NEW DELHI: The Indian government is making all efforts to save the strategic Rs. 4,000-crore Kishenganga hydro-electric project on the Kishenganga River (known as the Neelum River in Pakistan), as it readies to file a rejoinder on Pakistan’s reply before the International Court of Arbitration (COA) at The Hague by May 21, 2012. Hectic talks are on between the the ministry of external affairs (MEA) and power to salvage the project that is in very advance stage of construction and on which Rs. 2,500 crore has already been expended.

NEW DELHI: The Indian government is making all efforts to save the strategic Rs. 4,000-crore Kishenganga hydro-electric project on the Kishenganga River (known as the Neelum River in Pakistan), as it readies to file a rejoinder on Pakistan’s reply before the International Court of Arbitration (COA) at The Hague by May 21, 2012. Hectic talks are on between the the ministry of external affairs (MEA) and power to salvage the project that is in very advance stage of construction and on which Rs. 2,500 crore has already been expended.

The 330-MW project is located in the Bandipora district of J&K and is a run-of-the-river scheme, involving transfer of Kishenganga water in Gurez valley to Bonar Madmati nallah near Bandipora inKashmirvalley.Pakistan, which is also building a hydropower project (called the Neelum-Jhelum project) on the same river, has objected to the Kishenganga project contending that its construction of will adversely impact their development.

Few rounds of submissions have already taken place in the COA and submissions are in the final stage.

“In all probability, it does not appear likely that the work on the project would require to be stopped, but if the court accepts Pakistan’s contentions, in the worst scenario, India may be put to a financial loss as already Rs. 2,500 crore has been spend on the project,” said a senior government official who is part of the strategic negotiations to salvage this project.

Officials said the project is governed by Indus Waters Treaty 1960, betweenIndiaandPakistanwhich inter-alia provides for examination of the projects. “The treaty is administered through a Permanent Indus Commission (PIC) in which both the countries are represented by respective commissioners and other officials,” the official said.

“The issue came up for discussion on numerous meetings of the PIC resting with 103rd meeting held atNew Delhibetween May 31 to June 5, 2009 wherePakistanraised certain questions but could not be resolved.”

According toPakistan, the Kishenganga project envisages the diversion of the waters of the Kishenganga/Neelum into Bonar-Madmati Nallah.

POWER WILL COST MORE AS MINISTRY DECIDES TO ALLOW FUEL PRICE PASS ON

NEW DELHI: Get ready for higher electricity bills. The Power Ministry will soon allow developers to pass on the volatility in fuel prices to customers.

The Power Minister, Mr Sushilkumar Shinde, told Business Line that the Government will make this provision as part of the soon-to-be released bidding documents. All projects under the 12th Plan will have this benefit.

Till now, only NTPC was allowed to do so, as it operates under a regulated regime. Private players have been acquiring projects through tariff-based competitive bidding. But they have been crying foul over volatility in fuel prices. If benefits are not given, no developer would enter this country, Mr Shinde said, adding “Why should they invest their money?”

On electricity pricing, he said, “at the moment, I think we will have to see the overall picture. It is the duty of the regulator to fix the price.”

But the Ministry has to consider both sides, developer and consumer, he said, adding that “I feel both the parties should not face any losses, and the country, too, should move forward.”

For 2011-12, NTPC charged around Rs 2.96 a unit to discoms (distribution companies), which had their own commissions. The end consumer price averaged between Rs 4 and Rs 5 a unit.

In the case of Tata Power’s Mundra project, the tariff is levelised at Rs 2.26 a unit, a price at which they had bid in 2007, despite huge volatility in imported fuel price. The end consumer price is at Rs 2.40 a unit.

The business risk profile of projects based on imported coal is impacted by high price volatility, unpredictable long-term price arrangement and change in law/political risk in the source countries where the mine is located.

While private players mostly opted for the tariff-based model, NTPC followed the cost-plus method. Incidentally, the private players had termed NTPC’s method as safe and expensive. Today, with their calculations going wrong, they also are seeking a similar model, sources said.

