MUMBAI: The government is “actively considering” raising the insurance cover for bank deposits further from the ceiling of Rs 5 lakh fixed less than five years ago, department of financial services (DFS) secretary M Nagaraju said on Monday. The move comes in the backdrop of the fraud at New India Co-operative Bank (NICB) that led the Reserve Bank of India to supersede its board for a period of 12 months. The NICB episode has raised fresh concerns about safety of bank deposits, and the regulatory oversight on cooperative banks, even though the Reserve Bank of India now has enhanced powers to regulate these entities.

Speaking at an event here, Nagaraju said: “The point about increasing insurance (for bank deposits) is under active consideration. As and when the government approves, we will notify it.” The official, however, didn’t indicate what the new threshold could be or the time period in which the cap will be raised. He also The official declined to comment specifically on the NICB crisis, and said that the RBI is seized of the matter.

Separately, economic affairs secretary Ajay Seth said at the same event that while it is the regulator’s job to take action against banks where weaknesses have been found, painting all co-operative banks with the same brush is not right. He noted that such banks were working well in many states. He stressed that they were well regulated, and said there wasn’t any need to have an iota of doubt about them.

On February 13, the RBI prohibited NICB from issuing new loans and suspended deposit withdrawals for six months and superseded the board and appointed an administrator.

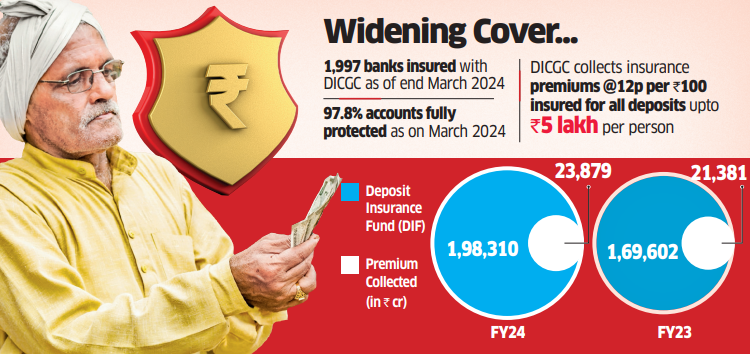

The Deposit Insurance and Credit Guarantee Corporation (DICGC) oversees the payment of insurance on bank deposits. It collects premiums –currently 0.12% per Rs 100 deposit–from banks for the cover.

The Rs 5 lakh limit cane into effect from April 1, 2020, which was a substantial hike from the previous cap of Rs 1 lakh, in the aftermath of Punjab & Maharashtra Cooperative Bank crisis. That was the first revision of the ceiling in 27 years.

In FY24, the DICGC settled claims from depositors worth Rs 1,432 crore, all of which for cooperative banks, according to RBI data. As on September 30, 2024, the number of banks registered with the DICGC were 1989, comprising 139 commercial banks (including 11 small finance banks, six payment banks, 43 regional rural banks, two local area banks) and 1850 co-operative banks.

With the present deposit insurance limit of Rs 5 lakh, 97.7% of the total number of deposit accounts (2.94 billion) were fully insured and 42.6% of the value of all deposits of Rs 227.3 lakh crore was insured as on September 30, 2024, according to RBI data.

Experts welcomed the Centre’s intention to consider raising the insurance limit for bank deposits further, but say that a risk-assessment has to be done. “An actuarial analysis is important, as to the optimal limit and appropriate premium that banks can pay. Most insurance companies, if they do this kind of backing, typically seed a portion of the risk to large reinsurance companies as well,” said Debashish Banerjee, partner & insurance sector leader, Deloitte India. Banerjee said that the limit of Rs 5 lakh per person, per bank is “very low”.

Vivek Iyer, partner & financial services risk leader, Grant Thornton Bharat said: “The profile of the depositors have changed and also the banks depend on their liquidity from CASA (current account and savings account) deposits given the low cost of the funds from that source. Banks are looking at a larger share of wallet of every customer and Rs 5 lakh is not a big amount from a purchasing power parity standpoint.”

The All India Bank Depositors’ Association has called for fundamental changes in the architecture of deposit insurance in our country. At present, deposit insurance premium is irrespective of risk and all banks pay the same premium (12 paise for Rs 100). The AIBDA suggests that DICGC must evaluate the risk profile of banks, and a risk based deposit insurance premium may be introduced.

Karan Gupta, director & head of financial institution, India Ratings & Research said: “From a customer point of view, the Centre is trying to protect their interests, which is a fair thing to do. If the cover goes up further, it is only beneficial for customers, specifically senior citizens.” “I don’t think the higher premiums paid by banks will have a big impact on their earnings,” he adds.

The deposit insurance ceiling started at Rs 1,500 in 1962, and was gradually increased to Rs 30,000 in 1980. In 1993, the ceiling was raised to Rs 1 lakh, which stayed the same for 27 years.

Source: The Financial Express

TRAI Recommends Bringing Teleport Operators, IXPs Under Authorisation Regime

TRAI Recommends Bringing Teleport Operators, IXPs Under Authorisation Regime