Business

India Inc Wakes Up To Stern Default Rule

MUMBAI: A top-rated, solvent corporate can be caught in a nasty surprise of a downgrade to ‘D’ or ‘Default’ category, even if for a few hours, if a demanding rule laid down by the capital market regulator is not followed to the T. The rule is simple: if a...

Microsoft To Invest $3 Billion In AI, Cloud Expansion In India

BENGALURU: Microsoft will invest $3 billion (about Rs 25,700 crore) to expand its cloud computing and artificial intelligence capabilities in India, its chief executive officer Satya Nadella said on Tuesday. The tech giant will also train 10 million people in AI skills in India by 2030, Nadella said, addressing...

Banks’ Profitability Likely To Moderate In FY26, Says India Ratings

MUMBAI: Indian banks’ profitability is expected to moderate in FY26 after reaching an inflexion point in FY25, due to delinquencies from over-leveraging of unsecured assets and an increase in unsecured credit costs, analysts at India Ratings said on Tuesday. “Ind-Ra estimates that the rapid improvement in financial metrics seen...

Govt Considers New Safety Devices For Heavy Commercial Vehicles To Check Accidents

NEW DELHI: To put a check on rising road accidents, the government is considering installation of three new safety devices on heavy commercial vehicles that will stop drivers from dozing off at the wheel and have provisions for emergency braking and vehicle stability, road transport and highways minister Nitin...

Consent Manager Framework A Key Big Tech Concern

NEW DELHI: Major technology firms, including Google, Amazon, Meta and Apple, plan to engage with the ministry of electronics and IT (MeitY) over concerns regarding the consent manager framework and a proposed government-appointed committee overseeing cross-border data transfers. These discussions will be a part of the public consultations on...

Banks, NBFCs See Hit To Cross-Selling

MUMBAI: Weighed down by the draft rules under the Digital Personal Data Protection (DPDP) Act, released on Friday, financial sector entities are hoping the final norms will provide them some relief from a potential hit to their cross-selling capabilities. According to the draft rules, banks and NBFCs will no...

Services PMI Hits 4-Month High Of 59.3 In December On Demand Buoyancy

NEW DELHI: India’s services sector remained strong in the month of December with HSBC India Services Business Activity Index, or services PMI for the month at 59.3, highlighting the strongest rate of expansion in four months. The services sector ended the year 2024 on a strong footing, on demand...

Big 4 In India Outshine MNC Parents; Combined Revenue Seen At Over Rs 45,000 Crore In FY25

MUMBAI: The Indian arms of the Big Four — Deloitte, PwC, EY and KPMG — outpaced their global parents in FY24 revenue growth numbers, fuelled by strong demand for consulting and tech consulting services, with their combined revenue expected to surpass Rs 45,000 crore by FY25 at the current...

Realty Sector Seeks Higher Tax Benefit On Home Loans

NEW DELHI: The real estate sector has requested the government to pay greater attention to the expansion of rental housing and provide higher tax benefit on home loans, in a pre-Budget consultation with the finance minister on Monday. “Until now we are only talking about ownership housing but a...

GDP Growth May’ve Picked Up Steam In Q3: Economists

NEW DELHI: Economic growth may have sped up following the slowdown in the September quarter, with business activity showing signs of improvement in the third quarter, economists said. However, growth for the year is expected to remain subdued, they added, putting it below FY24’s 8.2%. The government will release...

Falling Poverty Claims In SBI Report Spark Concerns About Methodology

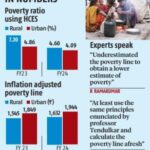

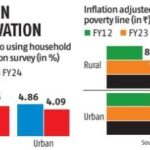

NEW DELHI: State Bank of India (SBI), in a report on Friday, claimed a significant decline in the headline poverty ratio in rural areas on account of enhanced physical infrastructure, higher consumption growth in the bottom fractile and direct benefit transfers (DBTs). Using the latest annual Household Consumption Expenditure...

TRAI To Tighten Anti-Spam Norms; Pilot To Digitise Past User Consents

NEW DELHI: TRAI will start, this month, a pilot to onboard paper-based and past permissions given by customers for receiving commercial communications onto its digital distributed ledger technology (DLT) platform, a process that in the long-run would include scrubbing and verifying their current validity and offering opt-outs to those...

Most Banks See Slower Loan Growth Amid Weak Demand

MUMBAI: Slower consumer demand, risk aversion to unsecured loans, and tepid deposit growth until late into the December quarter have meant that a majority of lenders clocked slower credit growth in the just concluded three-month period. Some banks such as HDFC Bank, which had an acute credit to deposit...

Growth In Agri Credit May Top 13% In FY25: NABARD Chairman

NEW DELHI: Agriculture credit growth this financial year is likely to be more than 13 per cent, reaching Rs 27-28 trillion, said National Bank for Agriculture and Rural Development (Nabard) chairman Shaji KV, at a media interaction in New Delhi. “Over the past decade, agricultural credit has consistently grown...

Draft DPDP Rules Tightens Grip Government On Data Handling

NEW DELHI: The government on Friday released the draft rules under the Digital Personal Data Protection (DPDP) Act, introducing specific provisions governing cross-border data flow, parental consent for processing children’s data, and new obligations for data fiduciaries. These rules, open for public consultation until February 18, mark a pivotal...

Centre Pushes Transfer To States To Meet Capital Expenditure Goals

NEW DELHI: Capital expenditure (capex) in the country in November declined 9 per cent over the previous month amid expectations that it would intensify in the second half this financial year. The data released by the Controller General of Accounts (CGA), however, shows a positive trend in the transfer...

Rural Poverty Ratio Fell Below 5% In Fy24 For The First Time: SBI Research

NEW DELHI: Poverty declined faster in rural areas during FY24 as the poverty ratio dipped below 5 per cent for the first time to 4.86 per cent from 7.2 per cent in FY23, according to a study by SBI Research released on Friday. In comparison, the poverty ratio in...

Banks Post Strong Growth In Advances, Deposits In Q3

MUMBAI: Starting the new year on a positive note, Bank of Baroda, Bank of India, Yes Bank, and IDFC First Bank reported strong growth in advances and deposits in Q3. The growth in the December quarter was driven by festival-led demand, provisional business updates released by the banks on...