MUMBAI: The Indian economy and the financial system remain strong and stable underpinned by sound macroeconomic fundamentals, healthy balance sheets of banks and non-banks and low volatility in financial markets despite some worries about global spillovers, according to the Financial Stability Report (FSR).

In his foreword to the report, RBI Governor Sanjay Malhotra said that prospects for the Indian economy are expected to improve after the slowdown in the pace of economic activity in the first half of 2024-25.

This is notwithstanding the uncertainties shrouding the global macrofinancial environment as it unfolds.

Malhotra said consumer and business confidence for the year ahead remain high and the investment scenario is brighter as corporations step into 2025 with robust balance sheets and high profitability.

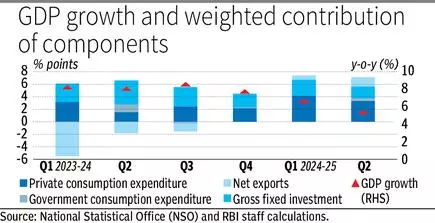

The report (which is a half-yearly publication, with contributions from all financial sector regulators) emphasised that despite recent deceleration in real GDP growth (year-on-year) to 6 per cent in H1 (April-September) FY25 from 8.2 per cent and 8.1 per cent growth recorded during H1 and H2 (October-March) of FY24, respectively, structural growth drivers remain intact.

Real GDP growth is expected to recover in Q3 (October-December) and Q4 (January-March) of FY25 supported by pick up in domestic drivers, mainly public consumption and investment, strong service exports and easy financial conditions, it added.

On the downside, the softness in industrial activity, especially in the manufacturing sector, moderation in urban demand, global spillovers and protective trade and industrial policies pose risks to the outlook.

On retail inflation, the report observed that with some softening of food prices and favourable base effect, it came down to 5.5 per cent in November 2024 (from 6.2 per cent in October 2024).

Going forward, the disinflationary effect of a bumper kharif harvest and the rabi crop prospects are expected to soften prices of foodgrains.

On the flipside, the rising frequency of extreme weather events (such as heat waves and unseasonal rains) continue to pose risks for food inflation dynamics. Persisting geopolitical conflicts and geo-economic fragmentation can also impose upside pressures on global supply chain and commodity prices.

The FSR said the soundness of scheduled commercial banks (SCBs) has been bolstered by strong profitability, lower non-performing assets and adequate capital and liquidity buffers.

Further, return on assets and return on equityare at decadal highs, while gross non-performing assets (GNPA) ratio has fallen to a multi-year low.

Macro stress tests reveal that SCBs’ aggregate capital would remain much higher than the minimum regulatory capital requirement of 9 per cent in March 2026 under adverse scenarios.

Stress test for NBFCs shows that even under a high-risk scenario, their CRARs (Capital to Risk-Weighted Assets Ratio) would remain much above the regulatory minimum level of 15 per cent.

The FSR underscored that the ability of the financial institutions to absorb shocks in adverse scenarios provide comfort on financing of economic growth dynamics, going forward.

Source: The Hindu Business Line

Late Jimmy Carter Was Right About Israel’s Apartheid

Late Jimmy Carter Was Right About Israel’s Apartheid