Private players have been saying that to cover the risk associated with high fuel prices, the Government should incorporate the provisions in the relevant articles of the power purchase agreements (PPAs).

The entire exercise is to ensure quicker capacity addition. Projects of over 50,000 MW capacity are at present under construction by private developers. The private sector is likely to add about 52 per cent of the total capacity in the 12{+t}{+h} Plan. More than 80,000 MW capacity (both public and private) is under construction for 11{+t}{+h} and 12{+t}{+h} Plan. NTPC’s current capacity is 37,514 MW

The private sector has grown from 11.6 per cent in 2006 to 30 per cent as of date. They have invested more than Rs 1 lakh crore and have committed an expenditure of Rs 2 lakh crore up to the first two years of the 12{+t}{+h} Plan.

GOVERNMENT MAY AWARD ONLY ONE ULTRA MEGA POWER PROJECT IN FY13

MUMBAI: The government may at best be able to award only one ultra mega power project in the current fiscal to March, a senior official from the ministry of power told ET.

“There have been delays in the bid process but we may be able to award the UMPP at Bhedabahal in Orissa in 2012-12,” the official said.

Indiafaces a peak power deficit of around 10%. The government had launched ultra mega power projects of 4,000 megawatts each, which would be developed by the private sector on a build-own-operate basis, to fill the growing gap between power demand and supply.

Tata Power is developing the first of these UMPPs at Mundra inGujarat, which has commissioned its first unit of 800 mw this month. Reliance Power is developing three such UMPPs.

The development of UMPPs has hit a roadblock as developers claim that costs escalation has rendered the projects unviable. Reliance Power has stopped work on its 4,000-mw UMPP at Krishnapatnam in Andhra Pradesh citing higher fuel costs after a change in policy inIndonesiahas increased the cost of imported coal.

Tata Power, which recently commissioned the first unit at its Mundra UMPP inGujarat, has sought increase in tariff on similar concerns.

“We are awaiting the new standard bid document which will address all issues. Once the bid document is in place, we would bid out new projects,” the ministry official said.

The government may next invite bids for a UMPP at Cheyyur in Tamil Nadu by March.

WE ARE CREATING LEVEL-PLAYING FIELD FOR ALL STAKEHOLDERS: SHINDE

NEW DELHI: Giving free electricity to 1.75 crore below poverty line households is not easy. And who would know this better than the Power Minister, Mr Sushil Kumar Shinde.

Fuel supply constraints coupled with poor equipment availability has been a major challenge for his Ministry. Sharing his thoughts with Business Line on six years of his journey in the Ministry, Mr Shinde said that offering a level-playing field for all stakeholders is the mandate set by him.

The country’s power equipment manufacturing capacity was very low, thus we were not able to meet targets. BHEL alone was not able to meet the demands. On the Ministry’s initiatives, six new joint venture companies — L&T-MHI, Bharat Forge-Alstom, Ansaldo-GB Power, Toshiba-JSW, Thermax-Babcock & Wilcox, and BGR with Hitachi – are setting up their base in India. Doosan is also putting up a facility inIndiawith 100 per cent FDI.

The orders are now being given through the competitive bidding process. Though we are giving preference to BHEL, it has to participate in the bidding rounds. If BHEL comes second or third in the bidding process, it will have to match the lowest bidder. That is the procedure. BHEL was also given preference in bulk tendering.

Others (suppliers including CoalIndia) were not keeping pace with our progress. While we were running so fast, the others were watching. They felt that growth will be slow. But, from 5,000-10,000 mega watt (MW) capacity addition a year earlier, suddenly, we went to 21,000 MW in 2011-12.

The growth was because of large private participation. This led to higher demand for fuel, while supply was not enough. Gas, in fact, is not available. Had gas been available, in the mid-term appraisal, I could have easily done 62,000 MW instead of 55,000 MW. It is because of supply constraints (gas and coal) that I could not add more capacities. However, fuel linkages for 12 {+t} {+h} Plan projects have been done. That is the work that we have done very minutely. So there is no problem.

