By Dr. Gyan Pathak

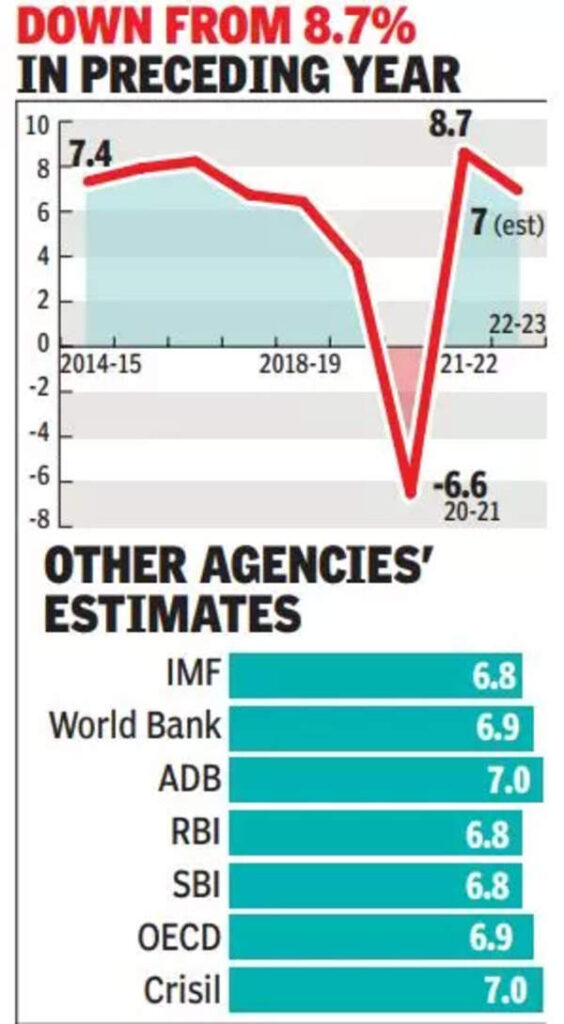

India’s growth rate for 2022-23 exceeded expectations. It has now been estimated upward to 7.2 per cent from 7 per cent as per second advance estimate released in February. The magic was the result of a stronger-than-expected fourth quarter growth when GDP rose to 6.1 per cent, in addition to upwardly revised data for third quarter to 4.5 per cent.

It surprised majority of economists, both within and outside the country, who have by and large been expecting the fourth quarter economic growth to be only around 5.1 per cent. The new data have prompted our Prime Minister Narendra Modi to tweet: “The 2022-23 GDP growth figures underscore the resilience of the Indian Economy amidst global challenges. This robust performance along with overall optimism and compelling macro-economic indicators, exemplify the promising trajectory of our economy and the tenacity of our people.”

However, the upgradation of the data for last year will in no way improve the decelerating trend of the economy for the current fiscal. Union Budget 2023-24 have expected baseline GDP growth in the range of 6 to 6.8 per cent depending on the trajectory of economic and political development globally. Baseline GDP growth projection of the Economic Survey 2022-23 for the current fiscal was 6.5 per cent implying the inflation rate of just 4 per cent. RBI had projected it to be 6.5 per cent in April. ADB projected even less at 6.4 per cent in the same month, World Bank at 6.3 per cent, and IMF at 5.9 per cent. All these show the threat of deceleration of the Indian economy, which needs special attention rather than just tweeting and patting own back on the economic growth of the last financial year.

Modi government should take note of the performance challenge for the current fiscal that the country will be facing. Earlier, it was expected that Indi would decelerate from a growth rate of 7 per cent to 5.9 per cent, but the news date has shown that the challenge has widened that may fall from higher growth rate of 7.2 per cent to below 5.9 per cent, as the world undergoes a turbulent period of financial distress and expected recession. Russia-Ukraine war, rise in oil and commodity prices, climate crisis with El Nina heating effect, and inflation are most likely to weigh down the economy.

In the face of the performance challenge for Indian economy in 2023-24, India needs to dive deep into the last years data that may help the country to overcome the deceleration of the economy this year. Two things emerged sharply – the share of gross fixed capital formation rose to 34 per cent of GDP which was highest since 2014-15, and private consumption to 58.5 per cent of GDP which was highest since 2006-07. In 2022-23 these registered a growth rate of 11.4 per cent and 7.5 per cent respectively. Though these helped in higher growth rate, it concealed the human miseries on the ground due to joblessness, high prices, and inflation.

Indian economy had contracted to (-)5.8 per cent in the pandemic year 2020-21, and from that low base it grew to 9.1 per cent in 2021-22, and now we found it grew at 7.2 per cent in 2022-23. If the Indian economy is set to decelerate below 5.9 per cent in the current fiscal, it would badly impact the cost-of-living crisis, that would be worst in the last three years. Modi government would face the music of this difficult scenario just before the Lok Sabha General election 2024. Modi’s tweet is just political softening, and has not economic value in it.

Stronger-than-expected growth in the quarter ending March 31, 2023 that has caused upward revision of the data of the full year 2022-23 need to be analysed carefully.

Manufacturing GVA rose to 4.5 per cent which reversed the preceding two quarters of contraction. India would need to sustain this momentum.

The gross fixed capital formation rose by 8.9 per cent against the previous quarter lifting its share to an all-time high of 35.3 per cent. It became possible due to government’s capital spending, which the government will find difficult to continue in a decelerating economic condition in the current fiscal.

Private consumption remained sluggish with a rise of only 2.9 per cent, which is indicative of the reality on the ground level that people did not have enough money in their hand. It shows the widened inequality, which was veiled under overall growth rate. Chief Economic Advisor V A Nageswaran is hopeful of increase in private consumption saying that there are signs of recovery in rural demand even as urban demand remains intact. However, several other economists are not hopeful of picking up of consumption and demand, that would ultimately weigh down the economy.

Farm sector output rose to 5.5 per cent during January-March. It was obvious for every year during this period of reaping season. Widespread destruction of various crops has been reported thereafter due to bad weather conditions, which is likely to be further disrupted due to El Nino which may start from July.

Overall GVA grew by 6.5 per cent in Q4 against 4.7 per cent in Q3. Construction grew at 10.4 per cent, financial sector at 7.1 per cent and trade, hotel, and transport 9.1 per cent. It is of course a good sign but, India needs to remain alert on possible domestic and global risks and be ready with intervention plans to protect its economy and people, rather than remain complacent.

Slower consumption growth, external conditions like Ukraine war and recent development in financial market in US, rising borrowing costs, slower income growth, low investment inflow, threat to public health, and jobless growth are the issues for closer watch. (IPA Service)

Coming Caste Census Has To Focus On Many New Dynamics Of Indian Society

Coming Caste Census Has To Focus On Many New Dynamics Of Indian Society