NEW DELHI: Growth in the private final consumption expenditure (PFCE), which is taken as a proxy for consumption demand in the economy, outpaced gross domestic product (GDP) growth in 2024-25 (FY25), even as the consumption demand slowed to a five-quarter low in the fourth quarter (Q4) of the financial year.

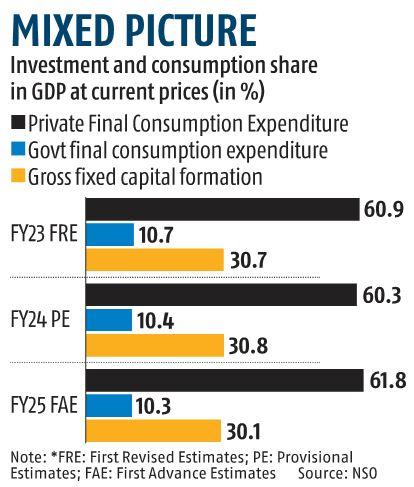

According to the latest data released by the National Statistical Office (NSO) on Friday, PFCE grew at 7.2 per cent in FY25, up from 5.6 per cent in FY24. As a share of nominal GDP, it stood at 61.4 per cent, up from 60.2 per cent in FY24.

Addressing the customary press conference, Chief Economic Advisor V Anantha Nageswaran said that the share of consumption in GDP in FY25 has risen to the highest levels since FY05 (61.5 per cent).

“As the headline (figure) suggests, we have a fairly robust domestic demand. Private consumption share of GDP has risen to the highest levels since all the way going back to FY04. It is the highest in two decades,” he added.

Dharmakriti Joshi, chief economist, Crisil, says that consumption growth outpaced GDP, primarily driven by robust rural demand supported by a strong agricultural sector.

“A sharp catchup in investment growth in the last quarter also brought annual investment growth above GDP growth,” Joshi added.

Rajani Sinha, chief economist, CareEdge Ratings, says that private consumption remained healthy and rural demand is expected to be supported by favourable agricultural output and easing inflation, while the outlook for urban demand remains mixed.

“Anecdotal evidence points to subdued wage growth, contributing to muted urban consumption. The unevenness witnessed in the consumption recovery remains a critical monitorable going forward. The strength in rural demand is expected to continue on the back of favourable prospects for monsoon, healthy reservoir levels, and upbeat agricultural output. However, the softness in urban demand continues to be an area of concern,” she adds.

Data also showed that the gross fixed capital formation (GFCF), which is taken as a proxy for investment demand in the economy, rose to a six-quarter high of 9.4 per cent in Q4. As a share of nominal GDP, it rose to 31 per cent in Q4 from 27.4 per cent in Q3.

“The seasonal rush by both Union and state governments along with the private sector to meet their capex targets, it appears, provided succour to the investment demand in Q4. The pickup in investment demand is significant but needs to be watched out for a sustainable trend in view of the economic uncertainty, and the weak foreign investment demand,” says Paras Jasrai, associate director, India Ratings.

However, government spending, as represented by government final consumption expenditure (GFCE), contracted by -1.8 per cent to touch a three-quarter low in Q4 due to the base effect and fiscal consolidation. As a share of nominal GDP, it grew to 11.1 per cent in Q4 from 8.7 per cent in Q3.

Source: Business Standard

Centre Manages To Meet 4.8 Per Cent Fiscal Deficit For FY25

Centre Manages To Meet 4.8 Per Cent Fiscal Deficit For FY25