fed raises its interest rates, portfolio investors would decide on their investments in emerging markets or in the US. That sets turmoils in the global financial markets, as we have often witnessed.

In his sphere at least, RBI can fire wall Indian markets from overexposure to global ups and downs. This cannot be done fully; however, to an extent this could be achieved as we hd done during the global financial meltdown.

In the coming days of global uncertainties, RBI should set in place such a buffer for India. The global finical markets instabilities should touch the Indian markets as mutely as possible. That will ensure both our continued growth as well as financial stability. We have not so far seen such an approach from the RBI this time. (IPA Service)

Thackeray was ready to align with BJP sans Shinde

Thackeray was ready to align with BJP sans Shinde