In its latest report ‘India Real Estate Q3 2023’, the real estate consultancy, Knight Frank India cited that the top eight markets of India have recorded office transactions of 16.1 million square feet (mn sq ft) recording a growth of 17% YoY during Q3 2023.

The elevated demand in the Indian office market reflects the confidence of occupiers as India continues to see economic stability despite global uncertainties, it added.

Global corporations have shown an increased commitment to their India operations by setting up or expanding their Global Capability Centres (GCC) in India which constituted 44% of the office transactions in the country.

The comparatively brisk Indian economy continued to propel the India-Facing businesses or domestic corporations which constituted 37% of the office transactions accounting to 6 mn sq ft in Q3 2023. With 3.2 mn sq ft of transactions, Mumbai was the most active office market during Q3 2023 accounting for 20% of the total transactions during the period.

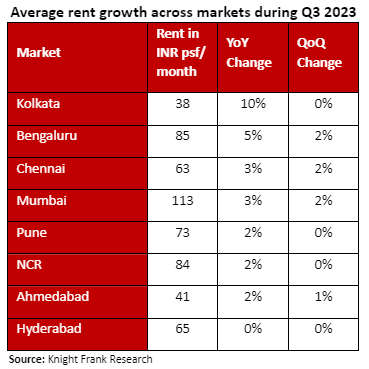

Mumbai is the most expensive office rental market at Rs 113/sq ft/month, followed by Bengaluru at Rs 85/sq ft/month.

Sixth consecutive quarter to exhibit rental stability or growth

Rental values continued to grow or remain stable in both YoY and sequential terms across all markets in Q3 2023. Most significantly, this is the sixth consecutive quarter where YoY rent movement has been either stable or positive.

Kolkata, albeit on a low base, recorded the highest rental value appreciation of 10% during Q3 2023. Office rents in the larger office markets of Bengaluru, Mumbai and NCR grew by 5%, 3% and 2% YoY respectively.

While Mumbai and NCR saw growth led by rising demand and relatively limited supply, Bengaluru’s rental growth was mostly led by a paucity of new Grade A spaces.

New office completions in Q3 2023 were recorded at 11.5 mn sq ft across the eight Indian cities led by Hyderabad accounting for 46% of the additional office space delivery with 5.3 mn sq ft, followed by Bengaluru with new office supply of 4.0 mn sq ft.

Mumbai is the market with highest office rental and Kolkata records the highest rental appreciation of 10% during the quarter.

Shishir Baijal, chairman & MD, Knight Frank India said, “The relative strength of the Indian economy continues to attract global corporate interest and is reflected in the recovering demand in the Indian office space market. The increasing incidence of GCCs being set up in the current quarter also points toward greater occupier commitment to the overall operational and business environment that India offers.”

“Occupier demand has trended up well over the year and looks to be on course to exceed levels seen in the previous year. It is the broader economic forces of inflation and GDP growth that will take centre-stage in shaping the fortunes of the Indian office market in the next few months,” Baijal added.

With inputs from News18

Israel ready for attack on Gaza by air, sea, land

Israel ready for attack on Gaza by air, sea, land