MUMBAI: In a meeting with the top management of the Reserve Bank of India (RBI), including Governor Sanjay Malhotra, on Thursday, the chiefs of select non-banking financial companies (NBFCs) recommended several measures to enhance funding access for the sector.

Bank funding to NBFCs has declined over the past year after the regulator increased risk weights on bank loans to the sector in November 2023.

“NBFCs have suggested measures including increasing the limit for external commercial borrowings (ECBs) under the automatic route within a financial year, establishing a National Housing Bank (NHB)-like body for NBFCs to provide liquidity to smaller NBFCs, and reclassifying gold loan-focused NBFCs similarly to housing finance and microfinance companies,” said a chief executive officer (CEO) who attended the meeting.

Currently, eligible borrowers can raise ECBs of up to $750 million or the equivalent per financial year under the automatic route.

This is the first time Malhotra has met the chiefs of NBFCs across all layers, including state-owned NBFCs, housing finance companies (HFCs), and microfinance institutions (MFIs), after taking charge as RBI governor in December.

Previously, Malhotra met the chiefs of state-owned and private-sector banks before the monetary policy meeting.

Malhotra, while highlighting the important role played by NBFCs in credit intermediation, also urged them to enhance their contribution to financial inclusion and join the Unified Lending Interface (ULI) being implemented by the central bank.

NBFC representatives suggested that the RBI should deepen the domestic debt capital market, which would not only help them raise funds for growth but also diversify their borrowing sources.

Currently, AAA-rated NBFCs receive adequate funding from the domestic bond market, while lower-rated NBFCs are increasingly tapping into the overseas bond market for longer-tenure funds.

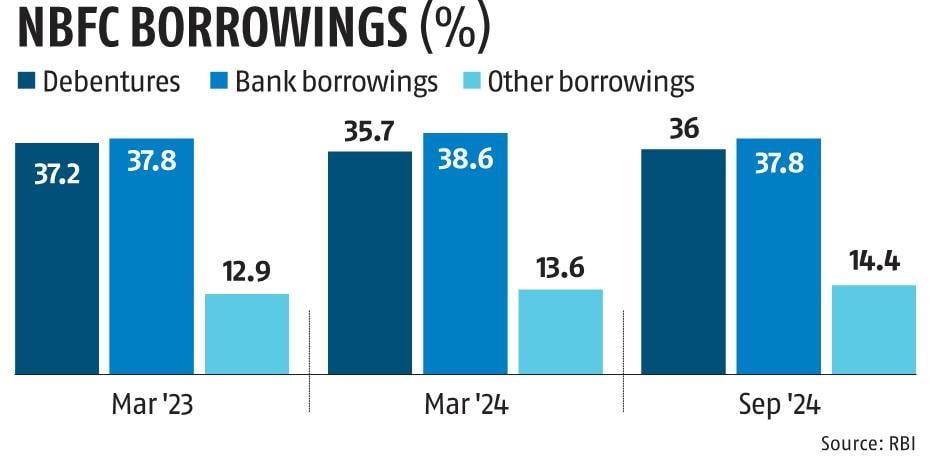

The RBI, in its recent trend and progress report, stated that the reduction in NBFCs’ reliance on banks for funds bodes well for overall financial stability.

Following the increase in risk weight for banks’ funding to NBFCs from 100 per cent to 125 per cent in November 2023, there was a moderation in bank funding to NBFCs.

Overall, banks’ exposure as a share of NBFCs’ borrowings moderated from 43.1 per cent at the end of March 2023 to 42.7 per cent at the end of March 2024, RBI data shows.

Another CEO who attended the meeting said a major recommendation from the industry is the creation of a dedicated refinancing body for MFIs, which have faced elevated stress levels in recent quarters.

This is the first meeting between the RBI and select NBFCs since August 25, 2023.

The NBFCs present at Thursday’s meeting accounted for nearly 50 per cent of the total assets of the NBFC sector.

Representatives from self-regulatory organisations Sa-Dhan and the Microfinance Institutions Network, as well as from the Finance Industry Development Council, attended the meeting.

Deputy Governors M Rajeshwar Rao, T Rabi Sankar, and Swaminathan J, along with executive directors in charge of regulation, supervision, and financial inclusion, were also present.

Addressing NBFC chiefs, Malhotra stressed the importance of balancing growth aspirations with sound practices to ensure inclusive development, customer protection, and financial stability. He also underscored fair treatment of customers and the need for a prompt grievance redress mechanism.

This comes after the RBI, in October last year, barred four NBFCs, including two MFIs, from sanctioning and disbursing loans for charging exorbitant interest rates. The restrictions were later lifted after these NBFCs implemented corrective measures.

Source: Business Standard

PM Modi Says US And India Target $500 Billion Bilateral Trade By 2030

PM Modi Says US And India Target $500 Billion Bilateral Trade By 2030