NEW DELHI: US President Donald Trump’s decision to impose universal reciprocal tariffs on imports has given India’s textile industry—especially apparel exporters—an edge over competitors like Vietnam, Bangladesh, and China, which face even higher tariffs.

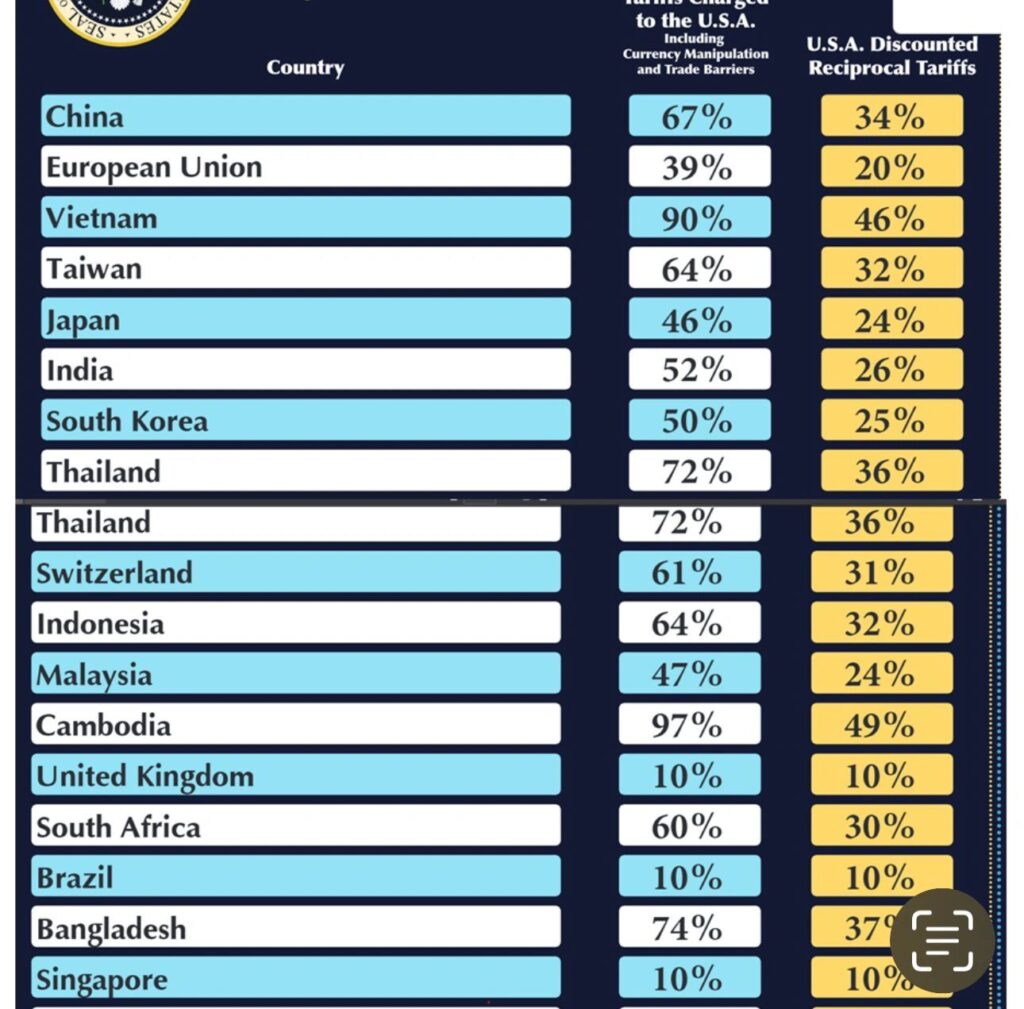

The Trump administration on Thursday announced a flat 27% tariff on Indian goods with some exemptions. In comparison, India’s main competitors—Vietnam (46% tariff), Bangladesh (37% tariff) and Sri Lanka (44% tariff)—face significantly higher tariffs under the new structure. To be sure, Indian apparel exports to the US currently face a tariff of 12-14%, with the new 27% tariff applied on top of that. So far, apparel from Bangladesh and Vietnam has also carried a 12-14% tariff.

“There was no differentiation in tariff rates earlier. With these new tariffs, India now holds a clear advantage over Vietnam and Bangladesh,” said Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation (ITF), a Coimbatore-based association.

China, the largest textile exporter to the US, will see its tariffs rise by 34% over existing duties. When combined with the 20% tariff imposed by the Trump administration earlier this year, China’s effective tariff rate will reach 54%.

Dhamodharan added that the bigger question now is who will capture China’s market share. With Chinese textile exporters facing a steep 54% tariff on exports to the US, they are at a significant disadvantage.

The US imported $107.72 billion worth of textiles in 2024, up 3% year-on-year, with apparel accounting for $80 billion. Of this, China holds the largest share at 21%, followed by Vietnam (19%), Bangladesh (9%), India (6%), and Sri Lanka (3%).

However, industry experts believe India’s prospects will also depend on how other countries respond to the latest US tariffs. “Apparel exports drive Bangladesh’s economy, so they may negotiate or reduce tariffs to stay competitive,” said an industry expert.

“The 27% tariff on Indian footwear and garment exports to the US is a significant challenge, especially for businesses operating on thin margins,” said Apollo Fashion International President Shiraz Askari. He added that the industry should focus on improving efficiency, strengthening compliance, and diversifying markets to reduce dependence on any one geography.

ITF’s Dhamodharan noted that buyers are likely to take a wait-and-watch approach, which could impact demand in the near term. However, he added that India remains better placed in the medium to long term.

K. Venkatachalam, chief advisor of the Tamil Nadu Spinning Mills Association, said India should respond by reducing the import duty on cotton from 11% to 0%, leveraging the latest tariff announcement and ongoing bilateral trade talks with the US. He pointed out that India relies on the US for contamination-free cotton and variants like extra-long staple (34MM+) cotton.

These 4 sectors are worst hit by Trump tariff: Brace for big dent in exports, say experts

China has already imposed retaliatory duties on US cotton. Compared to China, India now holds an advantage. While India currently imposes an 11% duty on cotton, it charges only 5.5% on imports from some African nations due to bilateral trade agreements. “We can extend the same benefit to the US and, in return, seek preferential treatment for Indian apparel,” Dhamodharan said.

India’s Apparel Export Promotion Council has approached the textiles ministry, advocating for a ‘zero-for-zero’ duty policy on textiles and apparel. It argues that the government should reduce duties on textile products to zero, prompting the US to apply the same tariff rate on Indian exports.

Source: The Financial Express

Experts See Tough Negotiations With US On Non-Tariff Barriers

Experts See Tough Negotiations With US On Non-Tariff Barriers