Since the last two years, we have been asking for an increase in coal supplies. Finally, the Prime Minister had to tell the supplier (CoalIndia) to increase production by five per cent. It is because of his directive that fuel supply agreements have been signed from 2009. There will be no problem now. They have been asked to increase production, and they are doing so now.

These are teething problems. Everyone is worried, including the Coal Ministry. Problems can be worked out. The PMO is also looking at them. The penalty is there to put more pressure, so that they can work hard. Otherwise there is no need (for the penalty cause).

After doing hard work, I do not want somebody to say that we have not achieved the target. We want a realistic target. And this is what we have been telling the Planning Commission. Now, they (Planning Commission) have to consider the ground reality and only then fix the targets.

For instance, we have been saying that for the 12 {+t} {+h} Plan, capacity addition should be 75,785 MW based on the ground reality. (For the 11 {+t} {+h} Plan, the capacity addition was 54,964 MW versus the target of 78,000 MW.)

There have been some issues. We are planning to make the document more flexible in the 12 {+t} {+h} Plan. Considering the position of imported coal and what happened to Tata Power’s Mundra project, we will have to change our rules. We just cannot keep sitting like bureaucrats. International prices (of coal) have gone up. So we are finding some way out (for Mundra project). There should not be any loss to the developer or consumer.

The issue has been decided by the Group of Ministers. Sasan (of Reliance Power) will follow the GoM’s decision. Henceforth, any such decision will be based on the new policy on surplus coal currently being formulated by the Coal Ministry.

Accountability is the key. I have appointed an advisory committee which monitors all projects, reviews the status. This entire group sits together every month. That is the reason we saw 21,500 MW coming in the terminal year of 11 {+t} {+h} Plan.

POWER PARALYSIS! 20% OF CAPACITY SHUT DOWN FOR LACK OF FUEL & EQUIPMENT FAILURE

NEW DELHI: As the mercury rises and the summer heat peaks, Indians may be in for sweaty days with long power cuts in some regions as several plants have been forced to shut down due to scarcity of fuel and transmission facilities and equipment failure.

Almost 20% ofIndia’s total installed power generation capacity has been shut down due to various reasons, forcing utilities to cut supplies to factories and households.

Analysts warned that the situation would deteriorate as demand for power peaks in the next four weeks. The shutdowns have wiped out the expected benefits of the record capacity addition of 20,000 mw in 2011-12.

Southern states such as Tamil Nadu, where the power deficit is as high as 23.5%, are facing prolonged blackouts. Haryana, where 1,200 mw of capacity is shut due to equipment failure, and Madhya Pradesh faced a deficit of 15-24% in April, well before the peak summer demand.

Data from the Central Electricity Authority reveals that almost 35,000 mw, or 18% of the country’s total generation capacity of 2 lakh mw, has been shut down this month.

Of this, about 25,000 mw has been closed under ‘forced outage’, which means these power plants have been shut down due to unforeseen reasons relating to lack of fuel, reluctance of state utilities to buy expensive power, technical disruptions or damages in plant equipment.

Industry officials said the massive shutdowns were disturbing. “At any given point, the outage should not be more than 12% of the total capacity. Such high degree of outage, that too during summer, is worrying,” said Ashok Khurana, director-general of the Association of Power Producers. The association represents 24 leading companies, including Tata Power and Reliance Power.

“Some of the forced outages could be also because demand from discoms (distribution companies) has fallen even though generators have declared power availability,” Khurana said. Companies usually shut down plants during monsoon for maintenance since demand is low and hydropower generation is high.

Utilities try to maintain high output in summer as demand is at its peak due to consumer and irrigation requirements. Power generators are also considering shutdowns as most loss-making state-owned distribution companies are undertaking load shedding to avoid buying expensive power.

Of the 94,500 mw of coal-fired capacity across 89 plants, 17 have coal stocks that will last less than four days, while 28 have stocks for less than a week, against the norm of 22 days. Around 3,000 mw of thermal capacity faces shutdown due to either shortage of fuel or disruption in supply.

