New Delhi: The controversial provision to retrospectively tax indirect transfer of Indian assets through deals executed overseas is likely to spare a large number of transactions by excluding those where the Indian assets account for less than half the total deal size.

New Delhi: The controversial provision to retrospectively tax indirect transfer of Indian assets through deals executed overseas is likely to spare a large number of transactions by excluding those where the Indian assets account for less than half the total deal size.

The retrospective amendment to the Income-Tax Act, part of this year’s budget and which most tax experts say is targeted at Vodafone Plc, says overseas acquisitions and mergers that involve ‘substantial’ Indian assets will be taxed here.

It does not define ‘substantial’. “It (substantial) could be defined as more than 50%,” a finance ministry official told ET.

The finance ministry has begun internal discussions on administrative guidelines to be issued in the form of a circular to provide clarity on how such transactions will be dealt with by the tax authorities.

The clarification is intended to reassure edgy foreign investors, including foreign institutional investors and private equity investors, and also help improve the overall investment climate.

Such a definition of ‘substantial’ stake change would be in line with the one provided in the Direct Taxes Code that is likely to be implemented from the next fiscal.

Experts say the clarification will give much-needed relief to foreign investors as it will help exclude transfer of Indian assets in a global scheme of merger and acquisition, where these assets account for only a small proportion of the deal.

“If the ‘substantial value’ test is rightly defined at more than 50% Indian value attribution to the global transaction, it would give great comfort to global investors that the tax laws in India are not unreasonable,” says Pranay Bhatia, associate partner, Economic Law Practice.

Says Rahul Garg, National Direct Tax Leader, PwC: “This would bring clarity and also exclude cases where substantial assets are not inIndia. But it would still need to be clarified that internal restructuring does not get hit even if value of asset derived fromIndiais more than 50%.”

Once internal discussions are over, a detailed circular will be issued by the Central Board of Direct Taxes, the apex body in charge of direct taxes.

Government officials say the circular will provide certainty to foreign investors on the kind of transactions that could become taxable.

The rule will apply to deals in which income tax assessment is not complete. The law does not apply to cases where assessment has been concluded.

A dozen such deals could fetch the government as much as 40,000 crore – more than half of it from Vodafone alone, finance ministry officials say.

Vodafone, which is being pursued by Indian authorities for not withholding tax on a 2007 deal in which it bought the local telecom business of Hutchison, is likely to challenge the validity of the tax demand before an international arbitration tribunal.

Foreign investors have been wary of investing here after the budget introduced the General Anti-Avoidance Rules, or GAAR, and changed the income-tax law retrospectively. Responding to the widespread concern, the government deferred GAAR by a year after FIIs pulled out nearly $1 billion fromIndiain April.

BPCL TO GIVE MAJORITY STAKE TO UK COMPANY IN PETCHEM JV

MUMBAI: State-run Bharat Petroleum Corporation Limited (BPCL) has finalised a joint venture (JV) agreement with UK-based LP Chemicals for petrochemical business. BPCL is likely to hold 49 per cent in the venture, with the British company holding a majority 51 per cent. The JV would invest about Rs 5,000 crore in the project and have a 70:30 debt equity ratio. LP Chemicals may bring in Rs 1,500 crore. BPCL plans to spend Rs 40,000 crore in the next five years to set up a petrochemical plant at the Kochirefinery to produce niche products, expand the capacity of existing refineries, gas marketing and exploration and production. “We will sign the memorandum of association shortly. After this, we will have to do a feasibility report and later a company will be formed. We should be able to put things in place by early next year,” said a senior BPCL executive, on condition of anonymity. The executive said the company would integrate the expansion of its Kochirefinery and construction of its petchem plant. The deadline for both projects has been set for 2015. The country’s second-biggest state-run refiner would expand the Kochirefinery by 63 per cent to process cheaper, high-sulphur crude to improve margins and products. (For details log on to : http://www.business-standard.com/india/news/bpcl-to-give-majority-stake-to-uk-company-in-petchem-jv/476227/)

WARBURG PINCUS TO BUY FUTURE CAPITAL FOR $100-125 M

MUMBAI: USprivate equity firm Warburg Pincus is set to buy a majority holding in Indian financial services firm Future Capital Holdings for $100-125 million, two sources with direct knowledge of the matter told Reuters on Sunday. Future Capital, currently controlled by Indian retailer Pantaloon Retail (India), provides consumer and mortgage loans. Warburg Pincus will pay R165-170 per share, which represents a premium of 18-24% to Future Capital’s Friday closing price of R136.95, said the sources, who declined to be named as they were not authorised to speak to the media prior to a public announcement. “The board (of Future Capital) is going to meet tomorrow to approve the transaction,” said one of the sources. Warburg Pincus and Future Capital officials did not immediately return phone calls seeking comment. (For details log on to: http://www.financialexpress.com/news/warburg-pincus-to-buy-future-capital-for-100125-m/957438/)

