MUMBAI: Fundraising by non-banking financial companies (NBFCs) through the external commercial borrowings (ECB) route has hit a five-year high in 2024. This comes after a slowdown in banks’ lending to the sector following strictures from the Reserve Bank of India in November 2023. NBFCs raised a total of Rs 3.64 lakh crore in 2024, the highest since 2019, according to data from PRIME database.

Analysts say easing of monetary cycles across the globe has added to the attractiveness of ECBs, as even below ‘AA’- rated NBFCs have been able to raise funds from the offshore market.

“Global rates have started moving downwards. Therefore, they (NBFCs) must be seeing an advantage in terms of borrowing at a relatively lower rate compared to domestic markets. Although there is a bit of volatility in the forex market, one should remember that until November or so, the rupee was one of the better performing and stable currencies. However, the risk factor is there. And that’s something which NBFCs will have to consider,” said Madan Sabnavis, chief economist at Bank of Baroda.

Barring the Reserve Bank of India, all the major central banks have recently cut interest rates, providing arbitrage opportunities to NBFCs to raise funds overseas.

The RBI’s decision in November last year to increase risk weights on bank funding to NBFCs prompted them to diversify funding sources. NBFCs have increasingly turned to the domestic capital market, raising funds through bonds, as well as the overseas market, tapping into dollar bonds and syndicated loans.The credit growth to NBFCs slowed down to 15.2% from 21.6% a year ago, as per the RBI data.

The rupee has depreciated 2.93% since the start of 2024 due to a surge in the dollar index, and is expected to remain under stress as the currency remains overvalued. Usually, ECBs tend to become unattractive as depreciation in the currency will push the forward premiums rate higher.

“If you look at the market rates for AA or AA plus or AAA, it is around 8.5%. So a lot of them are able to get ECBs at full hedged basis, around 8.6-8.7%. Also, we are seeing that they are coming with a huge quantum of money for a longer duration. A lot of the lenders would like to lock in for a longer period of time because that gives them some kind of stability in their funding mix and helps them manage their assets and liabilities,” said Jinay Gala, director at India Ratings and Research.

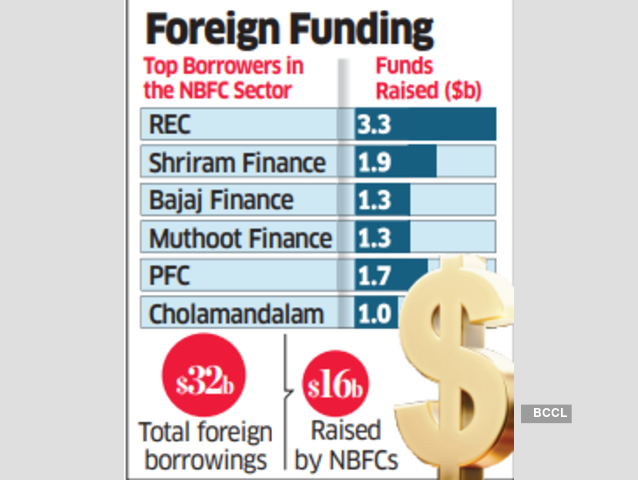

In 2024, various NBFCs raised money via the ECB channel. Shriram Finance (SFL), the flagship company of the Shriram Group, raised $1.277 billion in multiple currencies, including dollar, euro, and dirham (AED), through an ECB transaction.

Apart from Shriram Finance, Muthoot Finance raised $400 million (around Rs 3,350 crore) through the ECB route by issuing secured notes under its global medium term note programme of $2 billion.

Cholamandalam Investment and Finance Company and HUDCO are some of the other companies which are also planning to tap the ECB route.

Source: The Financial Express

Gold Imports In April-November Overstated By $11.7 Billion: Govt

Gold Imports In April-November Overstated By $11.7 Billion: Govt