NEW DELHI: The government is likely to revisit a plan to merge the four state-run general insurance companies to create a a behemoth that can compete with the Indian private-sector firms as well as foreign insurers.

The move may coincide with or closely follow the proposed hike in foreign direct investment (FDI) limit for the insurance sector from 74% now to 100%, which may materialse in the upcoming session of Parliament, sources told FE.

Of the four general insurers, New India Assurance Company (NIA) is listed, while Oriental Insurance Company (OIC), National Insurance Company (NIC) and United India Insurance Company (UIIC) are not.

“The discussions on the merger of the public-sector general insurance companies (PSGICs) are gaining pace,” an official said.

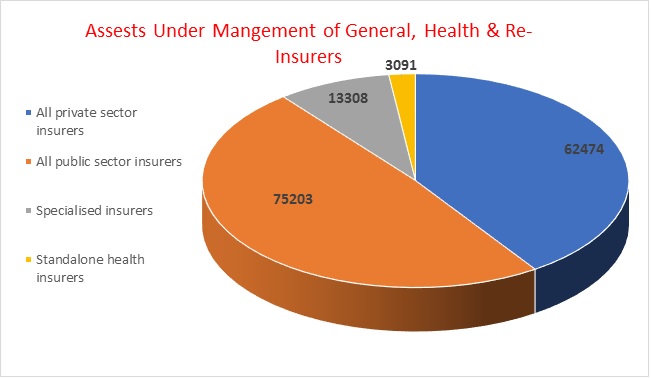

The Centre is keen to create a general insurance major on the lines of Life Insurance Corporation (LIC) in the life insurance space. The market share of state-run non-life insurers declined to 34.6% in FY25 from 39% in FY23, reflecting the growth differential between the public and private sector firms.

LIC, with a market share of 57% in premium receipts, is the largest life insurer in India. A merger of state-run general insurers would at once get the amalgamated entity the highest market share in the non-life space.

NIAC, the largest among state-run non-life insurers, has been making profits regularly. The other three have historically made losses, but have lately begun to make profits.

While OIC and NIC started posting quarterly profits from Q4 of FY24 and Q2 of FY25, respectively, UIIC posted a profit in Q3 of FY25 after a gap of 7 years.

Besides facing rising competition from the private sector, a bigger state-run general insurer would also help the government’s mission of “insurance for all” by 2047, the 100th year of independence, sources said.

To facilitate entry of new players from overseas to cater to the demand for insurance and increase penetration, the Centre may increase the FDI limit to 100% from 74% in insurance via a legislative proposal to be taken by Parliament for consideration and passing in the upcoming monsoon session.

The Centre has been nudging these PSGICs to create strong and competitive companies by introducing reforms, including regular key performance indicators-based monitoring.

The Centre had infused a total capital of Rs 17,450 crore in these PSGICs during 2019-20 to 2021-22 with the aim of allowing these companies to undertake structural reforms, enhance operational efficiencies, and return to profitability.

With improved risk-management practices, loss control initiatives, adoption of technology, development of new products, better customer services and diversification of portfolio, the PSGICs have posted a turnaround from combined losses of over Rs 10,000 crore in 2022-23, to all individual PSGICs becoming profitable by Q3 of the current financial year and posting a combined profit of Rs 1066 crore in Q3 of 2024-25.

PSGICs have been focusing on offering high-quality insurance products and services, ensuring long-term sustainability and enhancing customer experience, while achieving growth.

Insurance penetration in India is just 3.7%, whereas the global average for insurance penetration was at 7% in 2024.

Source: The Financial Express

New Rules Make It Tougher For E-Tailers To Resort To Predatory Pricing

New Rules Make It Tougher For E-Tailers To Resort To Predatory Pricing