JK PAPER TO PICK UP EQUITY STAKE IN MYANMAR PULP MILL

MUMBAI: JK Paper, a flagship of the JK Singhania Group, is set to pick up an equity stake in Myanmar’s largest state-owned pulp mill as part of a global public-private-participation deal. The move is significant as it would give the Indian company access to one of the world’s largest prime-grade, pulp-bearing forest acreages. The JK Group and the Myanmargovernment have agreed to allow the Delhi-based company to initially operate the Thar Paung Paper and Pulp Mill and subsequently expand capacity and export pulp for JK Paper’s Indian operations. Confirming this to ET, Harshpati Singhania, managing director of JK Paper, said: “This deal will give us at least a first-mover advantage in gaining a foothold in Myanmar which is now opening up for foreign investment.” Financial details are yet to be worked out by the two entities. “Details are still being worked out on how much equity we will put in,” added Singhania. (For details log on to : http://economictimes.indiatimes.com/news/news-by-industry/indl-goods/svs/paper-/-wood-/-glass/-plastic/-marbles/jk-paper-to-pick-up-equity-stake-in-myanmar-pulp-mill/articleshow/13791406.cms)

GUJARAT STATE PETROLEUM CORP LOWERS BID FOR GUJARAT GAS COMPANY STAKE

AHMEDABAD: BG is facing aggressive bargaining in the sale of 65% stake in its city gas venture, with the sole bidder, Gujarat State Petroleum Corp (GSPC), offering to pay less than its original bid, and the rupee’s depreciation squeezing the returns further for the global energy firm. The currency’s fall, from about 43 against the dollar last year to about 56, has also hit valuation of the stake as BG’s unit, Gujarat Gas Company (GGCL), depends on import of liquefied natural gas ( LNG) as domestic gas is scarce. According to industry sources, GSPC had earlier offered to pay 300 per equity share of GGCL. “With depreciating Indian rupee, imported LNG-dependent city gas distribution (CGD) companies are no more attractive for investors. GSPC is bargaining hard and is willing to pay only 250-260 per GGCL equity share to BG Group,” said a government of Gujaratofficial. (For details log on to : http://economictimes.indiatimes.com/news/news-by-industry/energy/oil-gas/gujarat-state-petroleum-corp-lowers-bid-for-gujarat-gas-company-stake/articleshow/13791084.cms)

RELIANCE BRANDS, AMERICAN MEN’S CLOTHIER CHAIN BROOKS BROTHERS INK PACT

MUMBAI: Reliance Brands, a unit of energy major Reliance Industries, is bringing the oldest American men’s clothier chain Brooks Brothers to India as it looks to create a strong portfolio of foreign labels in the fashion space. Brooks Brothers is privately owned by Italian billionaire Claudio Del Vecchio, son of the founder of Luxottica, the world’s largest eyewear company whose brands include Ray-Ban and Oakley. It will hold a 51% stake in the new entity with the rest being held by Reliance Brands. This partnership, which was in the works for nearly 15 months, will be Reliance’s fifth joint venture after Iconix, Paul & Shark, Diesel and Ermenegildo Zegna. It was in February that Reliance invested in a joint venture with Iconix, grabbing the ownership rights of 20 international lifestyle brands. Brooks’ Indiaventure comes after eight years of presence in China. Both Chinaand India’s lifestyle market are growing on the back of consumer awareness, aspirations and higher disposable income. Claudio Del Vecchio, chairman & CEO of Brooks Brothers said, “We partnered with Reliance Brands because of their passion for the Brooks Brothers brand, their track record with other premium brands, their expertise and connections within India.” The latest JV of Reliance in the fashion industry comes even as the Indian government is paving the way for 100% FDI in singlebrand retail. Many global fashion majors have preferred a JV route to build business in a promising but difficult market. (For details log on to: http://economictimes.indiatimes.com/news/news-by-industry/cons-products/garments-/-textiles/reliance-brands-american-mens-clothier-chain-brooks-brothers-ink-pact/articleshow/13803908.cms)

RIL RELENTS, TO SIGN GAS SUPPLY PACTS WITH PRAGATI POWER, NTPC

NEW DELHI: After initially resisting, Reliance Industries Ltd (RIL) has agreed to sign agreements with Pragati Power Corp and NTPC for supply of natural gas from its eastern offshore KG-D6 fields. With output from KG-D6 continuing to decline, RIL was against signing new Gas Sale and Purchase Agreements (GSPA) as meeting new supply commitments would have meant cutting gas supplies to existing power plants. But under intense pressure from Delhigovernment and oil ministry, RIL has now agreed to sign GSPAs for supply of 2.16 million standard cubic meters per day to Delhi’s Bawana power project and NTPC, industry sources said. RIL has informed the Delhigovernment and Pragati Power Corp of its intention to sign GSPA for supply of 0.93 mmsmcd of gas and has forwarded a draft agreement. (For details log on to : http://economictimes.indiatimes.com/news/news-by-industry/energy/oil-gas/ril-relents-to-sign-gas-supply-pacts-with-pragati-power-ntpc/articleshow/13776777.cms)

