MUMBAI: Private credit may be the buzzword in the investing world, but many bulge bracket investors have remained tight-fisted as far as the Indian markets are concerned. While those like Carlyle, SoftBank and CDPQ, who were exploring an entry into the Indian private credit market, have kept away so far, existing ones such as KKR and Goldman Sachs are going slow on it.

The reason for the limited large deals ranges from improved returns in the US to the booming equity markets in India. Besides, the high hedging costs and country risk are making only high-yield investors in distressed assets to cut big debt deals in the country.

US-based Carlyle Group, for instance, studied the market for some time and was reportedly in the process of appointing an India head for its credit business. But it is yet to make any deal in the credit space here, said an investment banker. An email sent to Carlyle Group did not elicit any response. Carlyle’s global credit platform manages $150 billion in assets globally.

Japanese investor SoftBank Investment Advisers, which manages two Vision Funds, was also exploring a private credit strategy that provides debt or debt-like structured financing for late-stage tech startups. According to sources in the know, the investor is yet to make any such deals in the Indian market. An email sent to SoftBank did not get any response.

Ivanhoe Cambridge, the real estate investment arm of Canadian pension fund CDPQ, was also studying the Indian market for investments. However, not much progress has been made so far. When contacted, a spokesperson for the investment firm said: “This market segment (private credit) remains a focus for Ivanhoé Cambridge but we have no update to share at this stage.”

Transactions worth $4 billion happened in the private credit space in India in the first half of 2023, Bharat Gupta, partner-turnaround and restructuring at EY, said in a report. This number does not include venture debt, debt funding in financial services players and offshore bond raises.

Barring the two high-value deals within the real estate and metal & mining sectors, the average ticket size for these identified transactions was $75 million. The real estate sector notably led the deal flow, representing an over 50% of the total value, he said.

But several existing global players such as KKR and Goldman Sachs are going slow on private credit. For instance, after the merger of its non-banking financial company KKR India Financial Services with Incred Finance, US-based investor KKR has done just one debt deal. “They seem to have scaled back private credit after the merger,” sources said. Emails sent to KKR and Goldman Sachs did not elicit any response.

Some others are of course more active. A spokesperson for Blackstone said its credit and insurance segment’s assets under management has grown more than two times over the last three years to $297 billion – and private credit makes up more than half of the business. Blackstone entered the segment in 2008. “In Q3, Blackstone’s credit, insurance and real estate credit businesses were more than half of total inflows for the firm.” the spokesperson said.

EY’s Gupta said the global funds have taken a “pause” due to couple of reasons. “A combination of lower high yield credit opportunities in India and increased interest rates globally have led to global private credit funds focusing on Western markets,” he said.

In India, influx of domestic funds is also leading to higher supply of private credit between 14% and 18% range, he added.

Vineet Sukumar, founder and MD at Vivriti Asset Management, which manages domestic credit funds agrees with Gupta. “If you’re able to get 8-10% of returns in the US market, why would you come to India? Today three-year US government bond returns are close to 5%; in India, it’s 7%. The differential is very less. US bonds are rated AA and Indian bonds are rated triple B minus,” Sukumar said.

Secondly, when equity markets are doing very well, promoters do not want to raise expensive debt, he said.

Ankur Jain, managing director, credit strategies at Incred Alternatives, has a different reason. “The credit market which large investors are interested that is Rs 300 crore and above, is a small market in India. Sub-Rs 300 crore is 95% of the market,” Jain said.

Jain said that global investors have to deal with forex issues here. “They have to convert dollar and invest here, and rupee is depreciating 4% every year. Combined with country risk and hedging costs, 14-16% returns do not make a good return. Only stressed asset or special situation deals at 18-20% makes sense,” he said.

(Source: The Financial Express

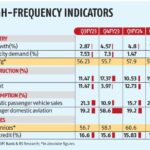

Urban Consumption Likely To Propel India’s GDP Growth In July-September

Urban Consumption Likely To Propel India’s GDP Growth In July-September