These include a 300 mw unit at Reliance Power’sRosaproject and a 600 mw unit at Lanco Infratech’s Anpara project, both in UP. “TheRosaplant has fuel linkage for 5 million tonnes of coal, but due to some problem in rakes, the supply was low and a 300 mw unit had to be shut down. The problem is likely to be resolved soon,” a source close to the development said.

Some units have been shut down due technical reasons and equipment breakdown. Haryana is the worst-hit as three of its power units, totalling 1,200 mw, have been shut down due to breakdown in machinery.

“Units running on imported coal are not getting the right price in the market, so some have shut down even though this is peak summer,” said Ajoy Mehta, MD, Maharashtra State Electricity Distribution Company.

A senior executive of the Central Electricity Authority said the shutdowns are also partly because some recently commissioned projects have not yet stabilised and started commercial production.

“India’s peak power shortage is around 11%. With forced shutdowns, it would get aggravated and lead to load shedding,” said Debasish Mishra, senior director (consulting), Deloitte Touche TohmatsuIndia. Tamil Nadu and Andhra Pradesh have enforced weekly power holidays for industrial consumers.

NTPC PLANS TO IMPORT 16 MILLION TONS COAL THIS FISCAL YEAR -EXECUTIVE

NEW DELHI– NTPC Ltd. (532555.BY),India’s biggest power producer by capacity, plans to increase this fiscal year’s coal imports by a third due to a local shortage, a senior company executive told Dow Jones Newswires Thursday.

The state-run utility plans to import 16 million metric tons in the year ending March 31 compared with 12 million tons last year, the executive, who didn’t wish to be named, said.

The plans to increase coal imports come amid falling income at NTPC. Last week the company reported a second consecutive drop in quarterly net profit during the January-March period, caused partly by lower power generation due to a shortage of coal.

NTPC has already more than halved its capacity addition target for the five years through March 31, 2017 to 14 gigawatts from 29 GW. The cut surprised many analysts and made the company focus on its coal import plans for fuel security.

Local coal shortages are estimated around 100 million tons. NTPC, which had contracted Adani Enterprises Ltd. in March to supply 4 million tons of imported coal, is seeking bids for another 5 million tons, the tender for which will open early next week.

“We will do another 7 million tons during the second half of the year,” the executive said. “With import plans in place, we are quite comfortable fuel-wise.”

Most of NTPC’s projects totalling 37.5 GW are coal-based.

The local coal supply-demand gap has widened over the past two years as output growth stagnated at Coal India Ltd., which supplies more than 80% ofIndia’s needs, due to various reasons including delays in getting environment clearances for mining projects.

The shortages hurt the electricity sector the most as more than half of its 200 GW capacity is coal-based and many upcoming projects are also dependent on it.

The shortfall has forced utilities to increase imports, which are expensive.

NTPC expects this year’s coal needs to go up by about 15.5% to 164 million tons, the executive said, as it targets an addition of 4.16 GW of fresh capacity, compared with an addition of 2.8 GW last year.

NSPCL POSTS NET PROFIT OF RS 194.22 CRORE

NEW DELHI: NSPCL, a joint venture of NTPC Ltd and SAIL, has posted a net profit of Rs 194.22 crore for the financial year ended 31 March 2012 as against a net profit of Rs 191.33 crore in the corresponding period of 2010-11.

The total revenues grew by 27.27 per cent to settle at Rs 2449.81 crore (including the value of coal) for 2011-12 as against Rs 1924.96 crore during the previous fiscal year.

The improved financial performance is attributable to increase in declared capacity and operational efficiency in the plants located at Bhilai,DurgapurandRourkela. Bhilai Power plant (2×250 MW) has secured an allIndia12th rank, amongst all coal-based power plants inIndia, in terms of achievement of PLF during the year.