HYUNDAI GOES BACK TO DRAWING BOARD FOR DIESEL PLANT IN INDIA

NEW DELHI: South Korean car maker Hyundai is starting from the scratch on plans to set up a diesel engine manufacturing plant in Indiawith a fresh feasibility study, reversing an earlier R400-crore proposal. The company’s wholly-owned arm, Hyundai Motor India (HMIL) had in 2010 announced to invest R400 crore on a diesel engine plant under its then head HanWooPark. It was, however, put on hold last year following slump in the market. According to industry sources, HMIL has decided to revisit the entire project with a fresh feasibility study following a change in guard at the top management in March this year. Park was replaced as managing director by Bo Shin Seo and returned to Korea as chief financial officer of Kia Motors, an arm of the company’s parent firm Hyundai Motor Co. (For details log on to : http://www.financialexpress.com/news/hyundai-goes-back-to-drawing-board-for-diesel-plant-in-india/957439/)

FIDELITY TO RAISE $250-M INDIA-FOCUSED FUND

MUMBAI: Bucking the recent negative outlook on India, private equity firm Fidelity Growth Partners India, part of American financial services firm Fidelity Investments, is looking to raise an India-focused fund, its second, in August with a $250-million (R1,374 crore) corpus, according to people with direct knowledge of the plan. The parent firm and Abigail Johnson and Edward Johnson III, Fidelity’s promoters, will invest in the fund. A Fidelity spokesperson refused to comment on the development. The company expects to close the fund within six months of its launch. The earlier fund, of the same size, was raised in 2007-08. Fidelity Growth Partners India has already invested 75% of the existing fund. The firm’s investment strategy remains the same. It will continue to focus on all sectors barring real estate. The fund typically invests $10-50 million in each company. (For details log on to : http://www.financialexpress.com/news/fidelity-to-raise-250m-indiafocused-fund/957436/)

LANCO TO RAMP UP OUTPUT FROM AUSTRALIA MINES

NEW DELHI: Lanco Infratech Ltd is working out a strategic plan to ramp up production from Griffin Coal mines in Australiato 18 million tonnes a year by 2017-18. The programme would cost the company up to $ 1 billion. “The capital expenditure (capex) would be finalised by September 2012. It would be up to $ 1 billion. The output would be increased in phases from four million tonnes at present to 18 million tonnes by 2018,” said an official privy to the development. Lanco acquired Australia’s The Griffin Coal Mining Company Pty Ltd in 2011 for $ 750 million. It has already paid $ 500 million and rest of the funds would be paid in two tranches in one year and three years. The capital expenditure for increasing output would be funded by both equity and debt. “The exact ratio of equity and debt funding is being worked out,” the official added. Lanco would borrow debt from overseas market in either US or Australian dollar. (For details log on to: http://www.thehindubusinessline.com/todays-paper/tp-corporate/article3487606.ece)

FAMILY-RUN CONGLOMERATES FORAY INTO NEW-AGE BUSINESSES

MUMBAI: India’s family-run business conglomerates, which relied on their manufacturing abilities to create wealth, are diversifying into new-age businesses, riding on the growing preference to create value through knowledge-based products in an economy that is fast integrating with the global world. The Piramals, Birlas, Mahindras – names synonymous with Indian business – have recently ventured into newer areas that promise to offer lucrative returns in the long run. The Ashok Piramal Group, which runs one of India’s oldest textile companies, has firmed up plans to branch out into education business. The Mumbai-based textiles-to-real-estate group, which was carved out of the original Piramal group, will set up schools that seek to address the growing needs of modern working couples. (For details log on to : http://economictimes.indiatimes.com/news/news-by-company/corporate-trends/family-run-conglomerates-like-piramals-birlas-mahindras-foray-into-new-age-businesses/articleshow/13791728.cms)

CHAMPION AGRO TO INVEST 100 CRORE IN EXPANSION IN 3 YEARS

NEW DELHI: Champion Agro Ltd, a farm products maker and retailer, plans to invest Rs 100 crore to open 400 agro-malls across Indiain the next three years. The company operates 40 agri one-stop shops in Gujaratand has recently forayed into northern markets as part of its strategy to expand business pan-India. “Champion Agro plans to open 400 agro-malls across Indiain the next three years. We are planning to invest Rs 100 crore in this expansion drive and is also hiring qualified people to ensure that their goals are achieved,” the company said in an e-mail response. It plans to hire around 200 persons for its North Indiaoperations, the company said. The Rajkot-based firm, which had a turnover of Rs 446 crore last fiscal, said it will fund the expansion through internal accruals and debt. (For details log on to : http://economictimes.indiatimes.com/news/news-by-industry/cons-products/food/champion-agro-to-invest-100-cr-in-expansion-in-3-years/articleshow/13767660.cms)

