MUMBAI: The Reserve Bank of India (RBI) on Monday announced a three-pronged measure to address tight liquidity conditions in the banking system, just 10 days before the six-member Monetary Policy Committee’s decision on the repo rate.

These steps, according to bankers, are expected to inject about Rs 1.5 trillion into the system, reducing the likelihood of further cash reserve ratio (CRR) cuts. Following the policy review in December, the RBI had already lowered the CRR by 50 basis points, infusing Rs 1.16 trillion.

Experts believe these steps towards boosting liquidity raise the likelihood of an interest rate cut in the February 5-7 monetary policy review.

The central bank announced open market operations (OMO) to purchase government securities worth Rs 60,000 crore in three tranches of Rs 20,000 crore each on January 30, February 13, and February 20.

“By announcing an OMO calendar, we think the RBI has clearly indicated its preference for tools other than the CRR to inject durable liquidity,” stated economists at Standard Chartered Bank in a note.

Additionally, the RBI will hold a 56-day variable rate repo (VRR) auction for Rs 50,000 crore on February 7 to ensure liquidity coverage until this financial year’s end. The date of the reversal of these funds will be close to the April monetary policy review.

The central bank also announced a $5 billion dollar-rupee buy-sell swap auction with a six-month tenor, scheduled for January 31. This is expected to inject about Rs 50,000 crore in the banking system. While foreign exchange participants anticipate pressure on forward premiums, they predict no significant impact on spot rates.

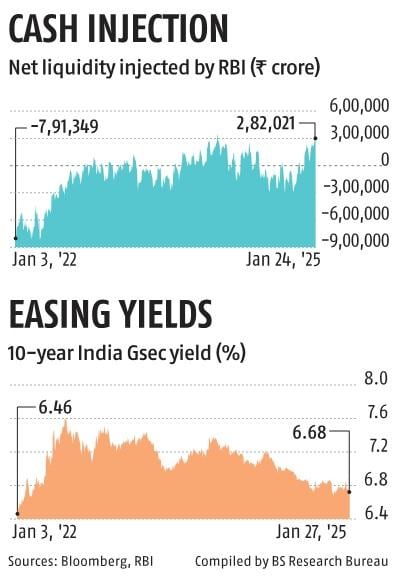

Data shows the banking system’s liquidity deficit, measured via the RBI’s liquidity adjustment facility, stood at Rs 3.13 trillion on Sunday, with the deficit consistently exceeding Rs 3 trillion over the past four days, barring Friday.

The RBI has front-loaded the liquidity infusion ahead of a possible rate cut to help monetary transmission, said experts. “Now, the chances of a rate cut in February are much higher,” said Gaura Sen Gupta, chief economist at IDFC FIRST Bank.

Standard Chartered Bank, which had anticipated a rate cut in April, has now revised its forecast to February. “We move forward our view of a 25 basis point repo rate cut in each of April and June to February and April policy meeting,” the Standard Chartered note said.

At the first OMO auction to be conducted on Thursday, the RBI plans to purchase 7.59 per cent GS 2029 bond maturing on March 20, 7.18 per cent GS 2033 bond maturing on August 14, 7.10 per cent GS 2034 bond maturing on April 8, 6.79 per cent GS 2034 bond maturing on October 7, and 7.18 per cent GS 2037 bond maturing on July 24.

Bond market participants now expect the benchmark 10-year bond yield to open at 6.60 per cent on Tuesday, compared to Monday’s close of 6.68 per cent.

“Bond markets will rejoice. Yields (benchmark bond yield) are likely to range between 6.60 per cent and 6.62 per cent over the next few days,” said Vijay Sharma, senior executive VP at PNB Gilts. He added: “The chances of rate cut in the policy are increasing because the first prerequisite for any rate cut is ample liquidity in the system. Actually, there should be no liquidity deficit.”

On Monday, government bond yields dropped after the RBI reported buying Rs 10,175 crore worth of government bonds through OMOs in the week ended January 17. The benchmark 10-year yield briefly fell to a nearly three-year low of 6.65 per cent (the lowest since February 15, 2022) before closing at 6.68 per cent due to profit-booking.

The newly announced 56-day VRR is viewed as equivalent to a 25 basis point rate cut. Previously, the market has been expecting a 50 basis point CRR cut in the February policy review.

With liquidity conditions tightening, these measures serve as an alternative to a CRR cut, said Madan Sabnavis, chief economist at Bank of Baroda. “The 56-day VRR is equivalent to a 25 basis points CRR cut,” he added.

“The money market rates, including those for instruments like CDs (certificates of deposit) and CPs (commercial papers), had been trading at elevated levels, reflecting tight liquidity in the market. The latest measures announced will help bring down short-term money market rates,” said the treasury head at a state-owned bank.

Source: Business Standard

Nine Ailing Central Public Sector Enterprises Headed For Closure

Nine Ailing Central Public Sector Enterprises Headed For Closure