MUMBAI: Hit hard by the recent guidelines issued by the Reserve Bank of India (RBI), more than half of the peer-to-peer (P2P) lending platforms have halted the onboarding of new customers. Previously, these platforms were bringing on 250,000 to 300,000 users (both borrowers and lenders) each month, but this has now plummeted to just 3,000-4,000, according to industry estimates. Liquiloans, the largest player in the P2P lending sector, is among the companies that have stopped adding new customers.

While some players have stated that the pause is temporary, allowing them to align their systems with the RBI’s new guidelines, others have expressed that operating under the new rules has become very difficult.

“Some platforms have temporarily paused onboarding of new customers so that they can align their systems with new guidelines issued by the RBI,” said a P2P lending platform’s founder. “We expect them to start adding customers again soon,” he said.

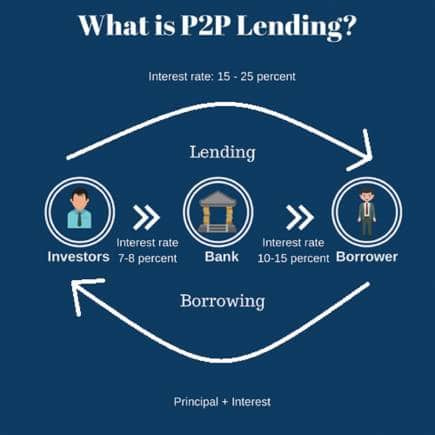

Last month, the RBI tightened the rules for P2P lending platforms prohibiting them from taking on any credit risk, offering credit enhancement or providing guarantees. In the revised guidelines, the banking regulator has said that a P2P platform should not promote P2P lending as an investment product with features like tenure-linked assured minimum returns, liquidity options, etc.

For some P2P platforms, the new guidelines are very harsh. “Retail lenders require liquidity. Secondary market is allowed in each and every asset class, whether it is a home, car, bonds, G-Sec (government securities) or equities, everywhere you can sell your asset to another participant on the platform. In P2P, it has been disallowed. How will a retail lender participate without a secondary market?” said another P2P platform founder. “We have stopped onboarding new customers,” he added.

Currently, there are 26 P2P lending platforms in India, out of which nearly 10 are active. P2P platforms connect borrowers and lenders online, bypassing traditional institutions for direct peer-to-peer transactions.

Those who have not stopped onboarding customers have slowed down the acquisition of new ones. “We have not stopped onboarding new customers but the number of new customer additions on monthly basis have declined by nearly 80%,” said a P2P platform co-founder.

Companies say that the new RBI rule, which requires funds in the escrow accounts of lenders and borrowers to be cleared within a day (T+1), is too harsh and they have requested the banking regulator to ease it.

“Implementing a T+1 settlement cycle presents significant operational challenges for the platform and difficulty for lenders. We believe a gradual approach would be more practical and are requesting the regulator to consider starting with a T+5 model, which can be progressively reduced to T+3. This aligns with the payment gateway category,” Bhavin Patel, founder & CEO, LenDenClub, told FE.

As per the current rules, a lender is not allowed to invest more than Rs 50 lakh in a platform. The maximum investment amount for a single borrower is Rs 50,000. The total loan amount taken by a borrower at a certain point of time should not be more than Rs 10 lakh. The maximum maturity duration of the loan is 36 months.

Source: The Financial Express

Growth In New Business Thrusts Services PMI To 5-Month High In August

Growth In New Business Thrusts Services PMI To 5-Month High In August