By Dr. Gyan Pathak

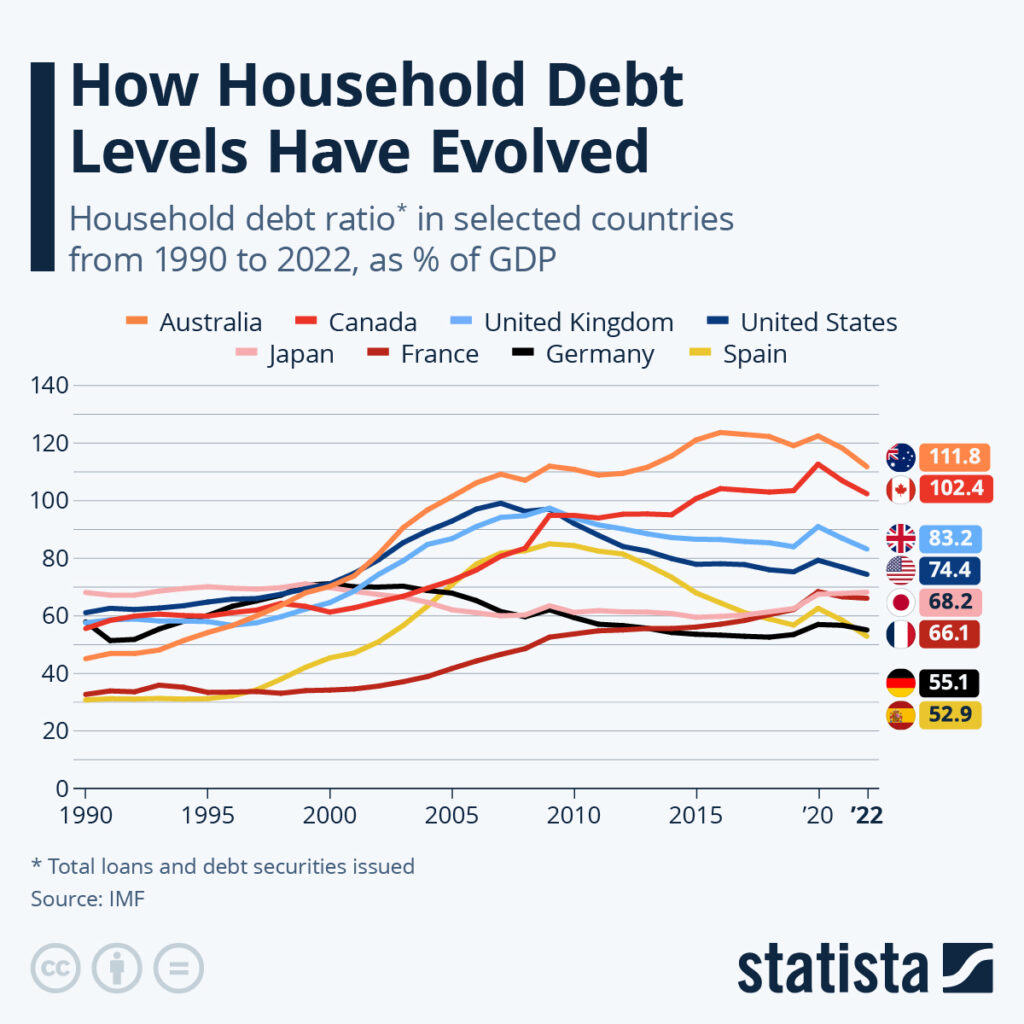

Household indebtedness in India and the suicides relating to it have been rising sharply since 2014, since the Modi government’s economic policy does not come to rescue the household borrowers, though it rescues businesses and corporates through write offs and relief under bankruptcy code. The data is alarming – household debt has increased from 32.6 per cent in June 2014 to 42.9 per cent as of June 2024, and estimated to have reached 43.5 per cent in the first half of 2024-25. Bankruptcy and indebtedness related suicides increased from 1.8 per cent in 2014 to 4.1 per cent this year.

