By Dr Imran Khalid

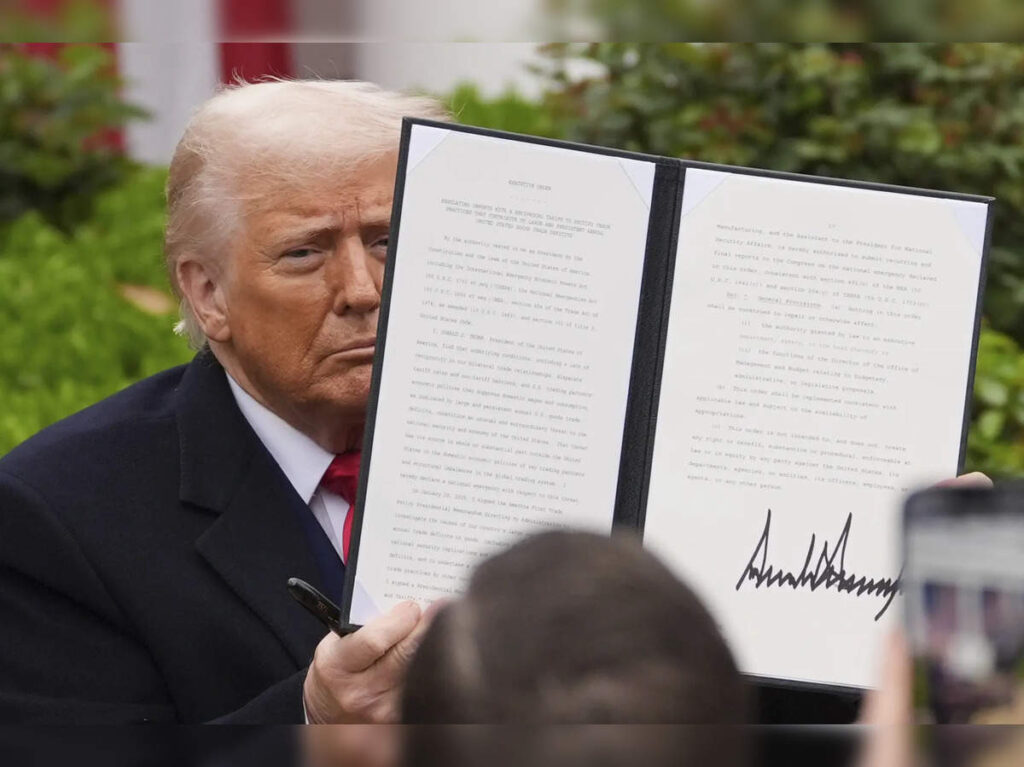

President Donald Trump’s declaration of April 2, 2025, as “Liberation Day” marked a seismic shift in U.S. trade policy, with the imposition of sweeping reciprocal tariffs that have sent shockwaves through the global economy. The new measures include a universal 10% tariff on all imports, with punitive rates as high as 54% for China, 46% for Vietnam, and 20% for the European Union, alongside a separate 25% levy on foreign-made automobiles. Framed as a corrective to decades of “unfair” trade practices, the policy has been celebrated by the administration as a rebirth of American industry. Yet beneath the rhetoric lies a complex web of economic consequences, retaliatory threats, and a potential reordering of global trade dynamics that could leave the U.S. and its allies grappling with long-term instability.

For American manufacturers, the tariffs present a double-edged sword. On one hand, industries like steel, automotive, and textiles – long battered by foreign competition – may see short-term gains as higher import costs push consumers toward domestically produced goods. The Alliance for American Manufacturing, for instance, praised the move as a lifeline for workers who have “seen unfair trade cut the ground from beneath their feet for decades”. However, the reality is more nuanced. Many U.S. manufacturers rely on global supply chains, importing components like auto parts from Mexico or semiconductors from Asia. The 25% tariff on foreign auto parts, for example, could raise production costs for American automakers by $2,000 to $15,000 per vehicle, forcing them to either absorb losses or pass expenses onto consumers. Small businesses, from craft breweries to electronics assemblers, face similar strains. The National Association of Manufacturers warned that thin margins could collapse under the weight of new tariffs, jeopardizing investments and jobs.

Consumers, meanwhile, are poised to bear the brunt of this policy. Despite White House claims that tariffs act as a “tax cut,” economists overwhelmingly agree that import taxes inflate prices for everyday goods. Fruits and vegetables from Mexico, clothing from Vietnam, and electronics from China – all staples of American households – will become more expensive. The Yale Budget Lab estimates that the average American family could pay an additional $2,700 to $3,400 annually. Retailers, already grappling with inflation, warn of unavoidable price hikes, particularly for items like apparel and toys, which lack a domestic manufacturing base. Even sectors temporarily spared, like pharmaceuticals, face uncertainty as the administration considers future investigations that could extend tariffs to critical medicines.

The global reaction has been swift and severe, signalling the onset of a protracted trade war. China, the EU, Canada, and Japan have all vowed retaliatory measures. Beijing denounced the tariffs as “bullying” and pledged to “fight till the end,” likely targeting U.S. agriculture and technology exports. The EU, already finalizing countermeasures against earlier steel tariffs, warned of duties on American tech firms, while Canada’s Prime Minister Mark Carney called the move a “fundamental change” to the trading system and promised “forceful” retaliation. Even traditionally neutral nations like Switzerland and Thailand are recalibrating trade strategies, with Thailand’s finance minister predicting a 1% GDP contraction due to lost exports. The collective backlash threatens to fracture supply chains, disrupt alliances, and erode the WTO’s authority, as countries increasingly bypass multilateral frameworks in favour of bilateral deals or regional blocs like the RCEP, where China holds sway.

The long-term implications for global trade are profound. Trump’s tariffs represent not just a tactical escalation but a philosophical rejection of the post-WWII liberal order. By weaponizing trade deficits and framing security alliances as transactional – where allies like Germany or Japan must “balance trade” to retain U.S. protection – the administration is dismantling the premise of mutual economic gain that underpinned institutions like the WTO. Economists warn that the resulting uncertainty could deter foreign investment in the U.S., as companies balk at volatile policy shifts. Many auto giants, which built U.S. plants to avoid earlier tariffs, now face renewed pressure as the 25% auto levy will disrupt their carefully calibrated supply networks. Meanwhile, the administration’s ambition to replace income tax revenue with tariff proceeds appears mathematically dubious, as reduced imports would shrink the very tax base it seeks to exploit.

Historical parallels offer cautionary tales. The Smoot-Hawley tariffs of 1930, which deepened the Great Depression, loom large in economists’ warnings. Goldman Sachs has already downgraded U.S. GDP growth forecasts to 1.7%, citing trade policy risks, while models predict a $438 billion contraction in U.S. GDP if retaliatory tariffs escalate – a larger blow than any other nation would suffer. The erosion of trust in U.S. predictability may prove irreversible, pushing trading partners toward self-sufficient regional ecosystems or alternative markets. Factually speaking, Trump’s tariffs are less a solution to globalization’s discontents than a high-stakes gamble – one that prioritizes political symbolism over economic stability. While the administration touts “liberation” from foreign competition, the costs – higher prices, lost exports, and a destabilized trading system – will be borne by the very workers and consumers it claims to protect. The world is now bracing for a new era of economic nationalism, where the rules of trade are written not through cooperation but through conflict, and the collateral damage could reshape economies for decades to come. (IPA Service)

By arrangement with the Arabian Post

CPI(M)’s 24th Party Congress Approves Political-Tactical Line

CPI(M)’s 24th Party Congress Approves Political-Tactical Line