Business

SEBI Proposes Relief For FPIs Investing In Government Bonds Under VRR, FAR

MUMBAI: The Securities and Exchange Board of India (Sebi) on Tuesday proposed regulatory relaxations for foreign portfolio investors (FPIs) investing solely in Indian government bonds under the Voluntary Retention Route (VRR) and Fully Accessible Route (FAR). Sebi has suggested easing registration and other compliance requirements for a new FPI...

Food Inflation Plunges To 41-Month Low

NEW DELHI: Retail food inflation eased for the six consecutive months to 1.78%% in April compared to 2.69% in March, as prices of vegetables, pulses, meat, fish and spices declined with arrivals of winter harvest. The consumer food price index (CFPI) declined by 0.153% sequentially last month compared to...

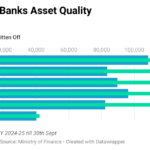

Government To Review Profitability Of Public Sector Banks, Bad Loan Recovery

NEW DELHI: Finance Minister Nirmala Sitharaman will likely meet the chiefs of public sector banks (PSBs) on Thursday to assess their performance in 2024-25 in various parameters, including profitability, bad loans recovery, deposit mobilisation, digital payments, cyber security and implementation of government schemes, sources told FE. It is to...

India Keeps Data Exclusivity Out Of UK FTA To Protect Local Drug Makers

NEW DELHI: India has protected the interest of its generic pharma industry by keeping out data exclusivity provisions from the Free Trade Agreement (FTA) with the UK. This is the second FTA in recent times where data exclusivity is not part of the trade agreement. The UK was pushing...

India Planning Retaliatory Duties Against US’ Steel, Aluminium Tariffs

NEW DELHI: India on Monday proposed to impose retaliatory duties under the WTO (World Trade Organisation) norms against the US over American tariffs on steel and aluminium in the name of safeguard measures. “The safeguard measures would affect $7.6 billion imports into the US of the relevant products originating...

Government Seeks First Right To Buy Oil & Gas Under Exigency Clause

NEW DELHI: The government will hold “pre-emption rights” over all crude oil and natural gas produced in the country in case of a national emergency, the oil ministry said in its latest draft regulations on petroleum and natural gas rules. A pre-emption right is a legal right of a...

Government Mulls Key Changes In Highway Monetisation Norms

NEW DELHI: The lull in the use of Toll Operate Transfer (ToT) mode of monetisation of highway assets could end soon, with a change in approach for future bids. The new bids will offer smaller bundles of highways of up to Rs 1,500 crore for bidding to private investors,...

PSU Banks May Take A Hit On Margins As Interest Rates Dip

KOLKATA | MUMBAI: Public sector lenders have gained about 26% in FY25 net profit cumulatively, but the current fiscal may expose them to pressure on net interest margins (NIM), thus likely leading to a moderation in their return on assets. Large banks such as State Bank of India, Canara...

India Calls Pakistan’s Nuclear Bluff, Rejects Kashmir Mediation: Govt Sources

NEW DELHI: India will never accept mediation on the Kashmir issue or discuss the matter, and the only item to talk about is Pakistan returning the portion of Kashmir that is in its illegal occupation, government sources on Sunday said in an off-the-record briefing. Sources also said India had...

Indian Economy Likely To Grow At 6.5 Per Cent In FY26: CII

NEW DELHI: India’s GDP is projected to grow at 6.5 per cent in the current fiscal and the country’s economy is resilient enough to overcome the short-term impact of geopolitical issues, Confederation of Indian Industry CII president Sanjiv Puri has said. In an interview, he asserted that the country...

India, EU To Hold Next Round Of FTA Talks From Monday For Early Conclusion

NEW DELHI: India and the European Union (EU) chief negotiators will begin the next round of talks on the proposed free trade agreement (FTA) here from Monday, with an aim to conclude the first phase of the pact as early as possible, according to an official. The two sides...

Retail Investors Still Going Strong On Index Options

MUMBAI: The Securities and Exchange Board of India’s (SEBI) stringent guidelines in the futures and options (F&O) segment haven’t served as a deterrent for retail investors who trade in index options, as their activity remains at elevated levels. In fact, it has grown marginally. According to NSE data, the...

India-Pakistan Tensions Rock Hospitality Business

MUMBAI: The hospitality sector has become one of the biggest casualties of conflicts between India and Pakistan. Hotel chains are grappling with business slowdown, with more than 50% of bookings getting cancelled over the past week across Mumbai, Delhi, Bangalore and Chennai, as companies have issued travel advisories, sources...

India Offers Steep Tariff Cuts To Speed Up Trade Pact Talks With Trump

NEW DELHI: India has offered to slash its tariff gap with the US to less than 4 per cent from nearly 13 per cent now, in exchange for an exemption from President Donald Trump’s “current and potential” tariff hikes, two sources said, as both nations move fast to clinch...

TRAI Recommends Spectrum Fee For Satcom Operators

NEW DELHI: Telecom regulator TRAI on Friday released its recommendations on pricing of spectrum to be given for satellite-based internet services, suggesting a levy of 4 per cent of annual revenues as fee on operators like Elon Musk’s Starlink. Operators offering services in urban areas would have to shell...

SBI, Private Banks Sell 20% Yes Bank Stake To SMBC For Rs 13,482 Crore

MUMBAI: State Bank of India (SBI) and seven private sector lenders that had invested in Yes Bank during its reconstruction in 2020, will together sell 20 per cent stake in the bank to Japan-based Sumitomo Mitsui Banking Corporation (SMBC) for ₹13,482 crore, in the largest cross-border deal in the...

SEBI Proposes New Disclosure Norms For Governance By High Value Debt Listed Entities In India

NEW DELHI: Markets regulator Sebi on Friday proposed tweaking its format for disclosure of corporate governance framework by High Value Debt Listed Entities (HVDLE). An entity having outstanding value of listed non-convertible debt securities of Rs 1,000 crore are referred to as ‘High Value Debt Listed Entities’. Under the...

India, New Zealand Wrap Up First Round Of FTA Talks

NEW DELHI: Working against a tight deadline, India and New Zealand on Friday wrapped up the first round of negotiations on a bilataral Free Trade Agreement (FTA). The round that started on May 5 discussed the broad contours of the agreement. The two countries decided in March to re-launch...