PMO, FINMIN DIFFER OVER BROWNFIELD PHARMA FDI

NEW DELHI: The row over the foreign direct investment (FDI) policy for the pharmaceutical sector refuses to die down. Ministries have again locked horns over who will regulate brownfield foreign investment in the sector, forcing the Prime Minister’s Office to advise a group of ministers (GoM) looking at the issue not to deviate from the earlier decision that the Competition Commission of India (CCI) will vet these cross-border deals. The finance ministry wanted to be represented in the GoM as it felt that the Foreign Investment Promotion Board (FIPB), not the CCI, is the right regulator for FDI. The need to regulate foreign investments in Indian pharma companies was felt because sections of the domestic industry and public health groups saw a trend of Indian drug companies being taken over by multinationals, which they feared could lead to the crippling of the domestic industry and flaring up of prices of medicines. After much inter-ministerial deliberations, it was decided last year that the CCI would look at brownfield foreign investment proposals while greenfieldinvestments will be freely allowed in the sector, where 100% FDI is allowed. (For details log on to : http://www.financialexpress.com/news/pmo-finmin-differ-over-brownfield-pharma-fdi/957474/)

NEW PROPOSAL FOR FDI IN AVIATION IS ON FAST TRACK

NEW DELHI: Amid all the criticism on policy inaction, the Government is to soon take up a new proposal to allow foreign airlines to acquire a stake in domestic airlines. The new proposal, which addresses security concerns that have been raised earlier, is expected to come up before the Union Cabinet shortly. Now, sources claim that various differences between Ministries, and even some political parties, have been sorted out and accordingly a new proposal has been readied with more and more safeguards. One of the key safeguards suggested is to allow foreign investment only through the inter-ministerial Foreign Investment Promotion Board route. With the Home Ministry being a part of the FIPB, any proposal seen as against India’s security interests will be blocked, the source said. A nod for the new proposal will help domestic carriers get equity support from foreign airlines. A highly placed Government official told Business Line: “It is expected that foreign airlines may be allowed to pick up equity of up to 49 per cent in domestic carriers.” (For details log on to : http://www.thehindubusinessline.com/todays-paper/article3487657.ece)

DIESEL, LPG HIKE MUST: PM’S ADVISER C RANGARAJAN

NEW DELHI: The Indian economy faces “a critical situation” and the government must raise the prices of diesel and cooking gas and move forward on economic reforms to revive growth, chairman of the Prime Minister’s Economic Advisory Council C Rangarajan has said. In an interview to a TV channel, Rangarajan said reforms needed to be pushed and there was a need to take action in various fields such as banking, insurance, pension and get the consent of the people for these reforms. “Yes, I think we face a critical situation,” he said when asked whether the economy faced a “serious problem”. The Indian economy, Asia’s third-largest, has slowed in recent quarters hit by high interest rates, stubborn inflation, weak global economy, lack of economic reforms and policy delays. A slew of scandals that hit the headlines in the past one year have dented the coalition’s appetite to announce big bang reforms. (For details log on to: http://timesofindia.indiatimes.com/business/india-business/Diesel-LPG-hike-must-PMs-adviser-C-Rangarajan/articleshow/13792908.cms)

TRADE POLICY MAY HAVE SOPS FOR SEZs

NEW DELHI: Commerce and industry minister Anand Sharma is planning not to confine himself to announcing merely sops for labour-intensive sectors such as textiles and gems & jewellery in the Foreign Trade Policy but use the annual event to revive special economic zones and boost investment at a time when companies are holding back on capacity creation. The Foreign Trade Policy will be announced on Tuesday. Government officials told TOI that despite revenue department’s objections to the SEZ policy proposals, the commerce department is pushing hard to announce some measures for the designated zones which had earned the reputation of being real estate ventures backed by tax incentives. So far, around 380 zones have been notified in the country but several of them have run up against bureaucratic hurdles erected by the income tax and customs and excise departments. In addition, several projects are held up as they could not acquire land. In all, 585 SEZs have been approved by the board of approvals, the inter-ministerial body responsible for clearing proposals. (For details log on to : http://timesofindia.indiatimes.com/business/india-business/Trade-policy-may-have-sops-for-SEZs/articleshow/13787938.cms)

GOVT SETS UP BODY TO PROMOTE MANUFACTURING

NEW DELHI: The government has set up a manufacturing industry promotion board (MIPB) in a move aimed at implementing the National Manufacturing Policy, which is expected to raise the share of manufacturing significantly. Commerce, industry and textiles minister Anand Sharma will head MIPB and it will have secretaries of various departments. There will be two industry representatives and the secretary industry will be the member secretary. The board may invite the industry ministers of states concerned if required, a government statement said on Saturday. The government has also notified Board of Approval, Green Manufacturing Committee and High Level Committee. The MIPB has been tasked to periodically review the overall situation of the manufacturing sector in the country. This will include review of state-wise/sector-wise performance of the manufacturing sector. (For details log on to : http://timesofindia.indiatimes.com/business/india-business/Govt-sets-up-body-to-promote-manufacturing/articleshow/13788105.cms)

