MUMBAI: With the high inflation still straining urban wallets, fast-moving consumer goods (FMCG) companies see faster sales volume growth continuing in the rural areas versus the urban regions in the December quarter.

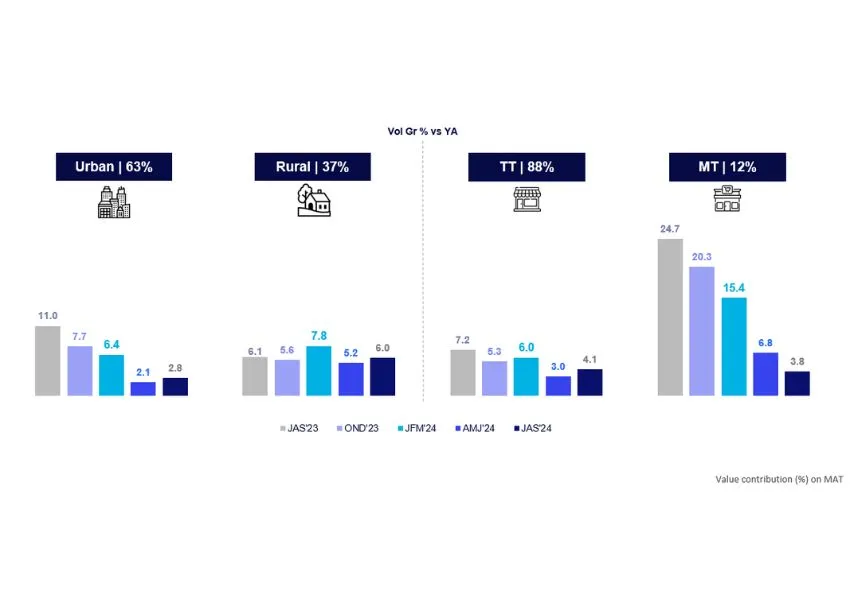

Q3FY25 will be the fourth straight quarter of rural volume growth outpacing urban volume growth, NielsenIQ data sourced from the industry suggest, with the trend expected to persist in the next two quarters at least, industry executives said.

Data suggest that the overall FMCG value growth during the October-November 2024 period is around 5%, volume growth is around 3%, and price growth is around 2%. December 2024 numbers are not out yet. Value growth is volume and price growth combined.

Executives citing NielsenIQ data say that urban volume growth for October-November is about 2%, while rural volume growth is about 5%, as sentiment continues to remain strong in the hinterland.

“During Q3, rural consumption for FMCG was resilient and continued to grow faster than urban. While general trade was still under pressure, modern trade, e-commerce and quick commerce continued to post strong growth,” Dabur India said in its recent Q3 update.

Marico, Godrej Consumer (GCPL) and Adani Wilmar in their quarterly updates for the October-December 2024 period noted that rural demand trends were better than urban, driven by a better monsoon and harvests. Companies are also expanding distribution in rural areas to take advantage of the momentum in the hinterland.

FMCG companies derive a third of their overall sales from rural areas. Two-third, though, continues to come from urban areas.

“Rural markets continued to drive faster growth for our foods business, fuelled by expanded coverage of rural towns and trial generation through combo offers. We also introduced smaller pack sizes for edible oils under the ‘King’s’ brand and adjusted pack sizes dynamically to keep the consumer price point within a narrow range, notably, in rural areas,” Adani Wilmar said.

Market researcher Kantar said in its recent FMCG market update that food inflation remained unrelenting, which was expected to push pressure on urban volume growth over the coming months.

“We might see value growth rapidly drawing away from volume growth for some more time. As a result, it is hard to see urban growing rapidly than the current levels,” Kantar said.

In its update for the October-December 2024 period, Marico said the rising trend in input costs was expected to result in a higher-than-anticipated gross margin contraction on a year-on-year basis.

“We also sustained investments in brand building in line with our strategic intent to continually strengthen the long-term equity of our franchises and accelerate diversification. Consequently, we expect modest operating profit growth on a year-on-year basis,” the firm said.

GCPL said that it has taken price increases, reduced grammage of key packs, and reduced trade schemes to offset inflationary pressures in commodities such as palm oil.

“Such pricing actions typically have minimal impact on category consumption but do result in reduced inventory across wholesale and household pantry. Historical patterns indicate a normalisation in volume growth following price stabilization, which we anticipate occurring in the next few months,” GCPL said.

Source: The Financial Express

India’s Inflation Likely To Stabilise Around 4.3-4.7 Per Cent In FY26: Report

India’s Inflation Likely To Stabilise Around 4.3-4.7 Per Cent In FY26: Report