MUMBAI: Starting the new year on a positive note, Bank of Baroda, Bank of India, Yes Bank, and IDFC First Bank reported strong growth in advances and deposits in Q3. The growth in the December quarter was driven by festival-led demand, provisional business updates released by the banks on Friday showed.

Bank of Baroda’s domestic advances rose 11.76% year-on-year to Rs 9.63 lakh crore in the third quarter against Rs 8.62 lakh crore in the December 2023 quarter, the lender said in a stock exchange filing.

Domestic deposits climbed 9.23% to Rs 11.65 lakh crore in the third quarter against Rs 10.67 lakh crore in the December 2023 quarter. The bank’s global advances rose 11.65% to Rs 11.72 lakh crore in the third quarter from Rs 10.49 lakh crore in the same quarter of the previous year. Global deposits jumped 11.82% to Rs 13.92 lakh crore as on December 31, against Rs 12.45 lakh crore in the third quarter of the previous fiscal.

Bank of India’s total domestic deposits grew 13% to Rs 6.79 lakh crore in the third quarter of the current financial year from Rs 6 lakh crore in the year-ago period. Its domestic advances increased 15% to Rs 5.46 lakh crore in the third quarter from Rs 4.75 lakh crore in the same quarter in the previous financial year. Global business grew 14% to Rs 14.5 lakh crore. Total global deposits of the bank rose 12% to Rs 7.95 lakh crore.

Yes Bank’s loans and advances in the third quarter grew 12.6% year-on-year to Rs 2.45 lakh crore. Its loan book was Rs 2.17 lakh crore at the end of December 2023, while on a sequential basis, the loan book grew 4.2% from Rs 2.35 lakh crore. Deposits in the third quarter grew 14.6% to Rs 2.77 lakh crore from Rs 2.41 lakh crore in the same quarter of the previous year.

Private lender IDFC First Bank’s loans and advances increased by 21.9% to Rs 2.22 lakh crore at the end of third quarter from Rs 1.89 lakh crore at the end of third quarter of the previous financial year. Deposits grew 28.8% to Rs 2.27 lakh crore as of December 31, 2024, against Rs 1.76 lakh crore as of December 31, 2023.

The bank’s current account savings account (CASA) deposits increased 32.3% to Rs 1.13 lakh crore as of December 31, 2024, from Rs 85,492 crore as on December 31, 2023. Its CASA ratio improved to 47.8% as of December 31, as compared to 46.8% as of December 31, 2023. Its credit-deposit (CD) ratio slipped to 95.7% as of December 31, 2024, compared to 101.4% as of December 31, 2023.

Source: The Financial Express

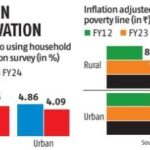

Rural Poverty Ratio Fell Below 5% In Fy24 For The First Time: SBI Research

Rural Poverty Ratio Fell Below 5% In Fy24 For The First Time: SBI Research