NEW DELHI: India’s services sector “regained momentum” in April after slowing down in March as demand expanded and companies reported a faster expansion in employment, said a private survey on Tuesday.

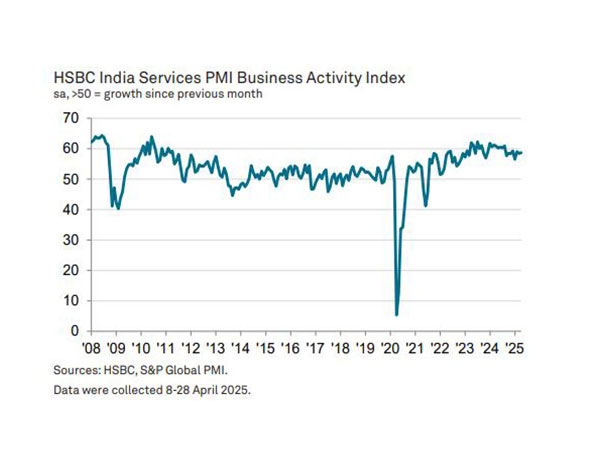

The HSBC India services purchasing managers’ index (PMI), compiled by S&P Global, rose to 58.7 in April from 58.5 in March. The index has been above 50.0, which separates contraction from expansion in the sector, for 45 months straight.

“This regained momentum was largely driven by a quicker increase in new order inflows, which also underpinned a faster expansion in employment. Alongside this positive trend, capacity pressures continued to build, with unfinished work rising solidly. On the pricing front, average charges increased at a quicker pace, despite cost pressures retreating to a six-month low,” said the survey.

It noted that companies in April reported favourable conditions for demand and successful marketing efforts. Some businesses took on more work due to “efficiency gains”. Finance and insurance companies clocked the highest growth rates in output and new orders, maintaining the performance they showed in March.

Indian companies continued to benefit from improved international demand for their services, particularly from Asia, Europe, West Asia and the United States. “Overall, new export orders expanded at the fastest pace since July 2024,” said the survey.

“Margins improved as cost pressures eased and prices charged rose at a faster pace. Though firms remained optimistic about future growth, their confidence waned slightly,” said Pranjul Bhandari, chief India economist at HSBC.

Companies in April increased their workforce for the 35 consecutive month, with the pace of job creation quicker than in March as anecdotal evidence showed that survey respondents improved capacity with full- and part-time employees to meet increased client demand.

“[However], despite the rise in staffing levels, firms reported another monthly increase in unfinished work, with the rate of backlog accumulation accelerating from the previous month and outpacing its long-term average,” the survey said.

Input prices increased at the slowest pace for six months, with respondents noting greater chemical, cosmetic, fish, staff and transportation costs.

Services companies increased their average selling prices in April, seeking to transfer the burden of higher cost to clients. The rate of charge inflation was solid, faster than in March and above its long-run average.

Growth in services activity is alongside the performance of manufacturing, where PMI increased to a 10-month high in April (58.2) compared with 58.1 in March.

Source: Business Standard

Climate Disaster Costs Could Reach $145 Billion Globally In 2025

Climate Disaster Costs Could Reach $145 Billion Globally In 2025