By Subrata Majumder

India’s fiscal budget for 2022-23 drew much despair and less cheer. It was alleged to miss counter measures to ebb inflation and generate more employment opportunities. Budget poured little for poor and middleclass. Little was made to create demand. No tax relief for resilience to pandemic. Marginal increases in education and healthcare expenditures. Food subsidy halved. Stock market tumbled. Paranoia raised over economy tending towards K-shape, which means rich becoming richer and the poor poorer during pandemic.

Nevertheless, there was mixed reaction from foreign investors. Foreign investors from USA and Europe were upbeat, leaving Japanese lacklustre. Basically, India has two major foreign investors, USA and Japan, albeit Singapore and Mauritius emerged trend setters in recent years. The angst with Singapore and Mauritius lies with the investors from these countries since they are not original Singaporeans and Mauritius investors. They are mostly foreign subsidiaries in these two nations. For example, major investors from Singapore are Japanese subsidiaries and from Mauritius are American investors. There are many hue and cry in the investment from these two nations, such as violation of FTA rules and misuse of tax breaks for capital gain. They are not considered dependable foreign investors.

Budget proposed massive capital expenditure for 2022-23. This was the biggest expenditure, sharing 19.2 percent of total expenditure and 2.9 percent of GDP. It increased by 35.4 percent over the previous year budget. In other words, capital expenditure was the main stay for budget 2022-23. Major shares in capital expenditures embody expenditure in infrastructure, such as building roads and other infrastructures and focus on national logistic infrastructure to bolster the supply chain manufacturing, a new vision for Make in India.

Boost in capital expenditure has manifold impact, the budget advocated. It is not only for development of infrastructure. The collateral impact is that it increases opportunities for employment for poor and middle class who were most affected by COVID 19 pandemic. Capital expenditure will trigger construction boom, which, in turn, increases scope for MNREG scheme, which ensures 100 days employment in a year to a member of a every rural family. Eventually, this will increase demand, which is crucial to bolster the economy.

Further, capital expenditure will have colossal impact on development of logistic infrastructure and manufacturing. It will pave the way to increase EODB (Ease of Doing business). India has already made a challenge since past five years, by revamping its ranking in World Bank EODB.

Given the fundamental directives in the budget for 2022-23, eyebrows were raised how the budget could influence the foreign investors, particularly USA and Japan, against the paradoxical situation in investment between the two countries. While USA investment surged during pandemic, by over 227 percent in 2020-21, Japanese investment declined by 39.5 percent.

The factors enticing USA investor to chant the budget for bounce back economy were big E- commerce market, focus on green infrastructure and formulating a National Logistic Policy. President of US-India Strategic and Partnership Forum (USISPF), Mr Mukhesh Aghi said “it was a “measured and pragmatic budget “. Decoding the significance of the budget to bolster bounce back economy, he said “35 percent increase in capital expenditure will support investment in critical infrastructure”. President of US-India Chamber of Commerce, Mr Karun Rishi surmised the budget a massive boost to business confidence with the formulation of National Logistic Policy.

American investors seemed to have bet India against China during COVID 19 .They splurged investment in India, despite COVID 19 battered the economy. The reversal of US investors’ mindset, focusing India an important destination and showing volte-face to China, portrays a new dimension in US investment in India. Recent surveys by USA investment suggest that firms are increasingly circumspect about China’s short and long term perceptions on foreign investment in the wake of trade tensions, hike in wages in China and protectionism.

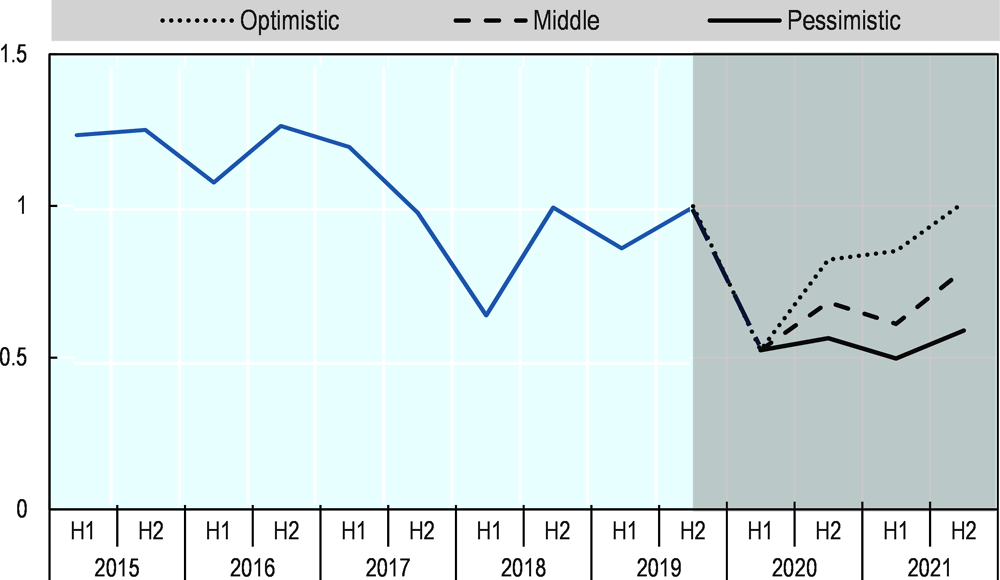

In case of Japan, a dramatic global structural change in Japanese investment during pandemic impacted India. Globally, Japanese investment waned in manufacturing and spurred in non-manufacturing, reversing the previous trend. Nearly three – fourth of Japanese investment abroad was made in non-manufacturing in first three quarters of 2021 (74.4 percent) , leaving a small space for investment in manufacturing ( 25.6 percent) , as compared to less than half in non-manufacturing (41.2 percent) and nearly sixty percent in manufacturing (58.8 percent) in 2021.

In manufacturing, the biggest investment flowed was in transport equipment ,viz. automobile sector , sharing 15.7 percent in 2020 of total investment, followed by electric machinery with 13.4 percent. In 2021 (January-September), investment in transport equipment dipped to 3.1 percent.

One reason for the dramatic change in Japanese investment abroad in manufacturing during pandemic could be the disruptions in supply chain. The gradual retreat of China in supply chain owing to lockdown and US-China trade off marred the Japanese investment in transport sector in overseas.

Eventually, the global downturn of Japanese investment in transport equipment lend a collateral impact on Indian automobile sector. This sector attracts largest Japanese investment in India. Besides, RCEP seemed to have thrown an hangover to the Japanese investment after India withdrew from the trade block. Japanese investment made a whopping growth in ASEAN despite COVID 19 which battered the trade block economy, including China. Japanese investment in ASEAN during first three quarter in 2021 (January-September) excelled investment in full year of 2020.

Hence, the structural change in Japanese global investment faded Japanese initiative to invest in India during pandemic. It is a misgiving that set back in the Indian economy due to COVID 19 left the Japanese investors in retreat. Some analysts quipped, had India stepped up liberalization in FDI in multi-brand retail, green shoot of Japanese investment would have been visible. During pandemic, Japanese global investment boomed in wholesale and retail trade. In first three quarters of 2021, they increased by 157.3 percent and accounted for 21.9 percent of total investment abroad, as compared to 9.2 percent during the same period in 2020. Should India give a thought on FDI relaxation in multi brand retail to recoup the Japanese investment? Multi-brand retail is beneficial to suppliers to retailers, particularly agro product growers and the middle class consumers, with a collateral impact on retail inflation. (IPA Service)

Yogi Adityanath Has Lost His Senses By Putting His UP Model Above Kerala

Yogi Adityanath Has Lost His Senses By Putting His UP Model Above Kerala