By Dr. Gyan Pathak

Consolidated state government finances as per the data for provisional accounts witnessed deterioration in 2024-25. The consolidated Gross Fiscal Deficit (GFD) to gross state domestic product (GFD-GSDP) ratio of states rose in 2024-25 owing to a shortfall in tax revenue and lower grants from the centre.

The State of the Economy presented in the latest bulletin (June 25, 2025) of Reserve Bank of India has said that the moderation in revenue receipts outweighed the decline in revenue expenditure, leading to a widening of the revenue deficit.

However, it says that the capital expenditure, as a per cent of GSDP, remained stable, aided by a significant year-end surge in most states. For 2025-26, states have budgeted a GFD-GDP ratio of 3.3 per cent, along with a rise in capital outlay to 3.0 per cent of GDP, reflecting a continued focus on enhancing the quality of expenditure within a calibrated fiscal path.

As for the Central government finances, RBI says that the provisional accounts for 2024-25 released on May 30, 2025, confirmed that the fiscal indicators are more or less in line with the revised estimates (RE). The gross fiscal deficit (GFD) of the union government stood at 4.8 per cent of GDP, lower than the initially budgeted estimate (BE) but slightly above the revised estimate (RE).

On the other hand, the revenue deficit (RD), at 1.7 per cent of GDP, was lower than BE and RE. The moderation in revenue expenditure, along with robust growth in revenue receipts paved the way for fiscal consolidation.

On the receipts side, the gross and net tax revenue posted healthy growth of 9.5 per cent and 7.4per cent, respectively. Gross tax revenue stood at 11.5per cent of GDP in 2024-25.While the growth in the corporation tax was higher than RE, the growth in income tax was slightly lower than RE. Although the union excise duty and custom duty collections were broadly in line with RE, their growth rate contracted from the previous year.

Apart from higher surplus transfer from the Reserve Bank, higher dividend transfer from central public sector enterprises (CPSEs) pushed non-tax revenue growth in 2024-25 above RE.

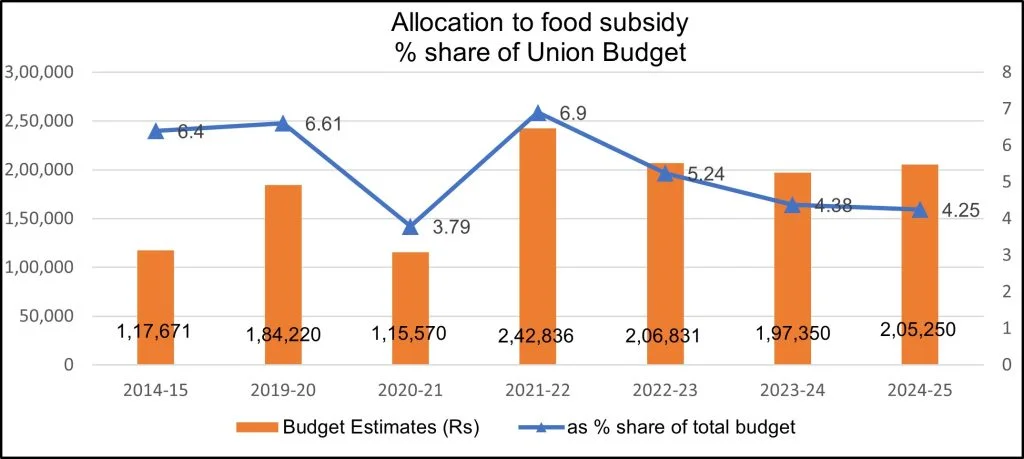

The total expenditure of the union government registered a growth of 4.8 per cent in 2024-25 over 2023-24. As per cent of GDP, while revenue expenditure declined in 2024-25vis-à-vis RE, capital expenditure remained broadly unchanged. The growth in interest payments moderated, while that of subsidy outgo saw a contraction during 2024-25 in line with RE. Furthermore, the ratio of revenue expenditure to capital outlay (RECO) declined to 4.2, lower than RE (from 4.4 in 2023-24), which bodes well for the quality of public expenditure.

Central government finances for April 2025indicated an improvement in GFD and RD – both in absolute terms and as per cent of BE – vis-à-vis the corresponding period of the previous year, aided by substantial growth in non-tax revenue, and non-debt capital receipts (including disinvestment receipts).While revenue expenditure recorded a contraction due to a decline in interest payments, capital outlay grew by 20.9 per cent.

The provisional estimates of GDP show India’s real GDP growth at 6.5 per cent. Private final consumption expenditure contributed 4 percentage points and gross fixed capital formation contributed 2.4 percentage points.

High-frequency indicators for May present mixed signals on aggregate demand. Urban demand showed signs of moderation as passenger vehicle sales declined with a sharp drop in entry-level segment. However, rural demand improved as evident from the increase in the retail sales of two-wheelers.

During May 2025, household demand for work under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) picked up, following the pursuit of alternative avenues for employment in the pre-sowing lean agricultural period and an increase in MGNREGS wage rates.

Employment indicators in May 2025 present a mixed picture. As per monthly Periodic Labour Force Survey (PLFS), the all-India unemployment rate rose to 5.6 per cent in May from 5.1 per cent last month, with a sharper increase in rural vis-à-vis urban areas. Increase in unemployment was partly driven by seasonal agricultural patterns and extreme heat in some regions, limiting outdoor work.

Organised job listings, as per the Naukri JobSpeak Index, moderated– dragged down by information technology (IT), retail, and banking and financial services – while sectors like insurance, real estate, oil and gas and emerging technologies recorded growth. However, the PMI employment diffusion indices signalled strong job creation in organised manufacturing and services, with 14 per cent of firms reporting increased payrolls.

Overall economic activity remained robust in May 2025, with key high-frequency indicators like E-way bills, Goods and Services Tax (GST) revenue, toll collections, and digital payments showing strong growth. GST revenue collections surpassed the Rs 2 lakh crore mark for the second consecutive month in May, boosted by import-related GST receipts. Petroleum consumption expanded for the first time in the last four months, driven by petrol. Unseasonal rains and premature onset of monsoon, however, led to a reduction in electricity demand.

India’s merchandise exports contracted by (-) 2.2per cent (y-o-y) to US$38.7 billion in May 2025 due to an unfavourable base effect. Exports of 13 out of 30 major commodities(accounting for 59.0 per cent of the export basket in2024-25) contracted on a y-o-y basis in May, 2025.

Merchandise imports also contracted by (-)1.7 per cent (y-o-y) to US$60.6 billion in May 2025.Imports of 10 out of 30 major commodities(accounting for 51.5 per cent of import basket in (2024-25) contracted on y-o-y basis in May 2025. (IPA Service)

NATO Summit At Hague Shows Once Again Europe Has Surrendered To Trump

NATO Summit At Hague Shows Once Again Europe Has Surrendered To Trump