During the last decade since 2014-15, the Centre has written off Rs16.35 lakh crore of loans to big businesses and corporates. Additionally, India has implemented the Insolvency and Bankruptcy Code (IBC) in 2016 to help the businesses and corporates out of the crisis by providing relief including dignified exit and fresh start. However, households and individuals have been denied such rights and help from the government. There is no exit for household, and many of them have committed suicide under the loan burdens.

The leaders from the ruling establishment led by BJP under PM Narendra Modi have been boasting that India has been developing fast, and has become 5th largest economy of the word, and by 2027 would the third largest economy. The benefit of the development clearly goes chiefly to the big business and corporates, not to the common households.

Suicides because of bankruptcy or indebtedness which was 4.1 per cent in 2022 as per the latest NCRB report would seem more alarming if we take into consideration that 0.8 per cent of suicides are triggered by poverty, 1.2 per cent caused by professional and career problems and 1.9 per cent due to unemployment.

A recent survey has found that over 68 per cent of Indian borrowers are under debt trouble. Media has been reporting many cases how people are committing suicides because they are not able to payback their loans, and they were no longer able to bear the pressures from lenders.

Even the Reserve Bank of India in their December 2024 Financial Stability Report had warned about the distress from the consumer credit segment spilling over to secured loans. RBI analysis showed that nearly half of the borrowers were availing credit card and personal loans had another live mortgage or vehicle loans.

The report noted, “Given that a default in any loan category results in other loans of the same borrower being treated as non-performing by the lending financial institution, these larger and secured loans are at risk of delinquency from slippages in relatively smaller personal loans.”

RBI data shows that 11 per cent borrowers originating a personal loan under Rs50,000 had an overdue personal loan and over 60 per cent had availed over three loans during the current financial year 2024-25.

Number of loans overdue between 91 and 180 days has surged to 3.3 per cent in 2024. Household liabilities were 17-year high at 6.4 per cent of GDP in 2023-24, just below the 6.6 per cent in 2016-17.

Household debt has reached 43.5 per cent of GDP in the first half of 2024-25, out of which housing loans are 30 per cent and non-housing loans 32.3 per cent.

A recent Bloomberg survey has said that 68 per cent of borrowers are distressed, and 27 per cent borrowers taking out new loans to service old ones, and some families driven to more extreme coping strategies, such as pulling children out of schools.

Household’s disposable income between 2021 and 2024 grew by 43 per cent, consumption by 49 per cent, and personal loan by 75 per cent. During this period retail credit extended by non-banking finance companies and housing finance companies grew by 70 per cent. One can easily perceive the distress.

As per RBI data, between March 26, 2021 and March 22, 2024, the unsecured personal loan book of banks (personal loans, credit cards and consumer durables) rose by 82 per cent, while that of NBFCs grew by roughly 130 per cent. Such loans tend to dominate the borrowings of the less well-off, that is those people whose annual income is Rs5 lakh or less.

RBI says that 11 per cent of borrowers with a personal loan of less than Rs 50,000 had an overdue personal loan. In the second quarter of 2024-25, nearly three-fifths of customers who have availed of a personal loan had more than three live loans. In the case of microfinance, the share of borrowers availing loans from four or more lenders was at almost 6 per cent in September 2024.

Households and individuals have been in distress due to many reasons, the chief among which are their falling real income and increasing cost of living.

The incidence of indebtedness in 2014, as per the NSS data, was about 31.4 per cent among rural households and 22.4 per cent among urban households. In 2019, the NSS Survey found 35 per cent rural and 22 per cent urban population in debt. The latest increase in household debt from 31.1 per cent in September 2016 to 43.5 per cent of GDP in first half of 2024-25, is indicative of the fact that incidence of household indebtedness has worsened sharply, which needs urgent attention. Modi’s economic growth model has clearly been pushing common people into unbearable distress of indebtedness while big business and corporates are minting money. (IPA Service)

Trump’s Trade War Has Turned Global With No Indication Of Coming To A Halt

Trump’s Trade War Has Turned Global With No Indication Of Coming To A Halt