BENGALURU: Facing margin headwinds, IT firms like Wipro, Tech Mahindra, and LTIMindtree, are reducing their exposure by giving up low-value clients in the Asia-Pacific region, which falls under the RoW (rest of the world) geographical segment for them.

Instead these firms are concentrating on deals in the North America region. Though this region is witnessing a slowdown in tech spending, whatever deals are coming through offers higher margins than other regions.

“Tech Mahindra has businesses where margins are structurally low (eg, high presence in low-margin RoW segment, specifically APAC) or has contractual structures with high pass-through component. We suspect such low or negligible margin business may be as high as 10% of revenue,” analysts at Kotak Institutional Equities wrote recently.

TechM’s share of revenue from RoW has fallen quarter-on-quarter and as well as year-on-year basis to reach 23.2% in the September quarter. In contrast, its share of revenue from Americas has increased to 53.3% in Q2 from 51.4% in Q1.

During the post-earnings call recently, Rohit Anand, CFO, TechM, “We have taken actions to reduce the exposure to non-core areas of business. These actions will, over time, help us improve our financial performance and enable long term sustainable growth”.

Similarly, Thierry Delaporte, CEO, Wipro, also highlighted the company’s strategy in the recent post-earnings call, “In our APMEA (Asia Pacific Middle East and Africa) business, revenues for the quarter declined 0.5% sequentially. Our goal in this region is absolutely to capture the rapidly digitising market. For that, we are leveraging our global scale and domain expertise to actually continue to move our portfolio towards higher value transformation projects”.

While Wipro’s revenues from APMEA region saw a marginal decline, the same increased by a percent from Americas1 during the quarter. In a recent interaction with Fe, Wipro’s CFO Aparna C Iyer said that the company is pivoting from low-value clients to defend margins.

LTIMindtree has also raised its revenue exposure to North America by 2% QoQ while seeing a decline of 2.3% in RoW during the September quarter.

Vinit Teredesai , CFO, LTIMindtree, said, “We are working on programmes which will help us in terms of improving our margins in terms of certain clienteles where they have been low”.

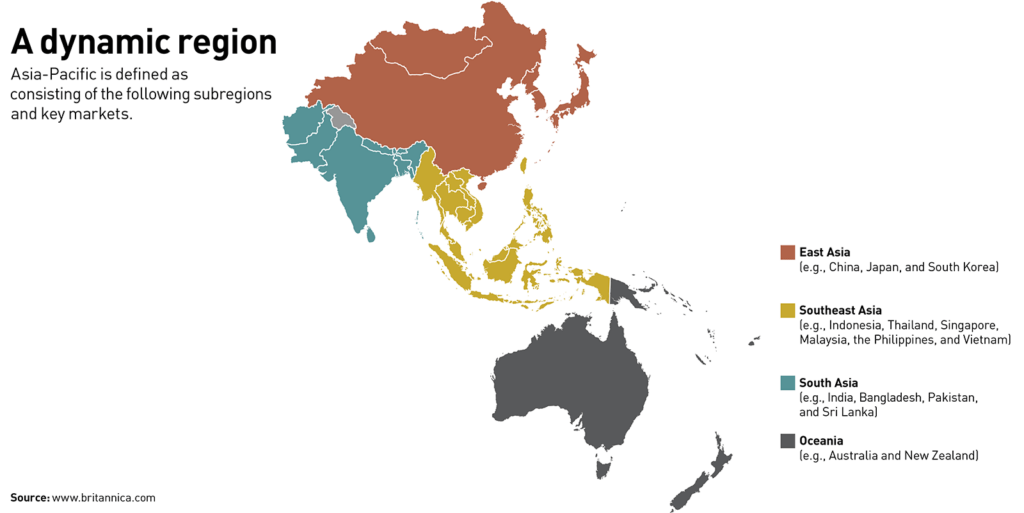

Commenting on this trend of reducing exposure in the Asia-Pacific region, Pareekh Jain, founder of Pareekh Consulting, said, “The primary reason is margin is low in emerging countries, especially in South Asia and South East Asia. Secondly, the clients based in RoW don’t have scalability potential. Companies today are looking for account that can grow big tomorrow”.

The tech spend capacity of North America is also substantiated by a recent Infosys research report, which said that North American companies in Canada and US will invest about $6 billion in 2024 in Generative AI initiatives. This is about 67% more than what they invested ($3.3 billion) in the last 12 months.

Source: The Financial Express

States Capex Up 50 Per Cent In H1 On Low Base

States Capex Up 50 Per Cent In H1 On Low Base