Business

India Inc May See 9% Salary Hike In 2025 But Big Slump In Tech Consultancy

NEW DELHI: The salary increments in India are expected to stabilise in 2025 with a rise of 9.2 per cent during the year, according to a survey conducted by professional services firm Aon. This is slightly lower than an increase of 9.3 per cent reported in 2024, amidst global...

India-Qatar Trade Agreement Must Be Approached With Caution: GTRI

NEW DELHI: India should tread cautiously on a potential free trade agreement (FTA) with Qatar, particularly in the petrochemical sector as both countries are strong in this segment, economic think tank GTRI said on Wednesday. The Global Trade Research Initiative (GTRI) added that India should ensure that tariff concessions...

Coal Ministry Plans To Offer Extra Incentives In Mine Auctions

KOLKATA: The Coal Ministry is planning additional incentives to boost underground (UG) commercial coal block auctions in India, a senior government official said on Wednesday. The push for UG mining aligns with India’s drive for sustainable coal production. The proposed incentives are in an advanced stage of discussions and...

Efforts To Serve Complaint On Gautam Adani, Sagar Adani Ongoing: SEC

NEW YORK: The United States (US) Securities and Exchange Commission (SEC) has told a federal judge here that its efforts to serve its complaint on Gautam Adani and Sagar Adani in the alleged bribery scheme are “ongoing”, including through a request for assistance to the Indian authorities. The SEC...

Mysuru Layoffs: Infosys Denies Force, Intimidation

NEW DELHI: IT services company Infosys on Wednesday said it did not use force or intimidation tactics when it laid off trainees at Mysuru campus over performance-related issues, and that it was explaining the circumstances to the labour department authorities. Shaji Mathew, Chief Human Resources Officer at Infosys, however,...

Markets End Marginally Lower In Volatile Trade

MUMBAI: Benchmark indices Sensex and Nifty ended marginally lower in a volatile trade on Wednesday dragged by blue-chip IT stocks. The 30-share BSE benchmark Sensex dipped 28.21 points or 0.04 per cent to settle at 75,939.18. Intra-day, it hit a high of 76,338.58 and a low of 75,581.38, gyrating...

India, Qatar Aim To Double Trade To $28 Billion In 5 Years, Explore FTA

NEW DELHI: India and Qatar are exploring the possibility of signing a free trade agreement (FTA) in future and the two nations have set an aim of doubling bilateral trade to $28 billion in the next five years. “While there are talks going on for the India-Gulf Cooperation FTA,...

India’s Fiscal Trajectory In Line With Our Expectations: S&P Global Ratings

NEW DELHI: S&P Global ratings on Tuesday said that India has had a strong record of meeting revenue and fiscal deficit targets at the central level and that the rating agency’s expectations for fiscal trajectory in India are in line with projections made in the Union Budget for financial...

VSAT Players To Vacate Key Spectrum Band For Telecom Companies

NEW DELHI: In a move set to benefit telecom operators and consumers, the government will be directing VSAT (very small aperture terminal) service providers such as Tata Group’s Nelco, Hughes Communications and Inmarsat to vacate the 6 GHz spectrum band to make way for high-speed 5G and future 6G...

Demand For Indian Workers Set To Rise In Seven Key Regions

NEW DELHI: The international employment landscape for Indian workers remains strong, with sustained hiring across regions, as many as 3 million Indian workers expected to get employment opportunities from seven key countries by 2030, according to an analysis by the Union labour ministry. Among the seven countries – Saudi...

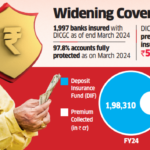

Insurance Cover For Bank Deposits May Be Doubled

NEW DELHI: The Centre is considering doubling the insurance cover for bank deposits, from Rs 5 lakh at present, to assuage the concerns of depositors, especially senior citizens, and strengthen the trust in the banking system, sources told FE. An announcement in this regard is expected by March end....

Trade Deficit Widens To Nearly $23 Billion In January As Exports Shrink

NEW DELHI: India’s merchandise trade deficit widened to nearly $23 billion in January, compared with $16.5 billion a year earlier, as the value of exports dropped amid subdued demand for petroleum products and global economic uncertainties. Exports contracted by 2.4 per cent year-on-year to $36.43 billion in January, according...

India Leading The Next Phase Of Global Outsourcing Expansion: Survey

NEW DELHI: India’s outsourcing landscape is undergoing a significant transformation, with 81% of organisations planning to increase outsourcing efforts over the next three to five years, according to Deloitte’s latest report, ‘The Outsourcing Compass: Decoding Strategies of Today’. This shift is driven by the growing demand for technological advancements,...

TRAI Recommends Bringing Teleport Operators, IXPs Under Authorisation Regime

NEW DELHI: The telecom regulator has recommended that new telecom entities such as satellite earth station gateway, or teleport, providers and internet exchanges be regulated under the authorisation regime that it has already proposed for replacing the licensing regime. In its recommendations published on Monday, the Telecom Regulatory Authority...

Higher Bank Deposit Insurance Cover On The Cards

MUMBAI: The government is “actively considering” raising the insurance cover for bank deposits further from the ceiling of Rs 5 lakh fixed less than five years ago, department of financial services (DFS) secretary M Nagaraju said on Monday. The move comes in the backdrop of the fraud at New...

Govt Moves To Streamline Insurance Sector Compliance Ahead Of 100% FDI

NEW DELHI: The government is looking to streamline compliance and enhance ease of doing business in the insurance sector. A government official said efforts are underway to identify redundant regulations, especially as India prepares to allow 100% foreign direct investment (FDI) in the sector. “Some of these issues will...

Profit Booking Leading FIIs To Sell Indian Equities: FM

MUMBAI: Seeking to assuage concerns over Foreign Institutional Investors (FII) selling Indian equities lately, Finance Minister Nirmala Sitharaman on Monday attributed the action to profit booking. Speaking to reporters in the financial capital, Sitharaman said the Indian economy is one where the investors are bagging better returns which leads...

Airtel Completes Landing Of SEA-ME-WE-6 Submarine Cable

NEW DELHI: Bharti Airtel on Monday said it has completed the landing of the new Southeast Asia-Middle East-West Europe-6 or SMW6 (SEA-ME-WE 6) submarine cable system in Chennai. The company recently landed the SEA-ME-WE 6 cable in Mumbai on December 30, 2024. “The cable landing, both in Mumbai and...