PROFITS SHOWN ONLY FOR BETTER RATINGS: OIL COMPANIES

NEW DELHI: State-owned oil companies have vehemently denied that they are making huge profits and asserted that only the government subsidy helped them to report a net profit of less than 1% of their turnover in 2011-12. This profit is reported in order to maintain creditworthiness, the companies said in a joint statement on Sunday. The assertion by the three companies — Indian Oil (IOC), Bharat Petroleum (BPCL) and Hindustan Petroleum (HPCL) — has come in the wake of a nationwide debate on whether they have overstated the under-recoveries from sale of fuels and if it was right on their part to expect the government to fully meet these when their other income streams allow them to make profits. This concern was also echoed by a Cabinet minister (Vayalar Ravi) who last week wrote to oil minister Jaipal Reddy, suggesting a closer look at the oil companies’ financials. However, on Sunday, home minister P Chidambaram came in support of the oil firms. Describing the petrol price hike as ‘not acceptable but inevitable’, Chidambaram justified the recent increase saying the supply of petrol and diesel could be affected if oil companies did not increase the price in line with international crude rates. (For details log on to : http://www.financialexpress.com/news/profits-shown-only-for-better-ratings-oilcos/957477/)

50,000 ACRES WITH PORTS MAY BE DIVERTED TO REALTY

NEW DELHI: Some 50,000 acres of land, worth several thousand crores, locked up with ports in major cities could soon be available for commercial development in what could give an impetus to the real estate sector. The Cabinet will shortly consider a draft policy on commercial development of surplus land owned by major port trusts in Indiaby leasing of these plots to developers. The note on ‘Policy directives for land management by major ports, 2012’, prepared by the shipping ministry, explains how ‘land alienation’ by major port trusts could be done in a transparent manner. An important feature of the policy is that when it comes to leasing of land lying with the 12 major ports, the final decision will be taken by the Cabinet. Discretionary powers of individual port authorities, including the respective port trust’s chairman, will go. This could weed out corrupt practices apart from boosting land supply for housing and commercial spaces in cities like Mumbai, Kolkata and Kochi. (For details log on to : http://www.financialexpress.com/news/50-000-acres-with-ports-may-be-diverted-to-realty/957468/)

ANIL AMBANI GROUP FIRMS SAVE ON EMPLOYEE COST

MUMBAI: Companies of the Anil Dhirubhai Ambani Group (ADAG) are saving heavily on employee cost. Two of the group’s largest entities, Reliance Communications (RCom) and Reliance Power (R-Power) have shown a decline in staff spends in 2011-12, compared to the year before. Reliance Infrastruc-ture’s spends on this count remained flat. RCom’s employee cost declined by 20.7 per cent to Rs 476 crore for 2011-12, from Rs 601 crore in 2010-11. RInfra, which is into infrastructure project development and construction, had the highest employee cost among the group. It spent Rs 1,028.6 crore, compared to Rs 1,002 crore in the previous year. In the fourth quarter, its employee benefits reduced by 17 per cent, compared to Rs 216.4 crore in the year-ago period. “People count have reduced,” said Lalit Jalan, chief executive officer, Rinfra, when asked how the company managed to rein in employee cost. (For details log on to : http://www.business-standard.com/india/news/anil-ambani-group-firms-saveemployee-cost/476225/)

CEMENT SECTOR LIKELY TO RETURN TO DOUBLE-DIGIT GROWTH PATH IN MAY

Robust sales from India’s two largest cement makers, Aditya Birla Group’s UltraTech and Swiss major Holcim’s Ambuja Cements, in May are likely to bring the industry back on a double-digit growth trajectory after a gap of two months. Amid India’s disappointing GDP growth of 5.3 per for the March quarter, strong dispatches of the building material, just before the start of the monsoon, has given hope to cement industry experts for better growth in 2012-13. Ambuja Cements, which has a capacity of 25 million tonnes per annum, sold 1.93 million tonnes in May, against 1.73 million tonnes in the corresponding month last year, a rise of 11.9 per cent. On the other hand, its peer, UltraTech Cement, registered sales growth of 10.6 per cent. (For details log on to : http://www.business-standard.com/india/news/cement-sector-likely-to-return-to-double-digit-growth-path-in-may/476228/)

REALTORS PUT LAUNCHES ON THE BACK BURNER

NEW DELHI: Pulled down by their muted bottom lines and a slowing economy, real estate developers are going low on new launches. Clearly treading the path of fiscal consolidation, their focus is on completion of projects in hand. DLF Ltd, India’s largest real estate developer by market capitalisation, which recorded a 33 per cent net profit fall in the January-March quarter and 26 per cent fall in full 2011-12, stated in its post-result analysts’ call that no numbers could be given for new launches during the first half of 2012-13. The biggest launch for DLF — the second phase of Magnolias project in Gurgaon at an estimated value of Rs 1,500 crore — is slated for the second half of the current financial year. Asked why DLF had been stuck at a launch range of 10 to 12 million sq ft over the past few years and when it planned to go to the next level, Ashok Tyagi, chief financial officer, said in the analyst’s call: “There’s no point thinking of the next level at this point.” (For details log on to : http://www.business-standard.com/india/news/realtors-put-launchesthe-back-burner-/476221/)

