NEW DELHI: India’s private sector output grew at its slowest since November 2023 as the pace of new business intake softened in the services sector, which in turn offset the robust growth seen in the manufacturing sector during the month, according to the HSBC flash Purchasing Managers’ Index (PMI) survey released on Friday.

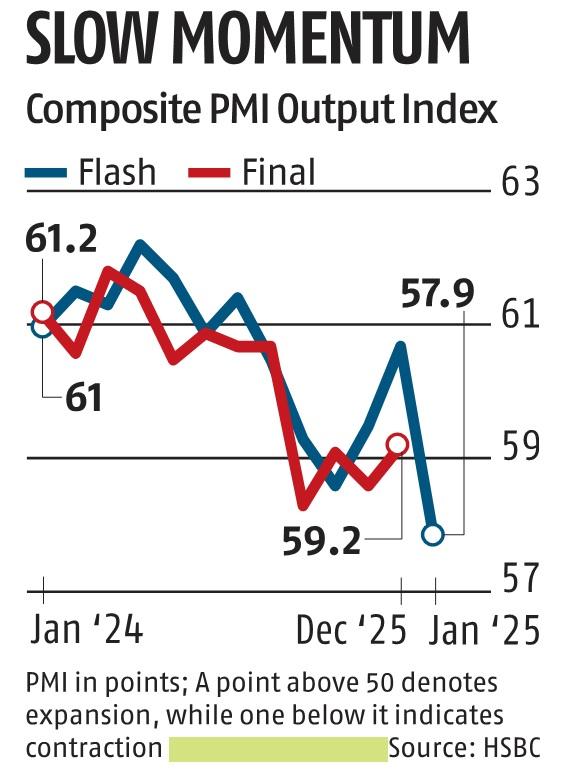

The index compiled by S&P Global fell to 57.9 in January from December’s final reading of 59.2.

However, the index which measures monthly change in the combined output of India’s manufacturing and service sectors, has been above the 50-level separating growth from contraction for the 42nd consecutive month.

“The latest HSBC flash PMI data, compiled by S&P Global, showed that a stronger expansion in the manufacturing industry was more-than-offset by a loss of growth momentum in the service economy. Meanwhile, prices charged for goods and services rose at a faster rate than in December as cost pressures intensified,” the survey said.

In the manufacturing sector, the flash PMI, which is a composite measure of new orders, output, employment, supplier delivery times, and inventory levels, indicated improved factory conditions as the January figure rose to 58 from 56.4 in December, its strongest showing since July 2024.

In contrast, the services sector experienced a deceleration, with the flash PMI figure declining to 56.8 in January from 59.3 in December.

Pranjul Bhandari, chief India economist at HSBC, said that India’s manufacturing sector started the year strong, with output and new orders bouncing back from a relatively weak third fiscal quarter.

“The rise in new export orders was especially noticeable and the easing of input cost inflation is also good news for manufacturers. The cooling in growth in new domestic business in the services sector, however, highlights a potentially emerging weak spot in the economy,” she added.

On the other hand, cost pressures escalated at the composite level, though trends varied at the granular level. In the manufacturing industry, the rate of inflation retreated to a ten-month low, while the expenses of service providers increased to the greatest degree in just under a year-and-a-half.

“Survey participants reported greater chemical, labour, leather, meat, rubber and vegetable costs. As for selling prices, rates of inflation were broadly similar at goods producers and service providers,” the survey said.

Similarly, job creation strengthened across the two tracked sub-sectors as January’s expansion in aggregate employment was the best registered since comparable data became available in December 2005.

“Survey members suggested that permanent and temporary workers had been hired on both part- and full-time bases,” the survey said.

Flash PMI records 75 to 85 per cent of the total 800 responses from services and manufacturing firms each month. The final manufacturing PMI figure for January will be released on February 3, whereas the services and composite PMI figures will be released on February 5.

Source: Business Standard

Liquidity Deficit Breaches Rs 3 Lakh-Crore Mark

Liquidity Deficit Breaches Rs 3 Lakh-Crore Mark