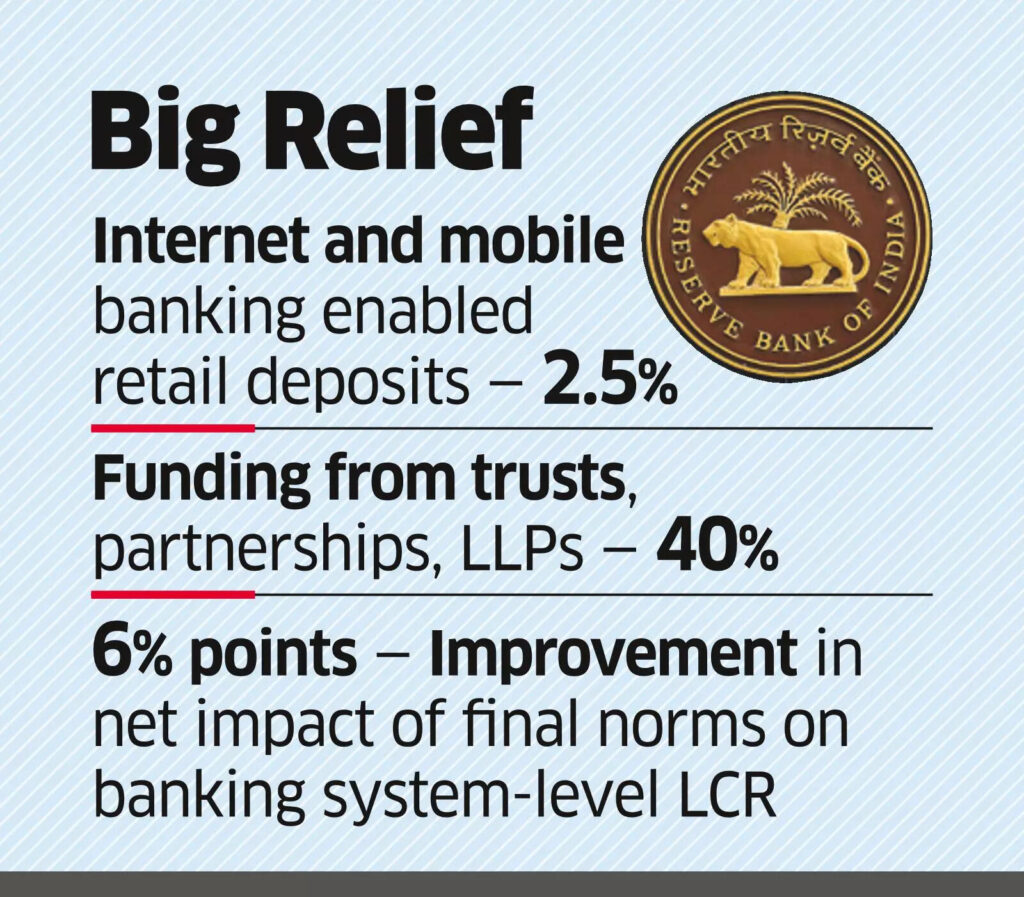

MUMBAI: In a relief to banks, the Reserve Bank of India (RBI) on Monday announced an increase of only 2.5 percentage points in the run-off factor for banks’ retail deposits enabled with internet and mobile banking facilities, paring the level proposed earlier.

In its draft liquidity coverage ratio (LCR) guidelines issued in July last year, the central bank had proposed an additional 5% run-off factor — the percentage of deposits expected to be withdrawn in a short period of stress. The final guidelines will come into effect from April 1 next year.

“These amendments would help improve the liquidity resilience of banks in India and would further align the guidelines with global standards while ensuring that such an enhancement is done in a non-disruptive manner,” the RBI said.

According to the final guidelines, stable retail deposits will have 7.5% run-off factor and less stable deposits will have 12.5% run-off factor as against 5% and 10% prescribed currently.

The draft had proposed implementation of additional run-off factor from April 1, 2025. In February this year, RBI governor Sanjay Malhotra had said that the liquidity coverage ratio implementation will be deferred by at least a year.

Banks covered under LCR framework are required to maintain a stock of high quality liquid assets (HQLA) to cover the expected net cash outflows in the next 30 calendar days.

The net impact of these measures will improve banks’ liquidity coverage ratio as on December-end by around 6 percentage points.

“The Reserve Bank has undertaken an impact analysis of the above measures based on data submitted by banks, as on December 31, 2024. It is estimated that the net impact of these measures will improve the LCR of banks, at the aggregate level, by around 6 percentage points as on that date,” the RBI said.

In addition, the latest guidelines also rationalise the composition of wholesale funding from “other legal entities”. Consequently, funding from non-financial entities like trusts (educational, charitable and religious), partnerships, and limited liability partnerships will attract a lower run-off rate of 40% as against 100% currently.

According to the RBI, all banks will continue to meet the minimum regulatory LCR requirements comfortably.

“With an estimated HQLA of almost Rs 45-50 lakh crore for the banking system, this could free up lendable resources by almost Rs 2.7-3 lakh crore and support the credit growth of the banks. This headroom can be equivalent to 1.4-1.5% of additional credit growth potential for the banking system,” said Anil Gupta, senior vice president & co group head – financial sector ratings, Icra.

Source: The Financial Express

eNAM Remains Local, Inter-State Trade Minimal, Halves In FY25

eNAM Remains Local, Inter-State Trade Minimal, Halves In FY25