GOVT RETAINS EXPORT OPTIMISM

NEW DELHI: Commerce and Industry Minister Anand Sharma last week informed the Board of Trade, consisting of industry captains and exporters, that the government was looking at achieving 20 per cent increase in the country’s merchandise exports this financial year over 2011-12, even as he noted the challenges facing the sector. Experts, however, are apprehensive of such an ambitious target against the backdrop of the difficult economic environment globally, especially that in the Euro zone. The ministry is expected to set a target of $361 billion, up 20 per cent from the $304 billion achieved in 2011-12 (the target was $300 billion), in the annual supplement to the Foreign Trade Policy (FTP) 2009-2014. This is to be unveiled on Tuesday. Sharma also stuck to the target of $500 billion worth of exports by 2013-2014, as set in a strategy paper of his ministry. Last month, his deputy, Jyotiraditya Scindia, said the government was hopeful of achieving $350 billion in exports in the current financial year, despite the difficult global economic condition. This will be a 15 per cent increase over 2011-12’s export figures. (For details log on to : http://www.business-standard.com/india/news/govt-retains-export-optimism/476233/)

VCs PARKING FUNDS IN ONLINE CAB RENTAL COMPANIES

BANGALORE: Your neighbourhood cabs have just got the green signal from the country’s leading venture capitalists (VCs). With a business model that is not very capital intensive and has high margins, investors are sensing serious business in the largely unorganised $6-billion domestic cab market, growing at 25-30% year-on-year. In the last two months VC majors, including Tiger Global Management, Inventus Capital, Helion, Accel Partners and Blume, have parked their funds in tech-startups operating in the online cab rental space. Experts point out that the recent spurt in this segment is fuelled by the sheer opportunity this category offers. According to estimates, 90% of the cab market in Indiais unorganised, offering tremendous growth prospects. Last month, Bangalore-based Serendipity Infolabs, which runs the online cab booking site TaxiForSure, attracted an undisclosed amount from Helion, Accel Partners and Blume. In April too the segment saw a slew of funding announcements. Savaari Car Rentals raised R5 crore from Indo-US venture fund Inventus Capital Partners. Mumbai-based Olacabs, which went operational only last year, also managed to convince VC major Tiger Global to invest in the company. Olacabs did not share the funding details, but it is estimated to be about R40 crore. (For details log on to : http://www.financialexpress.com/news/vcs-parking-funds-in-online-cab-rental-cos/957467/)

CIL IN DILEMMA OVER ITS DUTY TO SHAREHOLDERS

NEW DELHI: The issue of fuel supply agreements (FSAs) between Coal India (CIL) and newly commissioned power projects has again come to a head.At a recent board meeting, the CIL top brass decided that given the company’s obligations to shareholders as a listed entity, coal supply under the FSA cannot be allowed come in the way of company selling coal through e-auction, its most profitable venture. CIL has been selling about 10% of its output through e-auction with price realisation nearly twice its notified price. With CIL unable to find ways to implement the decree directing to sign FSAs with power companies without compromising its commercial interests, the matter could again come up for discussion at the highest level, sources in the know said. The legal implications of the situation are also being studied. The CIL board also agreed that the company will have sole discretion to import coal for meeting the committed demand. It has also sought clarification from the government on whether the presidential decree also stipulates 80% trigger level for invocation of penal provisions in case of supply shortfall for power plants commissioned during April 2012- March 2015. (For details log on to: http://www.financialexpress.com/news/cil-in-dilemma-over-its-duty-to-shareholders/957426/)

INDUSTRY PERFORMANCE MAY DECELERATE IN FIRST QUARTER: SURVEY

NEW DELHI: On the back of low investment spending, lack of credit flow, rupee depreciation, inflation, trade and fiscal deficits, and uncertain global recovery, industry performance is expected to decelerate in the first quarter of 2012-13, says a CII ASCON Survey. The survey, which covered 114 sectors, comprising over 35,000 companies, for the period April–June 2012 (estimated), shows a sharp deceleration in the growth of industrial sectors. “The situation calls for concerted efforts from the Government and the Reserve Bank to ensure that we have a cohesive economic recovery plan,” said Mr Chandrajit Banerjee, Director-General, Confederation of Indian Industry. The percentage of sectors with high growth (10-20 per cent) has decreased to 24.5 per cent in the first quarter 2012-13 from 31.8 per cent in the year ago period. (For details log on to : http://www.thehindubusinessline.com/todays-paper/tp-economy/article3487647.ece)