The company has proposed a dividend of 12 per cent on equity share capital of the company for the year ended 31 March 2012. Vishwaroop, chief executive officer, informed that the Bhilai Power Plant (2×250 MW) has been continuously exhibiting good performance in the current year also and has secured 4th rank amongst all the coalbased plants in the country during the month of April 2012.

CRISIL REVISES NTPC`S FAIR VALUE TO RS 214

CRISIL Research has come out with its report on NTPC . The research firm has maintained the fundamental grade of 5/5 to the company in its May 16, 2012 report.

NTPC Ltd’s Q4FY12 results were broadly in line with CRISIL Research’s expectations. The plant load factor (PLF) as well as the plant availability factor (PAF) for coal stations increased q-o-q owing to improved availability of coal. However, the capacity addition in FY12 disappointed. We have lowered the 12th Five-Year Plan capacity addition estimates owing to anticipated delays in land acquisition, coal availability and environmental clearances for some bulk-tender projects. Signing of fuel supply agreements (FSAs) with Coal India Ltd is a key monitorable. CRISIL Research continues to believe that NTPC is best placed to withstand the headwinds in the power sector. Consequently, we maintain our fundamental grade of 5/5.

• NTPC’s generation increased 4.0% y-o-y (up 6.7% q-o-q) on account of an increase in installed capacity. The improvement in coal availability led to q-o-q increase in generation (see page 3 for PLF and PAF).

• Operating income increased 4.9% y-o-y (5.3% q-o-q) to Rs 163.6 bn on account of higher power generation.

• Fuel cost increased 7.4% y-o-y (down 3.2% q-o-q) mainly on account of price hikes by CoalIndia. Other expenditure declined 31.3% y-o-y (13.3% q-o-q). The company had preponed its repair and maintenance activities which usually takes place in Q4 to Q3, which has resulted in y-o-y and q-o-q decrease in other expenditure.

• EBITDA increased 5.6% y-o-y (35.8% q-o-q) driven by increase in revenues and decline in other expenditure. The q-o-q increase in EBITDA was due to higher incentive income on account of q-o-q improvement in PAF and PLF.

• Adjusted PAT declined 14.8% y-o-y (up 19.8% q-o-q) on account of higher tax outgo. The provision for tax included Rs 1,548 mn on account of tax related to the previous years. EPS declined 14.8% y-o-y (up 19.8%) q-o-q to Rs 3.2.

• The company has announced a total dividend of Rs 4.0 per share for FY12. At the current market price of Rs 143, it offers a dividend yield of 2.8%.

We have revised our capacity addition estimates for the 12th Five-Year Plan from 21.3 GW to 13.7 GW on account of anticipated delays in some bulk-tender projects. We have reduced our FY13 and FY14 EPS estimates by 6.1% and 7.8%, respectively, due to lower capacity additions.

CRISIL Research has used the discounted cash flow method to value NTPC. Our fair value has been revised from Rs 238 to Rs 214. At the CMP of Rs 143, our valuation grade is 5/5.

RELIANCE POWER ASKS CAG TO DROP ‘UNDUE GAINS’ REMARK

NEW DELHI: After the government recently reaffirmed its earlier decision to allow Reliance Power Ltd (R-Power) to divert surplus coal from its Sasan project in Madhya Pradesh for a nearby project, the company has asked the Comptroller and Auditor General (CAG) to drop its observations of “undue benefit” in a draft audit report.

The final report is expected to be tabled in Parliament in the current session.

“In view of the action taken by the power ministry to review Sasan coal permission at the highest levels of the government as recommended by CAG and the decision of the EGoM (empowered group of ministers) that the surplus coal permission for Tilaiya would be governed by a comprehensive policy, we would request you to kindly consider dropping the para on undue benefits,” R-Power said in a letter written to CAG last week.

A draft report of CAG on coal allocation had alleged undue benefits to the tune of Rs 15,849 crore, extended by the government to R-Power by way of surplus coal allocation for two of its ultra mega power projects (UMPPs). The report pegged benefit to R-Power from surplus allocation for Sasan UMPP at Rs 4,875 crore. Another Rs 10,974 crore “may accrue” from the Tilaiya UMPP, it said.

