NEW DELHI: The Goods and Services Tax Council (GST) may meet in August to discuss the much-anticipated restructuring of tax rates and slabs, amid heightened expectation of the exercise leading to a consumption booster, with a reduction in aggregate tax incidence.

“Since there is not much time left before the monsoon session of Parliament, the next Council meeting may take place after the session,” an official said. This would also give some additional time to officials to work on the rate rationalisation, slabs rejig and any alternative arrangements to be made after the compensation cess, ceases to exist from March, the person added. However, another official said the Council meeting could take place during the Parliament session also.

The monsoon session will be held from July 21 to August 21.

The need for restructuring of GST has become more urgent in the wake of a plateauing of the GST receipts– for the last three years, the gross collections hovered around 6.7%, though it was much higher than the levels in the initial years of the tax launched eight years ago. Experts feel that generating further buoyancy will depend on how the tax’s structure is revamped, and simplified. Benign tax rates could lead to improved compliance, and a widening of the tax base, they contend. In June, the GST receipts grew 6.2% on year, the slowest rate in four years.

According to sources, an understanding has been reached among official circles rather than try to hike the rates and pursue a (higher) |revenue neutral rate,” the slabs recast should result in simplification and lower rates in general. In a recent interview with FE, finance minister Nirmala Sitharaman also gave credence to this idea, by stating that “the expectation is that it (weighted average GST rate) will come down.”

“We’re working to have it (lower rate). You can have the revenue buoyancy if the rates are low enough, and that leads to expansion (of base),” she said. Stating that the time has come for reaching a consensus in the (Centre-State) GST Council to design “a very simplified and easy-to-comply-with tax,” she iterated: “We will be doing it.”

However, the upcoming review is unlikely to result in inclusion of any of the major items that are currently outside the GST framework in its ambit, notably auto fuels and ready-to move-in real estate and electricity. When asked about expansion of GST base, Sitharaman asserted that GST/VAT a “well-laid-out system.” “Those (items) which were in the VAT regime were brought in here (under GST). So, we can simplify it and reduce it (tax) so that it becomes attractive,” she said.

FE had earlier reported that even after the compensation cess, which was meant for giving revenue guarantee to states, ceases to exist from March next year, a clutch of luxury and demerit goods might be subjected to other existing cesses.

The Confederation of Indian Industry has suggested a 3-tier GST system, with 5%, 28% slabs and another one between 12% and 18%. “If tax rates are reduced, there will be greater economic buoyancy. Some items which are not necessarily luxury items should not be categorised in the 28% (plus cess) slab,”CII president Rajiv Memani told FE, adding that the tax rates on refrigerators, cement and air conditioners etc. could be retained at 28% (sans cess) or brought down.

While the income tax relief announced in the Budget is estimated to result in tax giveaways to the tune of Rs 1 lakh crore, only a fraction of it is seen to push consumption. A part of the extra cash in hand may be be used by individuals to pare debt, and some funds are likely to be parked in banks, or find their way to the stock markets.

While as per the rules, the GST Council has to meet quarterly, a session has been delayed as the government was busy with the Union budget, and Operation Sindoor followed. The last meeting was in December 2024. Earlier, the officials had indicated that the meeting might take place before the monsoon session.

The Council, chaired by union finance minister, will examine the report of the group of ministers (GoM) report on rate rationalisation. The GoM headed by Bihar deputy chief minister Samrat Chaudhary submitted its report in December 2024.

It could consider reducing the health and life insurance tax rate to 5% with input tax credit (ITC) from 18%, among other rationalisations.

There are four major GST slabs – 5%, 12%, 18% and 28%. The central and state GST officers are currently deliberating on the GST slab rejig to reduce the number of slabs to two, possibly by abolishing the 12% slab.

Of the total gross GST revenues, the 18% slab contributes around 65%, followed by 28% slab (16%), 5% (10%) and 12% (18%). The balance 1% comes from other special rates on rates for gold, jewellery and precious stones.

Similarly, the discussions are going on whether to increase the 28% slab rate to 35% or 40% after the compensation cess comes to an end, by March 2026. Currently, the total tax plus compensation cess leads to a levy from 29% to around 50% for various demerit goods like tobacco products and luxury items.

Source: The Financial Express

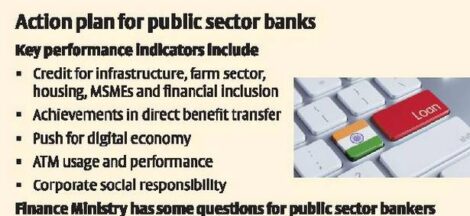

FinMin Directs Public Sector Banks To Evaluate Board Performance

FinMin Directs Public Sector Banks To Evaluate Board Performance