By K Raveendran

Reports from across the border suggest that Pakistan is already suffering a fuel crisis, with petrol pumps having been ordered closed for the time being. An analysis of the emerging energy scenario in the wake of the ongoing conflict suggests the beginning of a serious crisis for Pakistan, while India is relatively in a far better position to handle any situation.

The flare-up of tensions has also brought to the forefront the importance of emergency preparedness in the energy sector, as a prolonged conflict would severely impact the ability of both countries to meet their energy needs, according to analysts with the Rystad Energy.

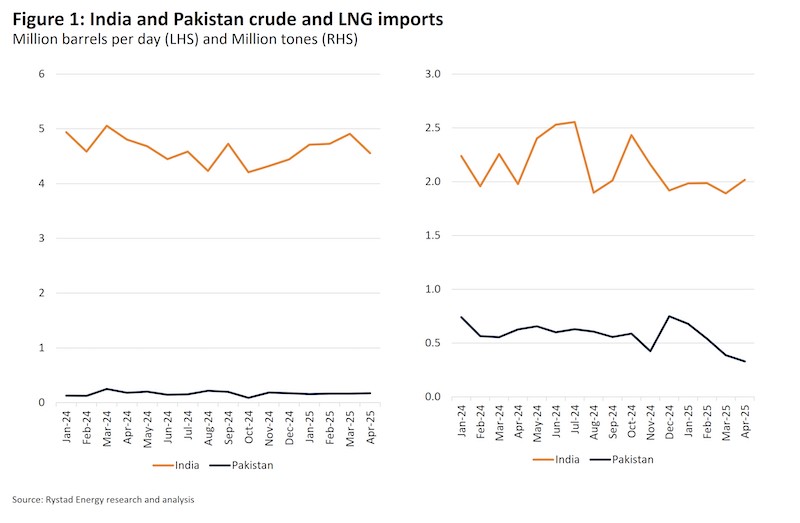

In terms of daily crude demand, India consumes 5.40 million barrels per day (bpd) compared to Pakistan’s 0.25 million bpd, according to estimates. However, the discrepancy goes beyond just demand—India’s strategic and commercial reserves can sustain supply for over a month, while Pakistan, which lacks any strategic reserves, has only 20 days’ worth in stock.

As tensions escalate, both countries are expected to increase crude procurement and refinery activity.

Diesel demand is likely to rise amid increased military mobilization, while airline fuel consumption declines as airspace closures lead to rerouted flights, cancellations and soaring airline ticket prices.

A comparison of their strategic petroleum reserves reveals a significant disparity – India has a strategic reserve capacity of 39 million barrels, with 21.4 million barrels currently available. In contrast, Pakistan lacks any strategic reserves, potentially leaving the nation vulnerable to disruptions in supply.

This gives India a reserve coverage of approximately seven days, based on its existing strategic reserves.

In addition, India’s commercial stockpiles of close to 160 million barrels can sustain the country for around 33 days, whereas Pakistan’s stockpiles will last for 20 days.

While India’s crude oil stockpile obligations are managed through a combination of government-owned strategic reserves and company-owned commercial reserves – with no fixed legal requirement – Pakistan has a clear regulatory requirement of a 20-day stockpile of refined products, mandated by its Oil and Gas Regulatory Authority (OGRA).

As the third-largest global crude importer, India’s reliance on imports is significant, with 85 percent of its demand being met through imports. Pakistan, too, relies heavily on imports, meeting around 78 percent of its demand.

Refineries on both sides are located away from the conflict region, removing the likeliness of an impact to the refinery operations. While the absence of refineries and LNG terminals in the affected regions may not impact crude and LNG imports, the disparity in emergency preparedness between India and Pakistan is a cause for concern.

The risk of direct attacks on commercial vessels is rare and prohibited under international law. Still, the risk of military confrontations or a misunderstanding, especially in areas close to naval operations, increases during times of heightened tension. Tankers passing through the region could be subject to scrutiny or diversion if the situation escalates.

India’s key refining hubs in western Gujarat handle over 50 percent of the country’s daily crude imports, with the Sikka, Vadinar and Mundra ports supplying six refineries. In the next five days, five Middle Eastern crude cargos are set to arrive – two already in Indian waters, with the other three carrying over 5 million barrels of Arab Light and Basrah Heavy are en route.

According to analysts, the suspension of the Indus Water Treaty poses a serious energy security risk for Pakistan, with up to 9.3 GW of hydropower capacity — or 90% of its total — at risk due to disrupted water flows from India.

Analysts feel that the termination of the treaty would give India full control of the Indus, Jhelum and Chenab rivers, enabling it to build more hydropower projects and potentially operate existing upstream facilities in ways that could adversely affect its downstream neighbour.

While India is less reliant on hydropower, further escalation could still put its energy infrastructure at risk. India has 2.7 gigawatts (GW) of hydropower projects dependent on the rivers included in the IWT out of a total of 52 GW of installed hydropower capacity countrywide.

The largest project at risk is the 900-megawatt (MW) Bagilhar Dam with inflow from the Chenab. Disruption to these projects will have a relatively small impact as hydropower only contributed 8% to total power generation in 2024.

On the other hand, any further escalation in tensions between India and Pakistan could put energy infrastructure, including nuclear power plants in both countries, at greater risk of becoming military targets. Rystad Energy analysis indicates disruption to the IWT could put up to 9.3 GW of hydropower capacity – equivalent to 90% of Pakistan’s total installed hydropower capacity – at risk. The largest hydropower project at risk is the 4.9-GW Tarbela Dam with inflow from the Indus. (IPA Service)

CEACEFIRE DECLARED

CEACEFIRE DECLARED