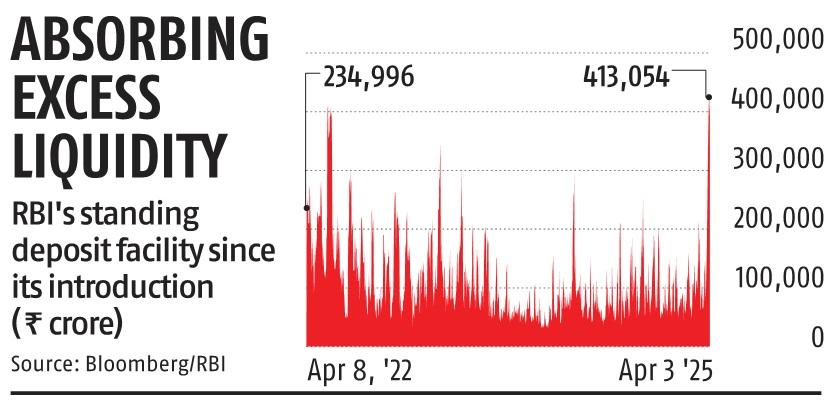

MUMBAI: As the banking system liquidity moves into surplus and with limited credit offtake at the start of the financial year 2025-26 (FY26), commercial banks on Thursday parked ₹4.13 trillion with the Reserve Bank of India (RBI) under the Standing Deposit Facility (SDF). This marked the highest amount banks have parked in the SDF since its introduction in April 2022.

SDF allows banks to deposit surplus funds with the central bank without the need for collateral at a rate of 25 basis points (bps) lower than the repo rate, which is 6.25 per cent now. SDF, which is an overnight facility, is available between 5.30 pm and 11.59 pm on all days, including Sundays and holidays, and the funds are reversed on the following working day.

With continuous infusion of funds in the banking system by the central bank, overnight rates such as weighted average call rate (WACR) and tri-party repo rate (TREPS) have fallen below 6 per cent, prompting banks to park funds under the SDF facility at 6 per cent, said dealers.

“Frictional liquidity has improved and banks have been borrowing through variable rate repo auctions and via issuances of certificates of deposit (CDs). Plus, weighted average TREPS and call rate have gone below 6 per cent. Therefore, it is profitable for any bank to park under SDF and make some gains, hence the surge in SDF holdings,” said VRC Reddy, deputy general manager-treasury at Karur Vysya Bank.

The banking system’s liquidity shifted to surplus in April after more than four months, driven by government spending and the central bank’s ongoing efforts to inject liquidity through dollar-rupee buy/sell swap auctions, open market operations (OMOs), and variable rate repo auctions, said experts. According to the latest RBI data, the surplus liquidity in the system, measured by banks parking funds at the liquidity adjustment facility, was ₹2.16 trillion.

A section of the market also pointed out that banks have accumulated temporary surplus due to increase in government cash balances and surge in CDs. This has led banks to park aggressively under the SDF facility. “Instead of lending these excess funds in the interbank market, many prefer the risk-free SDF window. Further, some banks avoid counterparty exposure and choose SDF over market lending,” said a call trader with a state-owned bank.

Further, foreign banks, especially at quarter-end, often place large rupee deposits under the SDF window due to currency management and regulatory requirements, leading to a surge in SDF parking, said experts.

Market participants believe that the present surplus in the liquidity is temporary and it may turn negative once the government spending gets over. Banks with large government deposits and excess funds prefer SDF when they believe the liquidity may turn into deficit, experts added.

“Despite an apparent liquidity surplus, the persistently high SDF balances point to a structural mismatch rather than actual excess liquidity. This suggests inefficiencies in liquidity distribution and risk aversion in market lending,” said Venkatakrishnan Srinivasan, founder, Rockfort Fincap.

Source: Business Standard

India’s Services PMI Declines Marginally To 58.5 In March

India’s Services PMI Declines Marginally To 58.5 In March