NEW DELHI: India’s import bill for natural gas surged by 7% to $4.6 billion during the first four months of the current fiscal year, compared with $4.3 billion in the same period a year ago, due to a rise in consumption particularly by the city gas distribution (CGD) companies and the power sector, data from the Petroleum Planning and Analysis Cell showed.

The import bill for the month of July stood at $1.1 billion registering an increase of 22% from the same period in last fiscal. The country imported 11,423 million standard cubic meters of LNG (liquified natural gas) during April to July, up by 13% from the corresponding period of FY24, the data showed. The growth was also supported by stabilised prices of natural gas from the earlier highs recorded in FY23, enabling consumers to buy more imported gas, as per analysts.

During the period, the country’s consumption of natural gas increased by almost 9% to 23,364 mmscm with major demand coming in from the CGD, fertilizer, and the power sector.

The power sector consumed 4,031 mmscm of natural gas in the first four months of FY25, up significantly by 31% from 3,071 mmscm in Apr-Jul of FY24 after the government mandated gas based thermal plants to run to their full capacity in order to meet the rising power demand.

Natural gas producing companies use some quantity of gas for their own use as internal consumption while some quantity of gas is flared as a part of technical requirement. After flare, loss and internal consumption by gas producing companies, the net production for sale of gas to consuming sectors like power, fertilizer, CGD, refinery, petrochemicals among others was approximately 83.2% of the gross production during July 2024, PPAC said.

In 2022, the sudden outbreak of war between Russia and Ukraine had led to a sharp increase in prices of natural gas in FY23 as a result of which gas lost its cost competitiveness to the alternate fuels. Accordingly, natural gas consumption declined in FY23. However, with range-bound prices, analysts expect the consumption to grow in the medium term.

“With imported LNG prices expected to remain range-bound (at $10-$12/mmbtu), growth in domestic natural gas production and sizable demand from key user industries, natural gas consumption is slated to grow significantly in the medium term,” CareEdge Ratings had earlier said in a report.

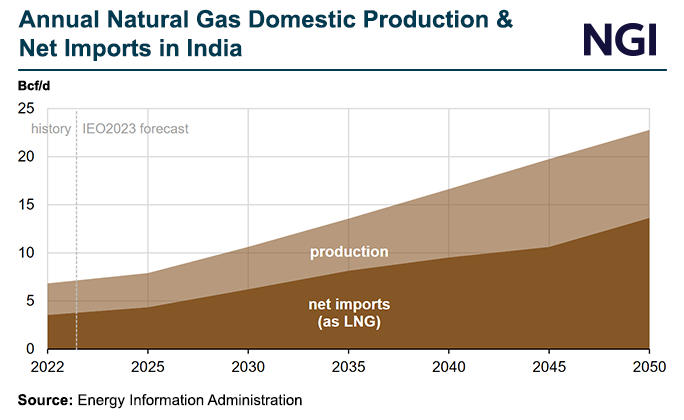

As the imports continue to grow, the country’s production of natural gas also registered a marginal increase of 4% in the Apr-Jul period. However, the production growth has remained below the set targets. State-owned major oil and gas production company Oil and Natural Gas Corp produced 6,271 mmscm of natural gas during the period, 4% lower than the same period of last fiscal and much lower than the target of 6,548 mmscm for the period, according to PPAC data.

Oil India however registered an increase of 6% in its gas production during Apr-Jul from last year at 1,052 mmscm but failed to reach the target of 1,272 mmscm gas production.

As a result, the country’s dependence on imported gas increased to 48.9% in the period from 46.9% in Apr-Jul of FY24. In the month of July alone, the import dependency surged to 47.2% against 43.5% in July 2023. CareEdge Ratings expects the country’s gas import dependency to remain at around 45% by FY26.

Even though domestic natural gas production has failed to meet the targets, the production levels have registered an increase. Domestic natural gas production was on a declining trend till FY21 on the back of depleting production from existing fields and with no major discoveries coming on-stream.

However, due to new gas discoveries in a few off-shore fields coming onstream, domestic natural gas production started improving from FY22, CareEdge had said. The agency expects domestic gas production to improve in the medium term on the back of production ramp-up from discoveries of the recent past along with sizable new production expected to come onstream in FY25.

Going forward, analysts also see gas imports to increase at a moderate pace in spite of expected growth in domestic production as the consumption of natural gas is expected to outpace domestic production.

“Still, imports as a percentage of total consumption are expected to remain largely range-bound during the next two years, up to FY26,” according to the agency earlier said. “Had there been no growth in domestic gas production, probably dependence on imports would have been much higher.”

Source: The Financial Express

India, Singapore Pledge To Cement Ties In ’Emerging Areas’

India, Singapore Pledge To Cement Ties In ’Emerging Areas’