CAG officials, however, maintained that a change in the report was not possible since the audit involves scrutiny of decisions during a time period based on the prevailing policy.

“The final report is ready for tabling in Parliament,” said one official.

On April 28, the government had decided to stick to an earlier decision to allow

R-Power to divert surplus coal from mines allotted for Sasan UMPP to another nearby project. After a meeting of EGoM, Law Minister Salman Khurshid had said the government cannot review decisions taken in the past.

“The AG (attorney general) had interpreted the decision of EGoM taken in 2008 and had said that the decision was correct. Obviously, we will go by the opinion as it explains and fortifies the 2008 decision,” he had said.

Asked whether the decision would set a precedence and be used by the government for allowing surplus coal diversion in all similar cases going forward, Khurshid had said a comprehensive policy on surplus coal would be finalised soon, based on AG’s recommendations, to avoid ambiguity in future.

AG has opined that the government has the right to permit allocatees to use surplus coal for other projects and that EGoM’s approval to diversion was a well considered decision.

The draft report was quoted in a Times of India news report on March 22 as finding undue benefits through allotments of 155 coal blocks to various companies.

Later, in a letter to Prime Minister Manmohan Singh, CAG had downplayed the draft report, saying “the details being brought out were observations under discussion at a very preliminary stage and do not even constitute our pre-final draft.”

ESSAR ENERGY SIGNS LONG-TERM POWER PURCHASE AGREEMENT WITH NOIDA POWER

MUMBAI: Essar Energy plc, the India-focused integrated energy company has signed a power purchase agreement (PPA) with Noida Power Company for 240 megawatts (MW) of contracted capacity from Essar Energy’s 600MW coal-fired Tori II power station which is under construction in Jharkhand.

The binding PPA has been signed by the Noida Power Company with Essar Energy’s subsidiary Essar Power Jharkhand Limited (EPJL) and has a 25 year duration.

The PPA was secured following a competitive bidding process, with supply of power under the terms of the PPA being due to commence from April 2014.

Under the terms of the PPA, Essar Energy will supply power at a delivered levelised tariff, including transmission costs, of Rs.4.08 per kilowatt hour (approximately 7.6 US cents per kWh), which is the highest long term tariff achieved through competitive bidding in India to date. The levelised tariff net of transmission costs is Rs. 3.27 per kWh (approximately 6.2 US cents per kWh).

The agreement is the first PPA that has been signed for the Tori II project. At its 1,200MW Tori I project, which is also under construction, Essar Energy has already signed two PPAs of 300MW and 450MW, both for 25 years, with the Bihar State Electricity Board.

Naresh Nayyar, chief executive of Essar Energy, said: “We are pleased to have concluded this agreement with Noida Power. We continue to make good progress in securing long term revenues from our power generation projects inIndia.”

Essar Energy currently has 2,200MW of generation capacity operational, with a further 2,310MW of capacity due to be commissioned this year at the Salaya I, Mahan I and Vadinar P2 projects. Beyond this a further four power projects are due to be commissioned by March 2014, including the Tori I and Tori II projects, which will take Essar Energy’s total to 6,700MW by that date.

AUSTRALIA‘S URANIUM SUPPLY TO INDIA WILL BE DEMAND BASED: ENERGY MINISTER MARTIN FERGUSON

MELBOURNE:Australia’s uranium supply toIndiawill be demand based once the approvals for the yellow cake exports toNew Delhiare finalised, Energy Minister Martin Ferguson has said.

“It (uranium supply) will be demand based. The supply once approved for exports will be of a commercial nature between the Australian uranium and mining industry and potential customers inIndia,”Fergusontold PTI.

Asked when the uranium exports will begin,Fergusonsaid “We don’t put a timeframe. This is about a negotiation of a product betweenAustraliaandIndia.”

“The issue is to get it right to resource negotiations and to make sure that we take the respective community with it in terms of their confidence about the fact that the uranium will be used safely.”