INDIA’S TOTAL POWER GENERATION CAPACITY CROSSES 200 GIGA WATT IN 11TH PLAN PERIOD

KOLKATA: The total installed capacity of the country has crossed two 200 giga watt, with a record capacity addition of 54,964 mw in the 11th plan — about two and half times the capacity added in the 10th plan. This was stated by power minister Sushil kumar Shinde while flagging off main plant civil works of NTPC’s Solapur Super thermal Power project (2x660MW) last evening. NTPC, with a rich experience of engineering, construction and operation of around 38,000 mw of thermal generating capacity, is the largest and one of the most efficient power companies in India, having operations that match the global standards. Towards this end, NTPC has adopted a multi-pronged strategy such as greenfieldprojects, brownfield projects, joint venture and acquisition route. Apart from this, NTPC has also adopted the diversification strategy in related business areas, such as, services, coal mining, power trading, power exchange, manufacturing to ensure robustness and growth of the company. (For details log on to : http://economictimes.indiatimes.com/news/news-by-industry/energy/power/indias-total-power-generation-capacity-crosses-200-giga-watt-in-11th-plan-period/articleshow/13785683.cms)

INDIAN CONSUMER SPACE TO GET A FACE-LIFT IN COMING YEARS: STUDY

NEW DELHI: The Indian household and personal care segment is set to change significantly in the coming years as consumption habits, fuelled by rising disposable income and changing lifestyles, align themselves with global trends, a report says. According to global research firm Macquarie, it is “time to look beyond fairness cream and hair oils”, as Indian consumers would start to look beyond “fairness” in personal care. The significant change will be accentuated by the bustling middle class and the importance foreign MNCs are giving to India. L’Oreal aims for sales of around 1 billion euro by 2020 in India, Reckitt aims to make Indiaits largest global sales contributor by 2016 and P&G plans to increase its number of product categories in Indiato 25 by 2015/16 from 15 in 2011. (For details log on to: http://economictimes.indiatimes.com/news/news-by-industry/cons-products/fmcg/indian-consumer-space-to-get-a-face-lift-in-coming-years-study/articleshow/13773604.cms)

NETWORKED DEVICES MAY GROW TWO-FOLD TO 2 BILLION BY 2016: CISCO

NEW DELHI: With increasing popularity of high-speed internet services and proliferation of tablets and smart phones, the number of networked devices would double to around 2 billion in the country by 2016, networking company Cisco has said. “In India, there will be two billion networked devices in 2016, up from one billion in 2011,” Cisco Visual Networking Index (VNI) Forecast said. Globally, the forecast projects there will be nearly 18.9 billion network connections, almost 2.5 connections for each person on earth, compared with 10.3 billion in 2011. “The Asia-Pacific region alone will have almost 46 per cent (8.7 billion) of the global network connections,” Cisco VNI said. The internet traffic in Indiawill grow at a compounded annual growth rate of 64 per cent between 2011 to 2016. (For details log on to : http://economictimes.indiatimes.com/tech/internet/networked-devices-may-grow-two-fold-to-2-billion-by-2016-cisco/articleshow/13777950.cms)

INDIAN PHARMA MARKET TO GROW AT 15.3 PER CENT CAGR BY FY14

MUMBAI: The growth rate for the domestic Indian pharmaceutical market is set to rise over medium-term, according to a research report. The revenue CAGR (compund annual growth rate) over the past three years had been 12.4 percent, but it is expected to be up at 15.3 percent from FY12 to FY14, Barclays Capital Equity Research said here in its report – India Healthcare & Pharmaceuticals. The growth is expected due to factors like new product launches, focus on improving effectiveness of field force additions and favourable pricing environment, it said. Most of the pharma companies are expecting to continue with product launches in Indiaover the next 2-3 years. The pricing environment in the Indian market has been a favourable one, and past growth has in part been driven by price increases of 2-4 percent annually. (For details log on to: http://economictimes.indiatimes.com/news/news-by-industry/healthcare/biotech/pharmaceuticals/indian-pharma-market-to-grow-at-15-3-pc-cagr-by-fy14/articleshow/13774459.cms)

NEW POWER BUY NORMS MAY CUT TARIFF

MUMBAI: The power ministry’s guidelines for short-term procurement of electricity for less than or equal to one year is likely to bring cheer to cash-strapped distribution companies. The new rules are expected to reduce power cost. The ministry had noted that the guidelines are aimed at promoting competitive procurement by problem-ridden distribution companies, by facilitating transparency and fairness. Ajoy Mehta, managing director, Maharashtra State Electricity Distribution Company (MahaVitaran), welcomed the ministry’s guidelines and said it would bring in transparency in short-term power procurement. “Even before the issuance of these guidelines, MahaVitaran is procuring short-term power through e-tendering and this has been followed very unscrupulously. However, I strongly believe that financial freedom should not be taken away from distribution companies by regulatory commission during short-term power procurement.” (For details log on to: http://www.business-standard.com/india/news/new-power-buy-norms-may-cut-tariff/476236/)

