NEW DELHI: Private sector output in India increased at a slower pace in March as compared to the previous month, amid a quicker expansion in manufacturing activity and a softer increase in services activity, according to the HSBC flash Purchasing Managers’ Index (PMI) survey released on Monday.

“Manufacturing was March’s brighter spot, posting quicker increases in sales and output that were faster than those registered in the service economy,” the survey noted.

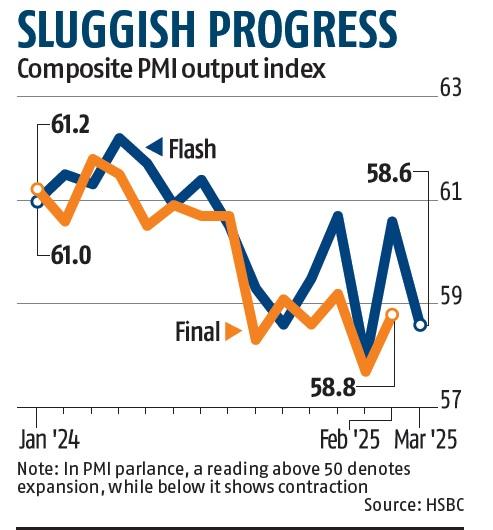

The index compiled by S&P Global fell to 58.6 in March from February’s final reading of 58.8. The index, which measures monthly change in the combined output of India’s manufacturing and service sectors, has been above the neutral 50-mark that separates growth from contraction for the 44th consecutive month.

“India’s private sector economy ended the FY25 on strong footing, sustaining robust expansions in new business intakes and output. Rates of growth softened from February, though remained well above their respective long-run averages,” the survey said.

In the manufacturing sector, the flash PMI, which is a composite measure of new orders, output, employment, supplier delivery times, and inventory levels, noted improvement in operating conditions that was broadly aligned with the average for FY25.

“When explaining the increase in output, private sector companies mostly remarked on positive demand trends. Indeed, new orders rose further, thereby stretching the current sequence of expansion to over three-and-a-half years,” it said.

“Goods producers indicated a quicker increase than in February, and one that was above the growth rate recorded for service providers. Among the latter, the pace of expansion was the second-slowest since November 2023 as firms noted an intensification of competitive pressure,” the survey noted.

Pranjul Bhandari, chief India economist at HSBC, said that India’s manufacturing sector expanded at a faster pace in March, according to the flash PMI as the output index rose to its highest level since July 2024.

“Yet the margin squeeze on manufacturers intensified as input price inflation ticked up while factory gate prices rose at the weakest rate in a year. The moderation in new export orders growth was also noteworthy amid tariff announcements,” she added.

On the employment front, the survey noted that despite slowing to a six-month low, the aggregate pace of job creation was solid by historical standards.

“For the first time in seven months, manufacturers signalled a faster increase in headcounts than service providers,” the survey said.

The survey also noted that private sector businesses in India reported a further increase in their operating expenses, amid greater outlays on copper, electronics, food (especially fruits and vegetables), leather, medical equipment, rubber and vehicle spare parts. The cost pressures were stronger in the service economy, despite a slowdown here and an acceleration at goods producers.

“The aggregate rate of inflation nevertheless remained below its long-run average.

Although some firms sought to share additional cost burdens with their clients by lifting selling charges, competitive conditions limited the extent to which these were passed on,” the survey noted.

Flash PMI records 75 to 85 per cent of the total 800 responses from services and manufacturing firms each month. The final manufacturing PMI figure for March will be released on April 2, whereas the services and composite PMI figures will be released on April 4.

Source: Business Standard

IMF Asks Indian Banks To Adopt Global Norms For Credit Risk Management

IMF Asks Indian Banks To Adopt Global Norms For Credit Risk Management