Business

India’s Buyout Market Expands, But Valuation Concerns Persist: PE Leaders

MUMBAI: India’s private equity (PE) market is witnessing increasing buyout activity, driven by consolidation opportunities and global investment shifts. However, high valuations and liquidity constraints remain key concerns, top private equity executives said at the Indian Venture and Alternate Capital Association (IVCA) Conclave here on Tuesday. Mukesh Mehta, senior...

HAL Order Book To Hit Rs 2.5 Trillion In FY26; Exports Remain A Challenge: CMD

NEW DELHI: Orders for 97 Light Combat Aircraft (LCA) Tejas Mark 1A and 156 Light Combat Helicopters (LCH) Prachand, worth Rs 1.3 trillion (Rs 1,30,000 crore), are at an advanced stage of clearance and are expected to materialise within the next three to six months, taking the order book...

US Tariffs May Increase Steel Dumping: India Inc

NEW DELHI: US President Donald Trump’s announcement that he plans to impose a 25% tariff on all steel and aluminium imports is expected to have a ripple effect on the global steel market, potentially increasing the threat of steel dumping in the country, according to domestic steel manufacturers. Industry...

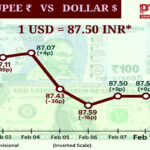

Imported Inflation, Rising Import Bill A Concern, But Not In Near-Term

NEW DELHI: The rupee’s relentless decline against the US dollar has intensified chances of imported inflation as well as widening of the current account deficit (CAD). However, many economists feel India’s exporters will benefit from the currency’s fall, and arrest its impact on the country’s CAD, which anyway is...

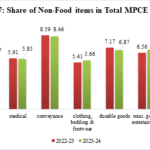

Conveyance Tops Non-Food Household Spending In 2023-24: HCES Data

NEW DELHI: In 2023-24, of Indian households’ average monthly expenditures on non-food items, that on conveyance was the highest, shows an analysis of the latest Household Consumption Expenditure Survey (HCES) data. Experts attribute the high share of commuting to increased mobility among households, fuel prices, and a poor public...

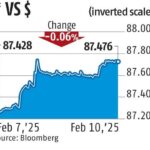

Reserve Bank Of India Pulls Back Rupee From The Brink Of 88 Against Dollar

MUMBAI: Intervention by the Reserve Bank of India (RBI) in the foreign exchange market stopped the rupee from touching 88/dollar-level mark on Monday as the Indian currency depreciated sharply in the early trade after US president Donald Trump announced to introduce 25 per cent tariff on all steel and...

India’s Pharma Market To Expand 2.4 Times Over Next 5 Years, Share In Global Market To Hit 5 Per Cent: Report

NEW DELHI: India’s pharmaceutical industry is poised for significant growth, with its share in the global market expected to rise to 5 per cent by 2030, according to a report by Bain & Company. The Indian pharma market, currently valued at around USD 55 billion, is projected to expand...

Rolls-Royce To Double Sourcing From India Over Next Five Years

NEW DELHI: Aerospace major Rolls-Royce on Monday said it intends to double its supply chain sourcing from India over the next five years. The company will seek to increase its sourcing of complex parts for advanced aerospace engines, naval propulsion systems, diesel engines and gas turbine engines as part...

India Sets Up EFTA Desk To Promote Trade, Investment

NEW DELHI: India is setting up a dedicated platform, European Free Trade Association (EFTA ) desk, to promote trade, investment, and business facilitation between the two regions, an official statement said on Monday. India and the four European nations EFTA bloc signed a free trade agreement on March 10...

Trump To Announce Steel, Aluminum Tariffs

WASHINGTON: President Donald Trump said he will announce that the United States (US) will impose 25 per cent tariffs on all steel and aluminium imports, including from Canada and Mexico, as well as other import duties later in the week. “Any steel coming into the US is going to...

Only 4.89 Per Cent Of Smart Meters Installed Under RDSS

NEW DELHI: Out of the total target of 20.33 Crore smart meters sanctioned under Revamped Distribution Sector Scheme (RDSS), approximately 99.51 Lakh or 4.89 per cent smart meters have been installed in the country, Parliament was informed on Monday. As per the data shared by the Minister of State...

Rupee Settles Flat At 87.50 Against USD

MUMBAI: The rupee on Monday plunged 45 paise and moved closer to the 88 per US dollar-level, weighed down by the strength of the American currency tariff concerns, but settled on a flat note at 87.50 (provisional) on suspected Reserve Bank of India (RBI) intervention. The American currency gained...

Projects Worth Rs 58,000 Crore Get Support Of Agri-Infra Fund

NEW DELHI: To boost post-harvest facilities, the government has approved proposals worth Rs 58,000 crore under Agri Infrastructure Fund (AIF) for more than 92,000 projects since its launch four years back. Sources said that so far these sanctioned projects by the agriculture ministry have mobilised an investment of Rs...

National Highways Infrastructure Trust Targets Rs 20,000 Crore In Biggest Fundraise

NEW DELHI: The National Highways Infrastructure Trust (NHIT), sponsored by the National Highways Authority of India (NHAI), is likely to raise over Rs 20,000 crore from domestic and foreign investors over the next few weeks for acquisition of 11 operational road assets. This will be the fourth and the...

Energy Booster From US On Menu In Runup To PM Modi’s Visit

NEW DELHI: Ahead of Prime Minister Narendra Modi’s meeting this week with US President Donald Trump, India is weighing how much more energy it can import from that country. Oil ministry officials and executives at state-run oil and gas companies have held multiple discussions on current energy imports from...

RBI May Cut Interest Rates Further By 50 Basis Points In 2025, Stance To Turn Accommodative: Report

NEW DELHI: The Reserve Bank of India (RBI) may cut interest rates further by 50 basis points (bps) in 2025 and shift its stance from “neutral” to “accommodative,” according to a report by Bank of Baroda. The report suggested that the central bank has entered a rate-cut cycle, and...

Government Looking At Procedural Easing To Further Promote FDI

NEW DELHI: The government is looking at further easing of procedures in certain sectors to attract more foreign direct investments (FDI) into the country, a government official said. The department for promotion of industry and internal trade (DPIIT) has held stakeholder consultations with different government departments, regulators, industry associations,...

Ministry of DoNER Working With Amazon, Two Other Companies To Boost Bamboo Market

CHENNAI: The Ministry of Development of North East Region would explore the market opportunities for Bamboo in domestic and overseas markets and it was working with Amazon and two other companies in this connection, a senior government official has said. Besides promoting Bamboo locally, the Ministry would also look...