HIND COPPER DIVESTMENT MAY FOLLOW RINL IPO

NEW DELHI: The Department of Disinvestment (DoD) has initiated the process of taking a fresh Cabinet nod for disinvesting 10 per cent equity stake in Hindustan Copper Ltd through a follow-on public offering (FPO). If the proposal gets Cabinet clearance, the disinvestment is likely to follow the initial public offering (IPO) of Rashtriya Ispat Nigam Ltd (RINL), for which the prospectus has already been filed with the Securities and Exchange Board of India. A senior official at DoD said consultation with the ministries and departments concerned had begun for taking the proposal to the Cabinet afresh, taking into consideration the present circumstances. He indicated the earlier proposal, cleared by the Cabinet in 2010, was set to be revised to divest only 10 per cent of the paid-up equity capital by the government as the company didn’t require funds. The Cabinet Committee on Economic Affairs had earlier cleared disinvestment of 10 per cent paid-up equity capital of Hindustan Copper out of the government’s shareholding, along with an issue of fresh equity of equal size by the company in June 2010. (For details log on to : http://www.business-standard.com/india/news/hind-copper-divestment-may-follow-rinl-ipo/476234/)

AMOUNT OF REEBOK FRAUD APPEARS INFLATED: SFIO

NEW DELHI: An initial probe by the Serious Fraud Investigation Office (SFIO), the investigative arm of the Ministry of Corporate Affairs, into the Reebok India scam suggested the amount of Rs 870 crore as alleged by the company’s German parent, appeared “exaggerated”. “We have started investigation and from the initial inquiry, it looks like the amount of fraud, as quoted by the company, is inflated,” an official in SFIO told Business Standard. Officials in the ministry endorsed the view. According to an official in the ministry, the preliminary inquiry shows annual sales of the company have not exceeded Rs 500 crore over the years and it is unlikely the quantum of the alleged financial fraud could be Rs 870 crore. The ministry also appears to have taken a lenient approach towards probing the role of the company’s auditors. “It’s too early. Let the initial report come. If that points towards the auditors, then we will question them,” another official said. He added the ministry as of now had not even asked the accounting regulator, Institute of Chartered Accountants of India (ICAI), to look into the role of auditors in the Reebok case. (For details log on to: http://www.business-standard.com/india/news/amountreebok-fraud-appears-inflated-sfio/476224/)

‘BIG FOUR’ TO AUDIT SPAIN’S BANKING SECTOR

MADRID: Spainhas picked the “Big Four” accounting firms KPMG, PwC, Deloitte and Ernst & Young to carry a full, individual audit of its ailing banks, a source with knowledge of the decision told Reuters on Saturday. The review, which should take a few months, will complement an ongoing exercise to stress test Spain’s banking sector by consulters Oliver Wyman and Roland Berger, whose first results are expected around mid-June. “I can confirm (the names),” the source said. Spain’s Prime Minister Mariano Rajoy on Saturday said his government would have a clear view of how much money will be needed to recapitalise troubled lenders by the end of June. He also said the government would make clear by then how it intends to inject the money. Economy Minister Luis De Guindos said earlier this week that Spain would likely go to the markets to find the euro 19 billion (£15.29 billion) nationalised lender Bankia said it would need to be cleaned up but investors are doubtful it can manage to prop up the entire sector without outside help. (For details log on to : http://www.business-standard.com/india/news/big-four-to-audit-spains-banking-sector/476231/)

HOW TO READ AN AUDIT REPORT

Imagine wading through pages of information to understand a company’s financial position – and without any knowledge of the nuances of financial reporting! The independent auditor’s report is here to help understand financial statements better. It summarises the scope of the audit, the management and auditors’ responsibilities, and the true and fair view of financial statements to name a few. Before looking at an audit report, readers should be aware of certain myths associated with it and its inherent limitations. It is believed that an audit is a guarantee for the management’s efficiency in running the company’s affairs. It is also seen as a guarantee for the company’s future viability. Another common myth is that an unqualified opinion means the company has sound financial health. Further, many people think the objective of an audit is to detect fraud and error, and that it includes commenting on the company’s policy decisions and use of resources. Many also think the auditor decides the accounting policies of the company and prepares its financial statements. (For details log on to : http://www.thehindubusinessline.com/todays-paper/tp-others/tp-accountancy/article3487607.ece)

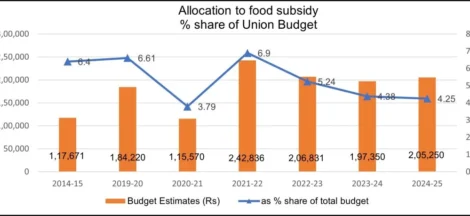

State Government Finances Witnessed Deterioration In 2024-25

in

IPA Special

Jun 26, 2025

·