Australia’s uranium reserves are the world’s largest, with 23 per cent of the total.

Ferguson, a Labor party leader who had earlier advocated uranium sale to India, yesterday become the first politician to receive the Ashoka Medal, the first of its kind award instituted by Australia India Business Council – Victoria and Australia India Institute (AII), for his outstanding contribution made towards India Australia relations in the last twelve months.

He said that Australian uranium industry was growing and the amount to be sold to countries likeIndiawould be based on demand and between the buyers and sellers.

In December last year, Labor party, led by Julia Gillard, cleared the way for Australian uranium to be exported to India after a strong debate on the floor of the party’s 46th national conference.

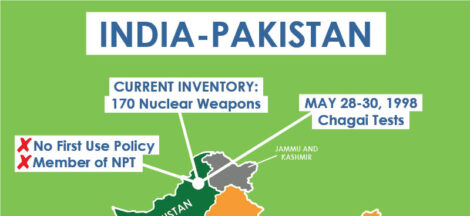

Despite resistance from opponents, the landmark policy change was carried by a majority of delegates, paving the way for the first Australian country-to-country agreement to sell yellow cake to a nation outside the Nuclear Non-Proliferation Treaty.

Ferguson, a strong supporter of the uranium industry, had been lobbying within the government for Labor to re-instate the Howard policy of selling uranium toIndia.

COAL BLOCK ALLOCATION WAS FAIR AND TRANSPARENT: COAL MINISTRY

NEW DELHI: Amid allegations of favouritism in allotment of captive coal blocks, the Coal Ministry today said fair and transparent procedure was followed while allocating mines between 1993-2009.

“Fair and transparent procedure was followed (in allocation of coal blocks between 1993-2009) which was devoid of any bias,” Coal Ministry said on its website.

The statement comes in the wake of the Comptroller and Auditor General (CAG) estimating a Rs 10.6 lakh crore loss to the exchequer on account of allotment of coal blocks without auction to companies.

The ministry also said that as the demand for coal grew, it was felt that Coal India alone would not be able to meet it. As a result, “the option of giving a bigger role to the private sector was explored,” it said.

“It is in this background…Why different governments during the period 1993-2009 allocated coal blocks to private parties for captive purposes.

However, no coal block was allocated to a private company without the recommendation of the state governments concerned,” it added.

The coal ministry further added that if mines were not allocated by it, it would have caused higher imports of coal, resulting in outflow of foreign exchange or no large investments in the sectors like power, steel and cement.

The coal reserves were given through a Screening Committee that consisted of representatives from state governments, concerned ministries (Centre) and coal firms.

“The coal blocks used to be advertised calling for the applications form interested parties,” it said.

CIL LAUNCHES MORE LIBERAL RESETTLING AND REHABILITATING POLICY

NEW DELHI: CoalIndiahas introduced a more flexible policy for resettling and rehabilitating people affected by its mining projects, the government said on Thursday.

“CIL has introduced a liberalised new Resettlement and Rehabilitation (R&R) policy…It attempts to consolidate the different resettlement and rehabilitation practices that are being followed by CIL subsidiaries,” coal minister Sriprakash Jaiswal said.

The concept of annuity in lieu of compensation is being introduced to mitigate the ever dependence of families affected by the project.

Other features include land compensation to land outstees as per the provisions of concerned act or state government notification, employment to land oustees against every two acres of land, among others, it added.

Pakistan’s Nuclear Threat To India Is Real

in

IPA Special

May 19, 2025

·

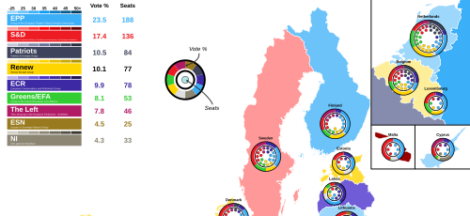

Three National Elections In Europe Send Mixed Political Signals

in

IPA Special

May 19, 2025

·