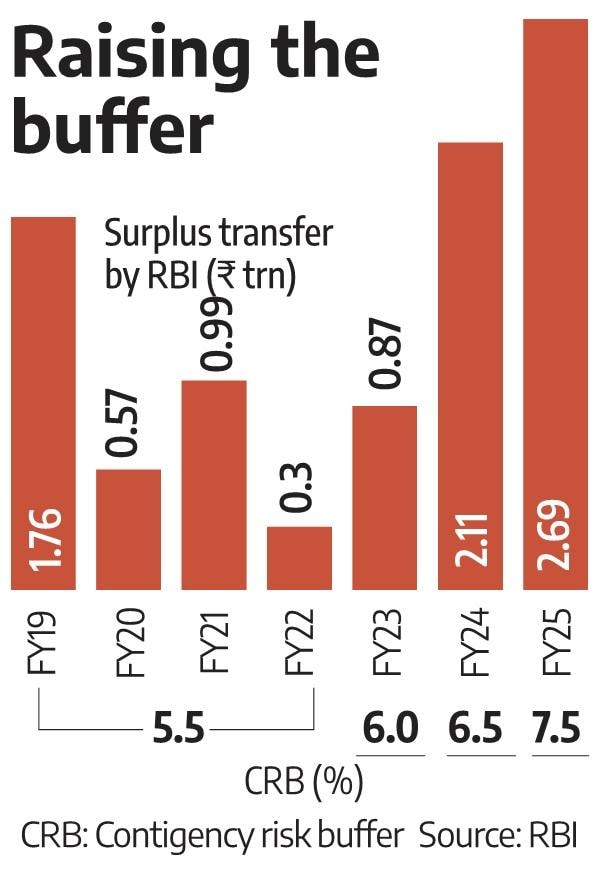

MUMBAI: The central board of the Reserve Bank of India (RBI) on Friday approved a record ₹2.69 trillion surplus transfer to the government for the financial year 2024-25, even after maintaining the contingent risk buffer at 7.5 per cent — the upper end of a new range it approved following a review of the RBI’s economic capital framework (ECF).

The board decided to expand the central bank’s contingent risk buffer or CRB range from 5.5-6.5 per cent of the balance sheet followed for the five years ending 2023-24, to 4.5-7.5 per cent, that is, 6 per cent +/- 1.5 per cent of its balance sheet.

This is the second year in a row that the RBI has transferred a record surplus to the Centre. In 2023-24, the RBI had transferred ₹2.11 trillion while maintaining the buffer at 6.5 per cent.

The transferable surplus of RBI for any year is arrived at on the basis of the ECF adopted by the central bank in 2019, as per the recommendations of the Expert Committee to Review the extant ECF of the Reserve Bank of India, chaired by former RBI governor Bimal Jalan.

The framework was reviewed after five years as mandated by the Jalan Committee.

“Based on the revised Economic Capital Framework, and taking into consideration the macroeconomic assessment, the Central Board decided to further increase the CRB to 7.50 percent,” the RBI said in a statement.

Despite an increase in the risk buffer, the central bank was able to transfer a higher surplus as it booked profits on heavy dollar sales in the previous financial year. The central bank undertook gross sales of $399 billion in the 2024-25 or FY25, compared to $153 billion in FY24.

On a net basis, the central bank sold $34.5 billion, the highest since the global financial crisis of 2008-09. The historical cost of the dollars is much lesser than the current spot rate.

With this bumper income, the fiscal deficit of the government is expected to ease around 20 basis points (bps) from the budgeted level of 4.4 per cent of the GDP, reckoned Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

The Union Budget for 2025-26 had projected a dividend income of ₹2.56 trillion cumulatively from the RBI and public sector financial institutions. “With today’s transfer, this number would now be much higher than the budgeted estimates… Alternatively, it will open up for additional spending for around ₹70,000 crore, other things remaining unchanged,” Ghosh said in a note.

However, the bond market was expecting a higher surplus transfer as they were not expecting broadening of the CRB range.

“The market did not expect widening of the risk buffer range, but that should not have any impact on yields. However, markets were expecting possibly revised estimates of around ₹3 trillion dividend, which could be a slight disappointment,” said Anshul Chandak, head of treasury at RBL Bank.

If the buffer was maintained at last year’s level, the RBI’s surplus would have surpassed ₹3 trillion.

“If the RBI hadn’t increased its provisions, the dividend could have been as high as ₹3.5 trillion. The strong dividend this year was primarily driven by gross dollar sales of nearly $400 billion and interest income from RBI’s holdings of government securities and foreign currency assets,” said Gaura Sen Gupta, chief economist, IDFC First Bank.

The central bank said it undertook an internal review of the economic capital framework, based on the experience gained from the operationalization framework, developments in the external operating environment, and changes in the asset profile of the RBI.

The board has noted that the framework had met its objective of ensuring a resilient balance sheet for RBI, while maintaining a healthy transfer of surplus to the government. It was decided to retain the broad principles of the framework, with no major changes in risk assessment methodologies.

“Certain changes have, however, been made with the objective of further strengthening the framework to align better with any emerging risks to the balance sheet of the RBI,” it said.

RBI said the revised ECF provides requisite flexibility year-on-year to the board in the maintenance of risk buffers, considering the prevailing macroeconomic and other factors, while also ensuring needed inter-temporal smoothening of the surplus transfer to the government.

With respect to the Surplus Distribution Policy, the central bank said that if the Available Realised Equity (ARE) – which is a sum of Capital, Reserve Fund, Contingency Fund and Asset Development Fund — is excess of 7.5% of balance sheet size (after considering shortfall in market risk buffers, if any), it may be written back from the Contingency Fund to income.

On the other hand, if the ARE is below the lower bound of the RBI’s requirement that is 4.5 per cent, no surplus will be transferred to the Government till at least the minimum level of Required Realised Equity is achieved.

In FY24, the ARE was Rs 4.58 trillion, 6.5 per cent of the balance sheet. The figures for the current financial year will be released with the RBI annual report, which is expected in the next few days.

Sen Gupta attributed the RBI board’s move to expand the CRB range to two key reasons. “First, to smoothen dividend payouts over time and avoid large fluctuations, which is why they widened the buffer range from 4.5% to 7.5%, giving them more flexibility to adjust provisioning based on revenue. And second, to guard against heightened global volatility,” he postulated.

Source: Business Standard

ED Officer Seeks Pre-Arrest Bail

ED Officer Seeks Pre-Arrest Bail