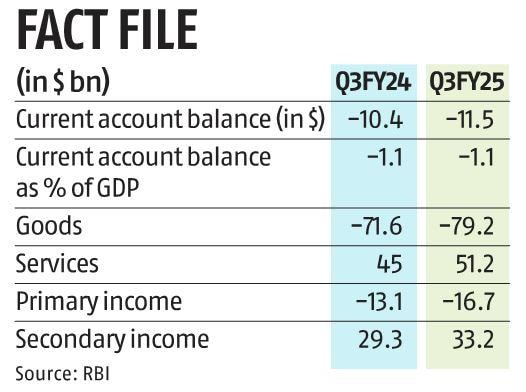

MUMBAI: India’s current account deficit (CAD) rose marginally to $11.5 billion, or 1.1 per cent of gross domestic product (GDP), during the October-December 2024 quarter of the ongoing financial year (Q3FY25) from $10.4 billion, or 1.1 per cent of GDP, a year ago, amid a rise in service exports.

Sequentially, CAD moderated from $16.7 billion in Q2FY25, or 1.8 per cent of GDP, latest data released by the Reserve Bank of India (RBI) showed.

“India’s current account deficit widened, albeit to a lower-than-expected $11.5 billion in Q3FY25 from $10.4 billion in the year-ago quarter, led by a higher merchandise trade deficit. This amounted to 1.1 per cent of GDP, similar to the year-ago levels, although it was well below the 1.8 per cent of GDP seen in Q2FY25, and Icra’s expectations of 1.4 per cent of GDP for that quarter,” said Aditi Nayar, chief economist, Icra.

The current account is expected to witness a surplus of $4-6 billion in Q4FY25, aided by a seasonal uptick in merchandise exports and the resulting moderation in the merchandise trade deficit, as well as healthy services surpluses. Overall, CAD is estimated to be at 0.8 per cent of GDP in FY25, before expanding slightly to nearly 1.0 per cent of GDP in FY26, even though the tariff-related uncertainty could act as a spoiler, Nayar added.

Merchandise trade deficit increased to $79.2 billion in Q3FY25 from $71.6 billion during the same period of FY24.

“Net services receipts increased to $51.2 billion in Q3FY25 from $45 billion a year ago. Services exports have risen on a year-on-year (Y-o-Y) basis across major categories such as computer services, business services, travel services, and transportation services,” the RBI said in a statement.

Net outgo on the primary income account, mainly reflecting payments of investment income, rose to $16.7 billion in Q3FY25 from $13.1 billion in Q3FY24.

Private transfer receipts, primarily representing remittances by Indians employed overseas, rose to $35.1 billion in Q3FY25 from $30.6 billion in Q3FY24, the RBI said.

Non-resident deposits (NRI deposits) recorded net inflows of $3.1 billion, lower than $3.9 billion a year ago. Net outflows under foreign portfolio investment stood at $11.4 billion in Q3FY25 as against inflow of $12 billion in the year-ago period.

Net inflows under external commercial borrowings (ECBs) in the country were $4.3 billion in Q3FY25 as against outflows of $2.7 billion in the corresponding period a year ago.

India’s balance of payments (BoP) saw depletion of $37.7 billion in September-December 2024, compared with accretion of $ 6.0 billion in the year-ago period.

For the nine months of FY25, CAD widened to $37 billion, or 1.3 per cent of GDP, as compared with $30.6 billion, or 1.1 per cent of GDP, during the same period of FY24.

“With the February goods trade deficit narrowing to ~$14bn, we are currently tracking a current account surplus in Q4 FY25,” a note from Barclays said, adding following the sharp upside revision to Q2 data, the Apr-Dec current account deficit is at $37.1bn, and coupled with the likely surplus in Q4, CA deficit for full year FY25 is seen at $30bn.

Source: Business Standard

India Looks To Offer US Tariff Cuts On Farm Imports, Eyes Trade Success

India Looks To Offer US Tariff Cuts On Farm Imports, Eyes Trade Success