NEW DELHI: The Centre is considering doubling the insurance cover for bank deposits, from Rs 5 lakh at present, to assuage the concerns of depositors, especially senior citizens, and strengthen the trust in the banking system, sources told FE. An announcement in this regard is expected by March end.

Actuarial calculations are currently underway to decide on the enhanced cover keeping in mind the affordability of banks as they would be required to pay higher premium to the Deposit Insurance and Credit Guarantee Corporation (DICGC), sources said.

“The effort is to increase the deposit cover substantially to Rs 8-12 lakh. It may be announced in the current financial year itself,” a person aware of the matter told FE.

Public representations have been received to increase the deposit cover to as much as Rs 20-25 lakh, given the rise in income level and inflation. “But it might be raised to Rs 10 lakh. DICGC may increase fees to some extent for that,” another person aware of the matter said.

Senior citizen associations have been demanding an increase in the deposit cover. Total bank deposits by senior citizens have increased 150% to Rs 34.2 lakh crore in 2023 from Rs 13.7 lakh crore in 2018.

The government is “actively considering” raising the insurance cover for bank deposits, department of financial services secretary M Nagaraju had said on Monday.

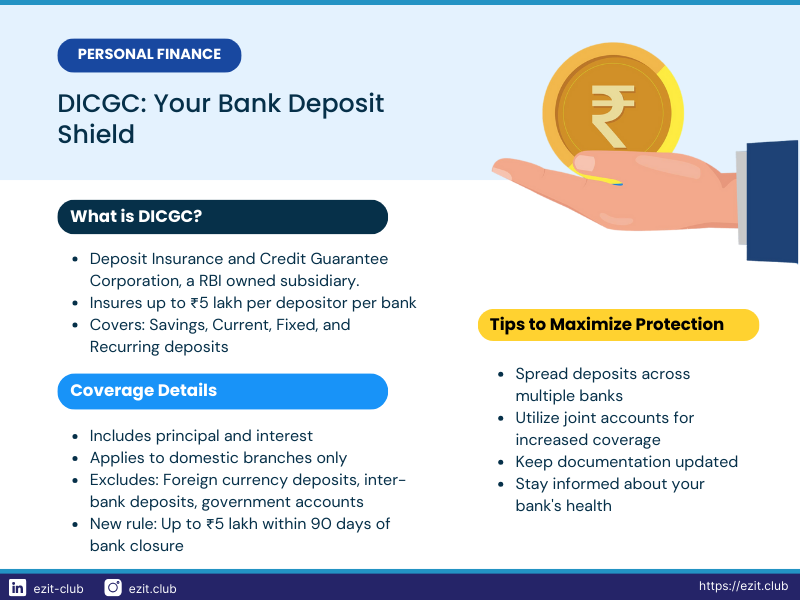

Currently, the deposit insurance cover of Rs 5 lakh applies uniformly to all insured banks, including cooperative banks and their depositors, and is payable to any depositor in case of liquidation or failure of a bank.

The DICGC has settled claims worth Rs 1,432 crore in 2023-24, which pertained entirely to 27 cooperative banks placed under liquidation or all-inclusive directions (AID). During the year, DICGC collected Rs 23,879 crore premium.

The recent fraud at New India Co-operative Bank (NICB) has further riled depositors and led the Reserve Bank of India (RBI) to supersede its board for 12 months. The cooperative bank has a network of 30 branches and a deposit base of Rs 2,436 crore as of March 2024. Post the RBI’s action, the bank’s depositors have been queuing up at its branches to withdraw their money. Depositors of NICB would be entitled to receive deposit insurance claim amounts of up to a monetary ceiling of Rs 5 lakh from the DICGC, the RBI has said.

The rate of insurance premium paid by banks was fixed at 0.05 paise per Rs 100 of assessable deposits per annum in 1962. The premium was raised to 8 paise in April 2004, 10 paise in April 2005 and 12 paise in April 2020, reflecting the rise in cases of defaults largely at the level of co-operative banks. The premium paid by the insured banks to the DICGC is required to be absorbed by the banks themselves so that the benefit of deposit insurance protection is made available to the depositors free of cost.

The deposit insurance coverage limit has been enhanced six times since 1962, from Rs 1,500 per depositor to Rs 1 lakh on May 1, 1993, and further to Rs 5 lakh on February 4, 2020.

According to DICGC data, 97.8% of the total number of deposit accounts are fully protected (below Rs 5 lakh). For the remaining 2.2% of accounts, deposits up to Rs 5 lakh are covered. In terms of value, 43.1% of the deposits (Rs 94.1 lakh crore) were insured as of March 2024. The accumulated deposit insurance fund of the corporation stood at Rs 1.99 lakh crore.

Source: The Financial Express

BJP Sweep in Chhattisgarh Civic Polls Sparks Congress Turmoil

BJP Sweep in Chhattisgarh Civic Polls Sparks Congress Turmoil